The New Zealand Dollar (NZD) gained some ground ahead of the Reserve Bank of New Zealand’s (RBNZ) final interest rate decision in 2024 as markets prepare for a less dramatic cut than some had hoped. While the RBNZ is expected to reduce the Official Cash Rate (OCR) by 50 basis points (bps) to 4.25%, some investors had speculated about a larger 75 bps cut. However, analysts like David Forrester from Crédit Agricole believe the central bank will be more cautious.

Forrester highlights that New Zealand’s economy is stabilizing, with improved business confidence, steady consumer spending, and substantial dairy payouts from Fonterra. Inflation remains elevated, and the OCR is still above its neutral level, making a more significant rate cut less likely. If the RBNZ signals slower easing or sticks to a minor cut, it could support the NZD by surprising those expecting more aggressive cuts.

The NZDUSD pair has already seen modest gains as markets adjust expectations. A careful approach by the RBNZ may strengthen the NZD further, especially with signs of a recovering economy. All eyes are on the upcoming announcement, as it will influence the direction of the NZD and investor sentiment for 2024.

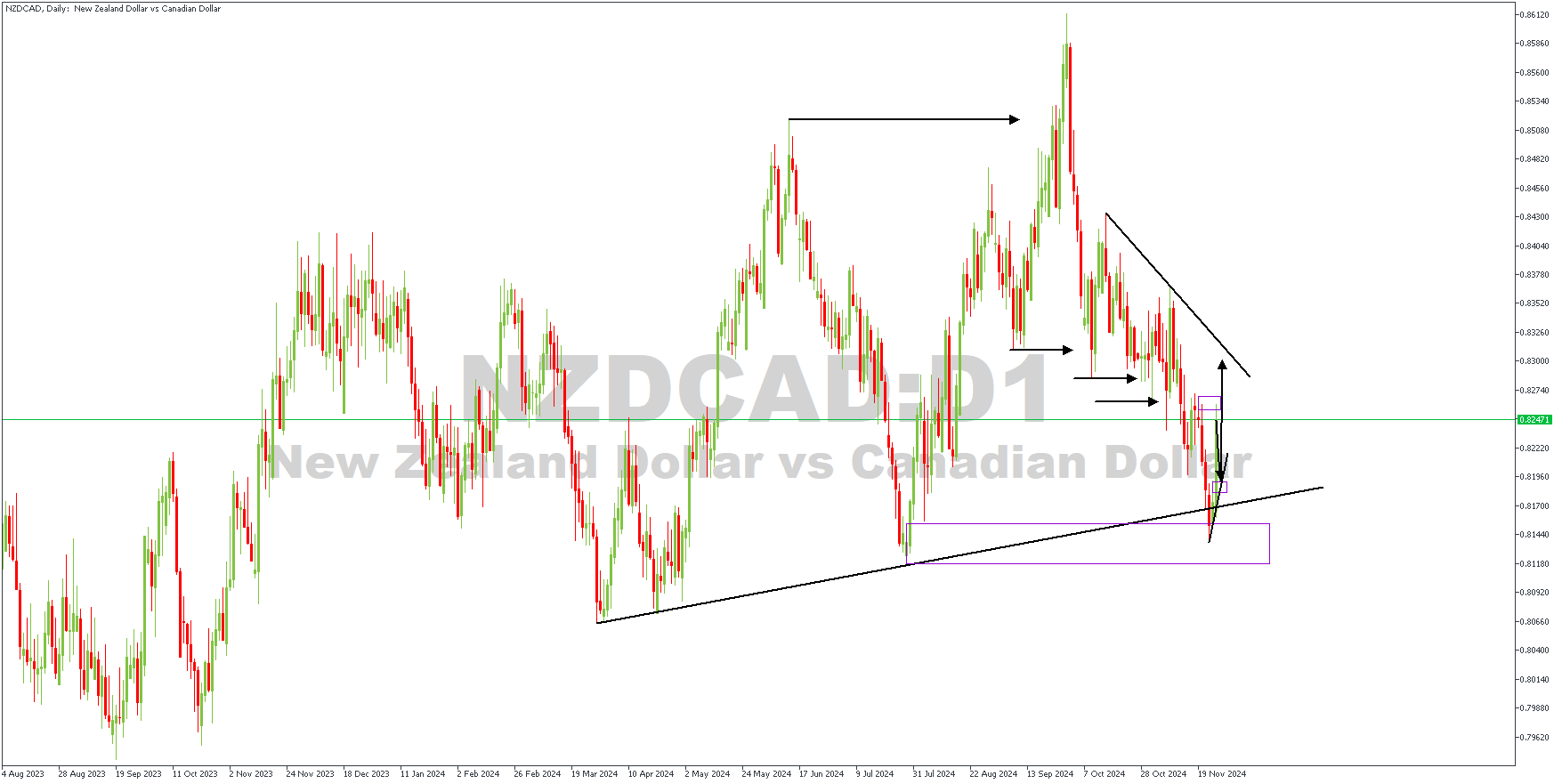

NZDCAD – D1 Timeframe

The break above the previous high on the daily timeframe chart of NZDCAD originated from the highlighted demand zone, from which the price has already reacted bullishly because of the trendline confluence with the demand zone. The price action is headed for a crucial supply zone at the trendline resistance. Let’s see how this looks in the lower timeframe, though.

