Donald Trump has announced plans to impose steep tariffs on major trading partners, including a 25% tax on goods from Canada and Mexico and an additional 10% on Chinese exports. This news has caused the US dollar to surge, while currencies from trade-heavy economies, like Canada, Australia, and New Zealand, have taken a hit. The USDCAD pair climbed above 1.4105, reaching its highest level since early in the pandemic, and could aim for further gains if momentum holds.

Similarly, AUDUSD has dropped close to its 2024 low of 0.6441, with traders watching this level closely for a potential bounce or further declines. In New Zealand, the NZDUSD pair briefly touched new lows before rebounding slightly but remains under bearish pressure. Traders are now cautious, with many focusing on selling rallies in the Kiwi and waiting for more precise signals. Overall, these currency movements highlight the strong impact of trade policies and the dominance of the US dollar in the current market environment.

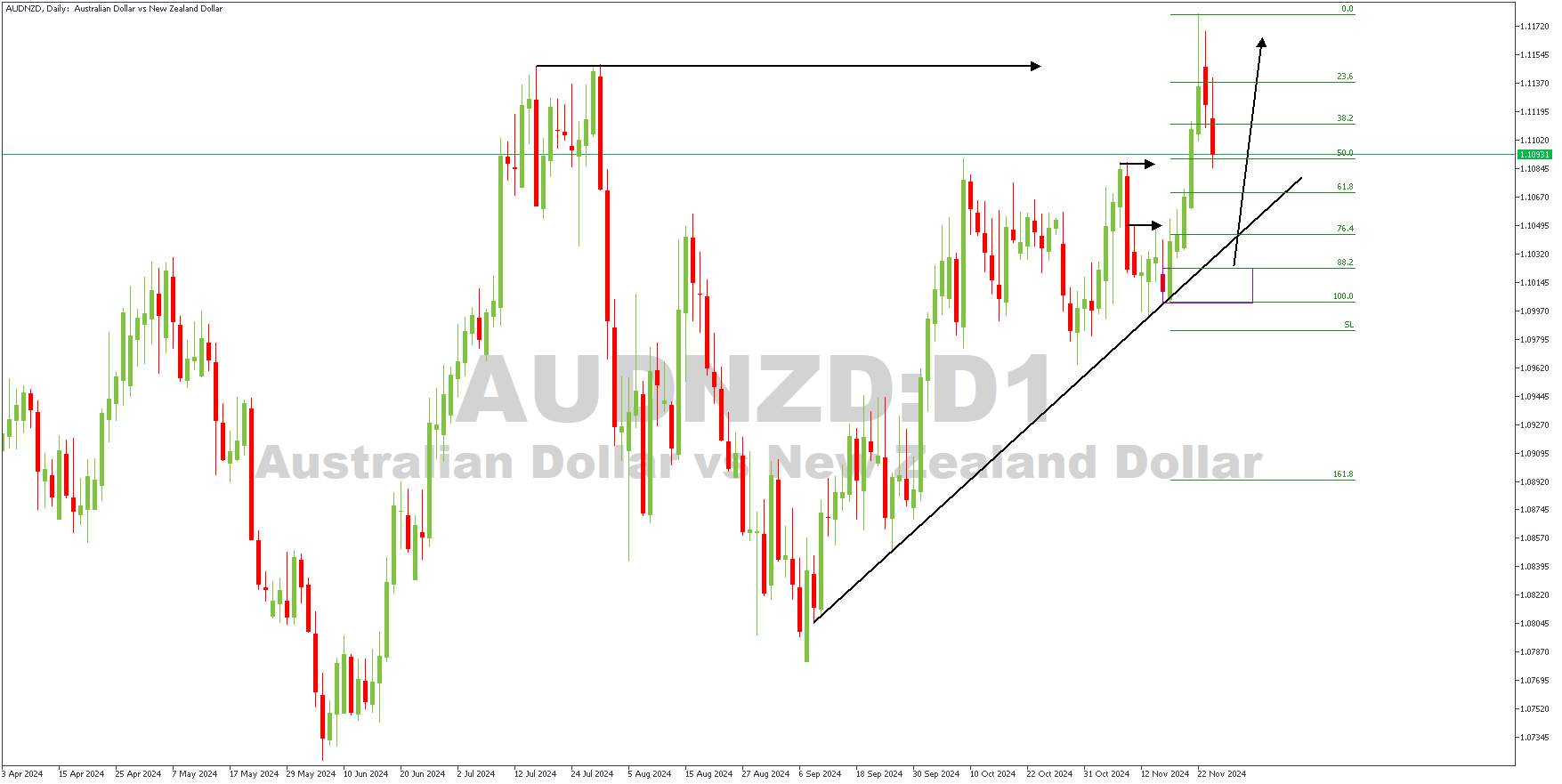

AUDNZD – D1 Timeframe

AUDNZD has recently broken above the swing high on the daily timeframe, followed by a retracement. The retracement on the daily timeframe is expected to reach 76% of the Fibonacci retracement, after which the bullish momentum may resume. Let’s now see how well the price action on the lower timeframe aligns with this sentiment.

