Escenario bajista: Ventas por debajo de 150.30 con TP1:150.00... Escenario alcista tras retroceso: Compras intradía sobre 149.40 con TP: 150.00, TP2:151.00

2023-03-08 • Actualizada

The stock markets are usually considered indicators of the strength or weakness of a country's economy. Therefore, many traders review indices as a leading indicator of what to expect from large economies around the globe. Let's look at a few of these without further ado.

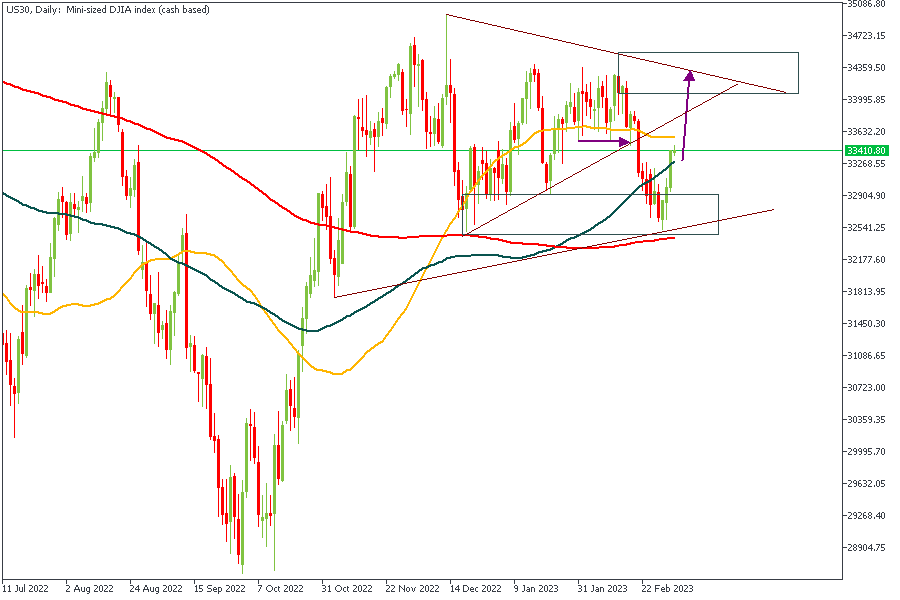

The US30 is trading inside a wedge pattern on the daily timeframe. The price has recently bounced off the demand zone that overlapped the 200-period moving average. From the positioning of the moving averages, the sentiment is bullish. The primary target area would be the supply zone at the resistance trendline of the wedge.

Analysts’ Expectations:

Direction: Bullish

Target: 33 996

Invalidation: 32 541

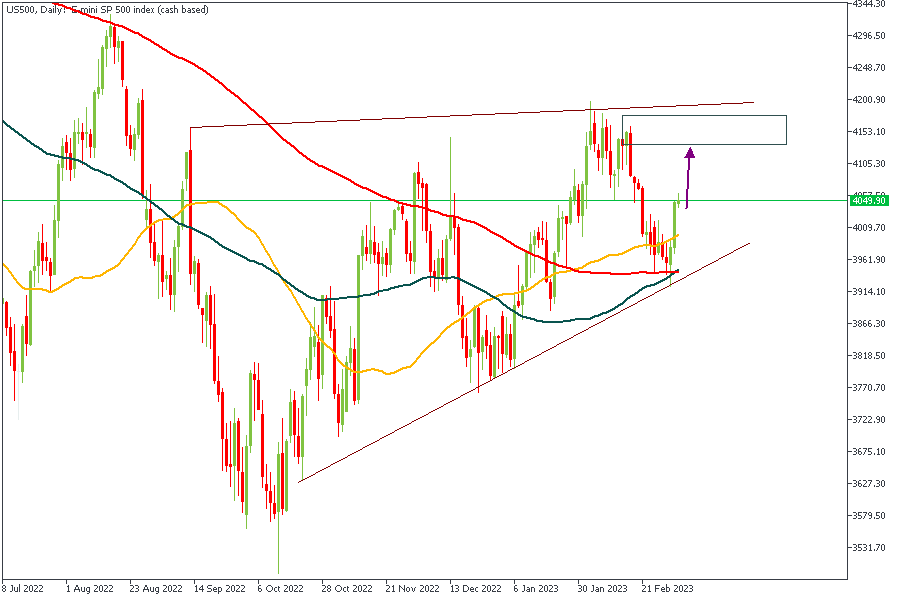

The trend on US500 is currently contracting and has thus created a wedge pattern. We have seen that the 50 and 100-period moving averages are currently above the 200-period MA, implying a bullish sentiment. Working with this sentiment in mind means that the initial price target would be somewhere around the supply zone, just below the trendline resistance of the wedge pattern.

Analysts’ Expectations:

Direction: Bullish

Target: 4153

Invalidation: 3961

HK50 has reacted quite powerfully to the supply zone, as we can observe from how far the price dropped from the zone. However, I expect we will see some bullish reaction from the current area based on the crossing of the 50-Day moving average above the 100 and 200 moving averages. Additional confluences include: · the 88% of the Fibonacci retracement· 200-moving average as a support · the break above the previous high at 20100.

Analysts’ Expectations:

Direction: Bullish

Target: 22 000

Invalidation: 19 500

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Escenario bajista: Ventas por debajo de 150.30 con TP1:150.00... Escenario alcista tras retroceso: Compras intradía sobre 149.40 con TP: 150.00, TP2:151.00

Panorama General de la semana pasada…

Análisis Fundamental y Análisis técnico EURUSD, EURGBP y EURCAD

Escenario bajista: Ventas por debajo de 1.0820 / 1.0841... Escenario alcista: Compras sobre 1.0827...

Escenario bajista: Ventas por debajo de 2200 / 2194... Escenario alcista más próximo: Compras sobre 2197... Escenario alcista tras retroceso: Considera compras en torno a cada zona de demanda...

Escenario bajista: Ventas por debajo de 5220 ... Escenario alcista: Compras sobre 5225 (Si el precio falla en romper por debajo con decisión)

FBS mantiene un registro de tus datos para ejecutar este sitio web. Al presionar el botón "Aceptar", estás aceptando nuestra Política de Privacidad .

Su solicitud ha sido aceptada

Un gerente le contactará pronto

La próxima solicitud de devolución de llamada para este número telefónico

estará disponible en

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD y gana!