The EURUSD currency pair is starting the week trying to stabilize after dropping to 1.0332 last week, its lowest level in two years. The Euro has struggled, falling 4.21% this month and 5.54% since the start of 2024, as concerns about the Eurozone's slowing economy weigh on the currency. Business activity in the region unexpectedly shrank, raising fears about future growth and putting pressure on the European Central Bank (ECB) to cut interest rates more aggressively. Rising wages, political challenges in Germany and France, and potential tariffs from Donald Trump's presidency add to the Euro's troubles. ECB President Christine Lagarde has emphasized the need for Europe to deepen its capital markets and support innovation to counter these challenges. Let's look now at the current technical outlook from our weekly market review session.

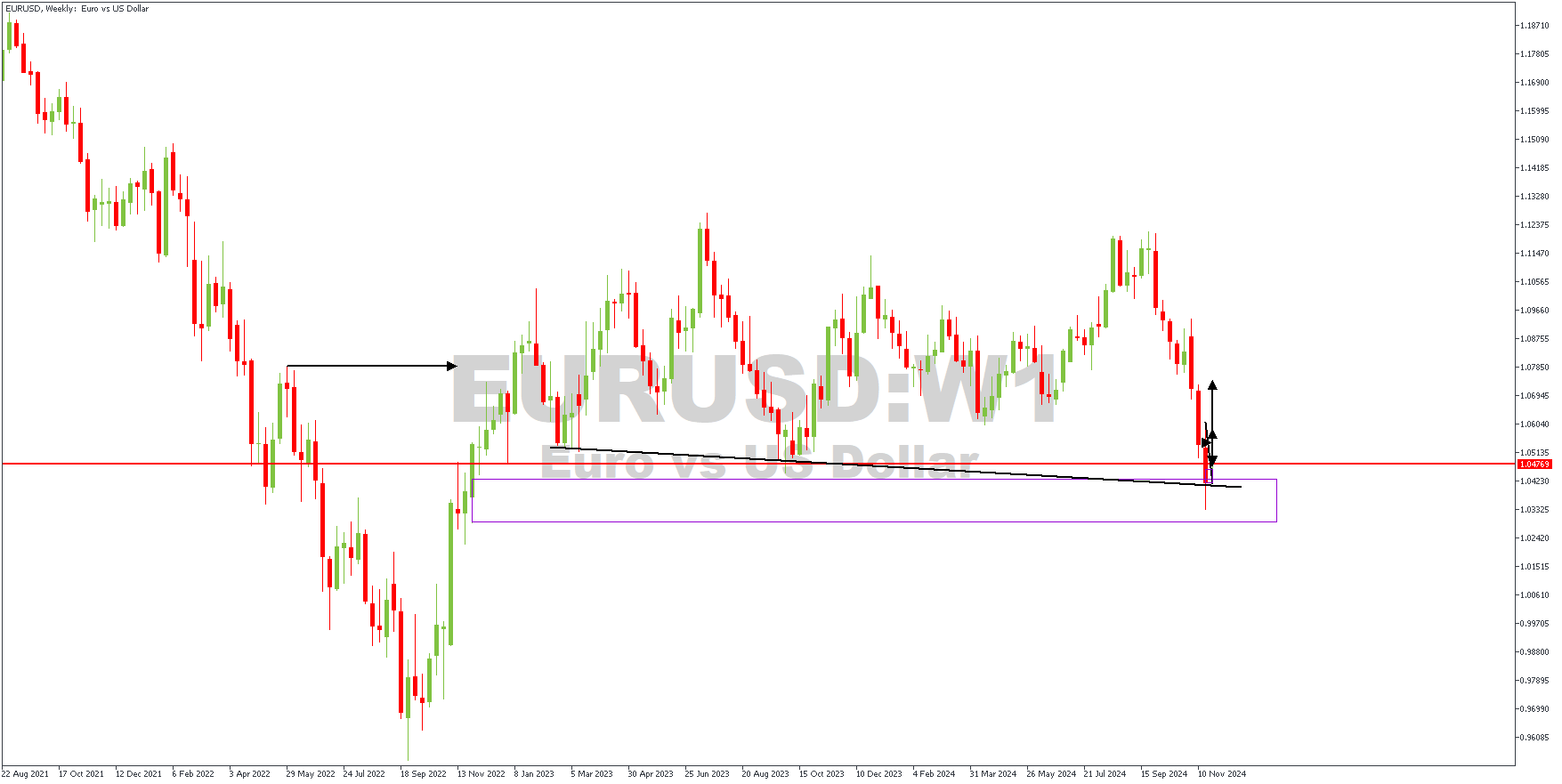

EURUSD – W1 Timeframe

The weekly timeframe price action indicates that price has reached a critical level, and a reversal may follow. There is a weekly timeframe pivot (the horizontal red line) and a rally-base-rally demand zone serving as the visible confluence on the weekly timeframe. A closer look at the price action on the lower timeframe would give ample detail on the criteria for entry in the direction of the bullish sentiment.