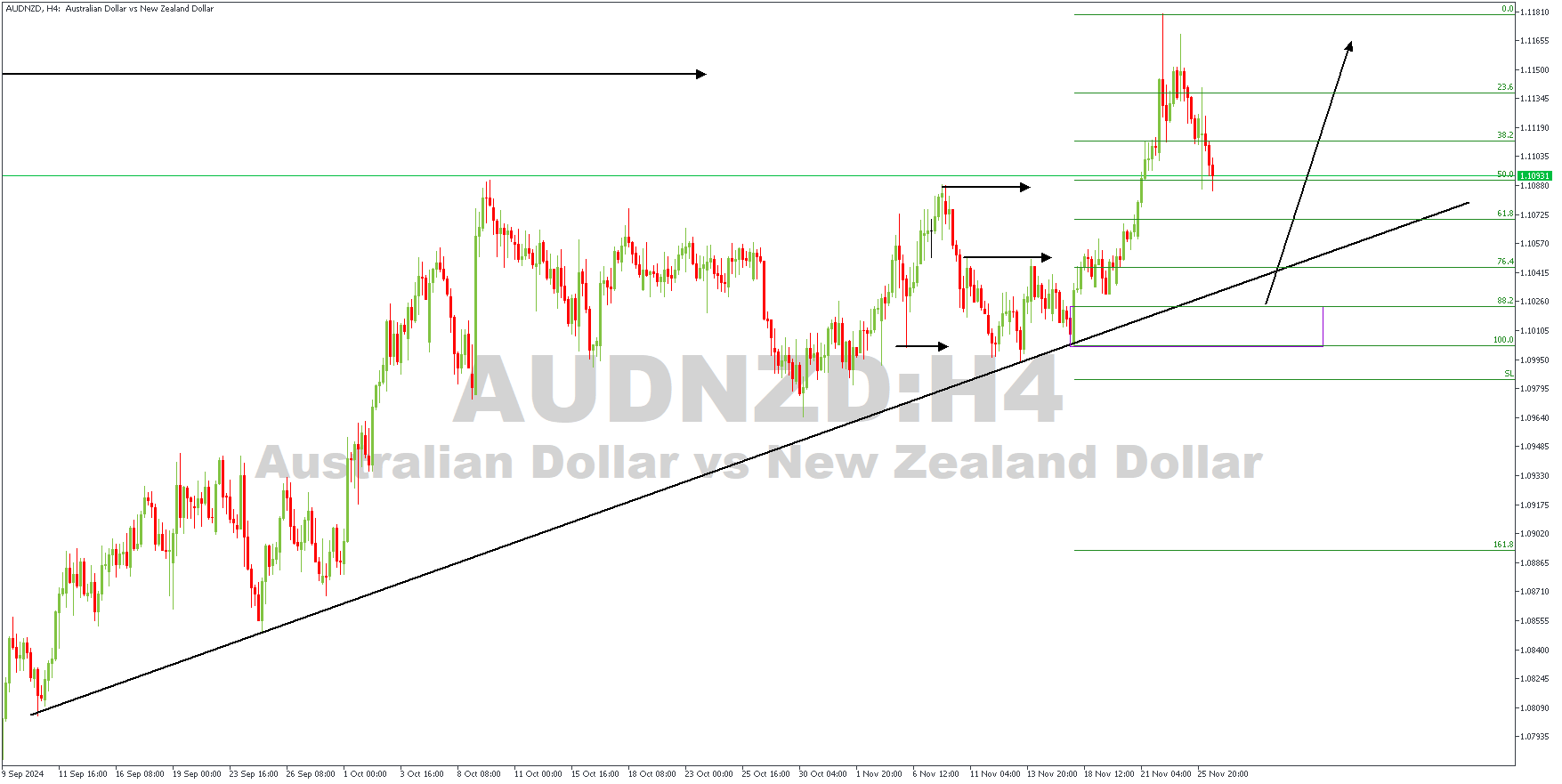

H4 Timeframe

On the 4-hour timeframe of AUDNZD, we see an SBR pattern starting from the left shoulder, highlighted by the horizontal arrow to the left. The trendline support is the major area of interest for the bullish entry since it falls in sync with the drop-base-rally demand zone, the 88% Fibonacci retracement level, and the SBR right shoulder completion.

Analyst’s Expectations:

Direction: Bullish

Target:1.11380

Invalidation: 1.09939

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.