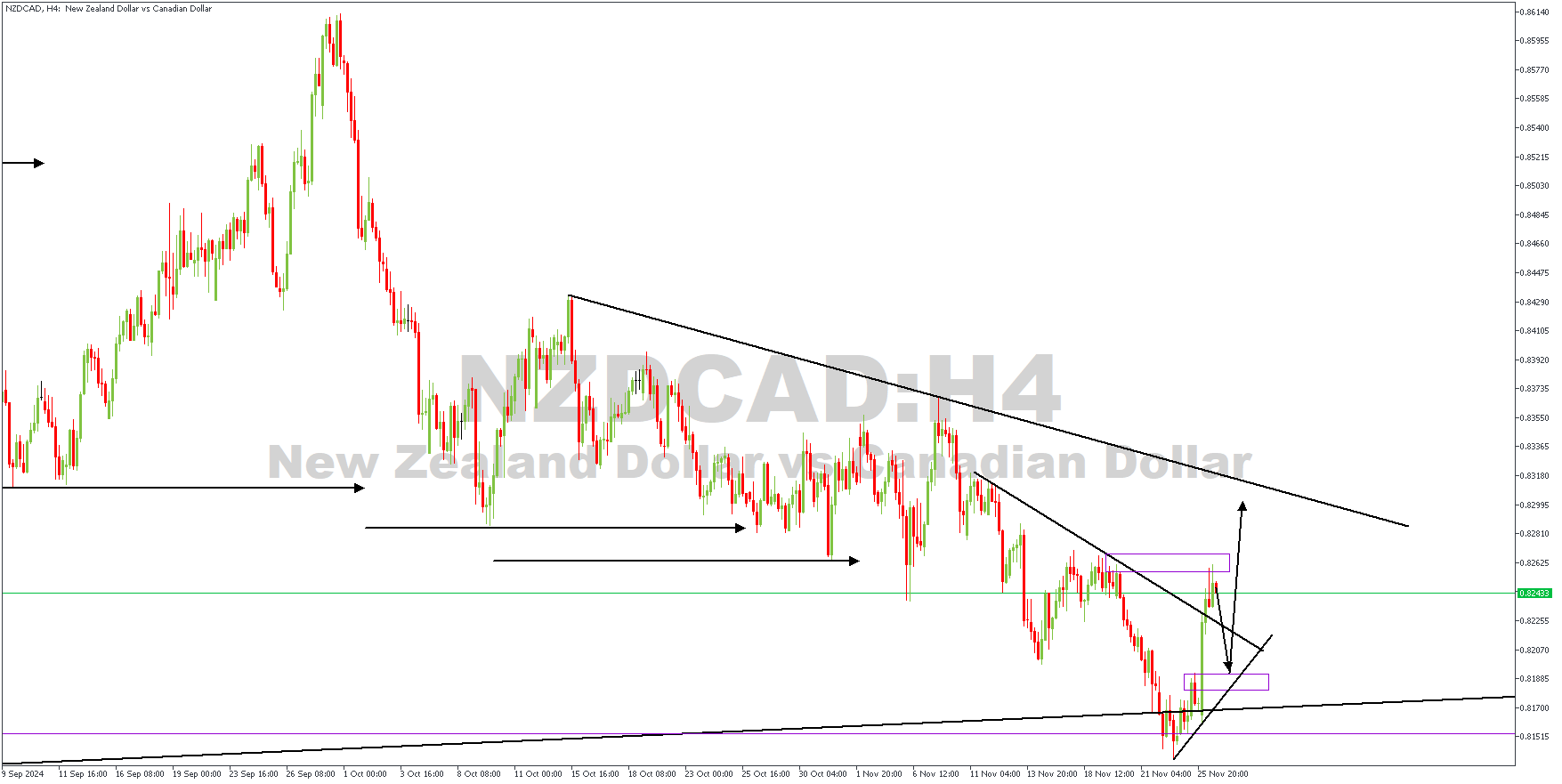

H4 Timeframe

On the 4-hour timeframe chart, the initial bullish reaction from the demand zone wanes gradually, following the resistance from the supply region. However, the bullish sentiment remains intact as soon as the price reaches the confluence of the trendline support and the rally-base-rally demand zone.

Analyst’s Expectations:

Direction: Bullish

Target:0.83004

Invalidation: 0.81375

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.