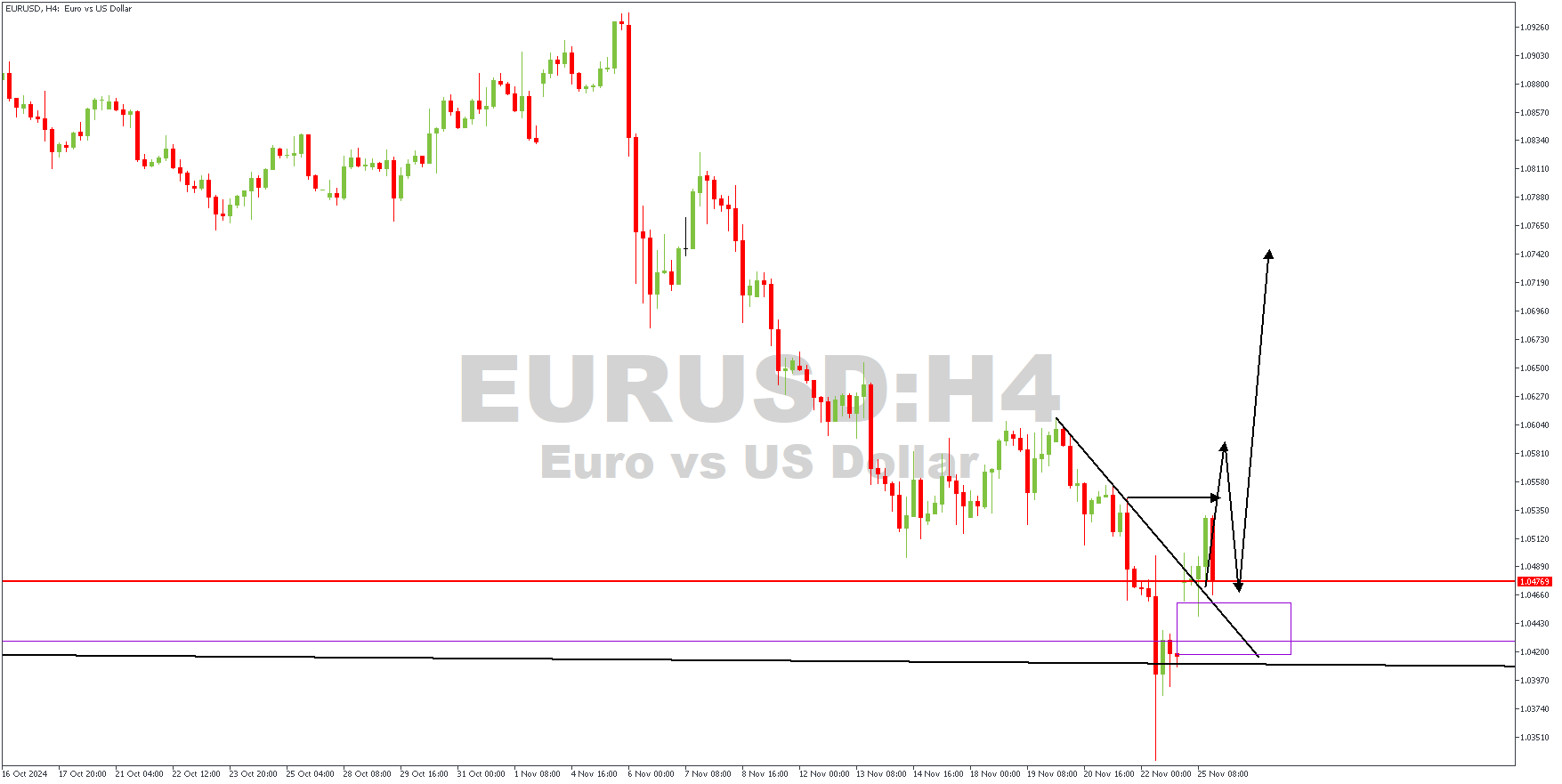

H4 Timeframe

The 4-hour timeframe presents a classic break-and-retest pattern, where the point of interest is the demand zone at the base of the break of structure. In any case, the overall sentiment for EURUSD is bullish, albeit the point of entry may differ slightly.

Analyst's Expectations:

Direction: Bullish

Target:1.07089

Invalidation: 1.03044

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.