El AUDUSD se prepara para un movimiento. ¡Los traders deben mantenerse alerta!

El par AUDUSD, a menudo referido por los traders como el "Aussie," es un par de divisas principal que representa la tasa de cambio entre el dólar australiano y el dólar estadounidense. El dólar australiano está muy influenciado por los precios de los commodities (en especial el mineral de hierro y el oro), las decisiones sobre tasas de interés del Banco de la Reserva de Australia y datos económicos domésticos como el empleo y la inflación. Por otro lado, el dólar estadounidense responde a los indicadores económicos de EE.UU., incluidos los informes de empleo, los datos de inflación y las decisiones de la Reserva Federal.

Índice de gestores de compras (PMI) manufacturero de EE.UU., 23 de septiembre, 15:45 (GMT+2)

El PMI manufacturero de EE.UU. se pronostica en 48, un poco superior al anterior 47.9. Si el resultado del PMI es mejor de lo esperado, señalando un crecimiento más fuerte de lo anticipado en el sector manufacturero, esto podría fortalecer al dólar estadounidense. En ese caso, es probable que el par AUDUSD caiga ya que el dólar más fuerte presiona al dólar australiano. Sin embargo, si el PMI no alcanza las expectativas, reflejando una mayor contracción en la manufactura, el dólar estadounidense podría debilitarse. Esto podría llevar a un aumento en el par AUDUSD, a medida que el dólar australiano se fortalece en relación con la moneda estadounidense.

Decisión sobre tasas de interés de Australia, 24 de septiembre, 6:30 (GMT+2)

Se espera que el Banco de la Reserva de Australia deje las tasas de interés sin cambios en 4.35%. Si la decisión del RBA o la declaración acompañante resulta ser más agresiva de lo esperado, como señalando una continuación futura de las tasas en los niveles actuales, podría llevar a un ligero aumento del dólar australiano, empujando el AUDUSD hacia arriba. Por otro lado, si el RBA recorta las tasas de manera inesperada o las previsiones dovish sugieren un enfoque más suave hacia la política monetaria, es probable que el dólar australiano se debilite. Esto llevará a una caída en el AUDUSD.

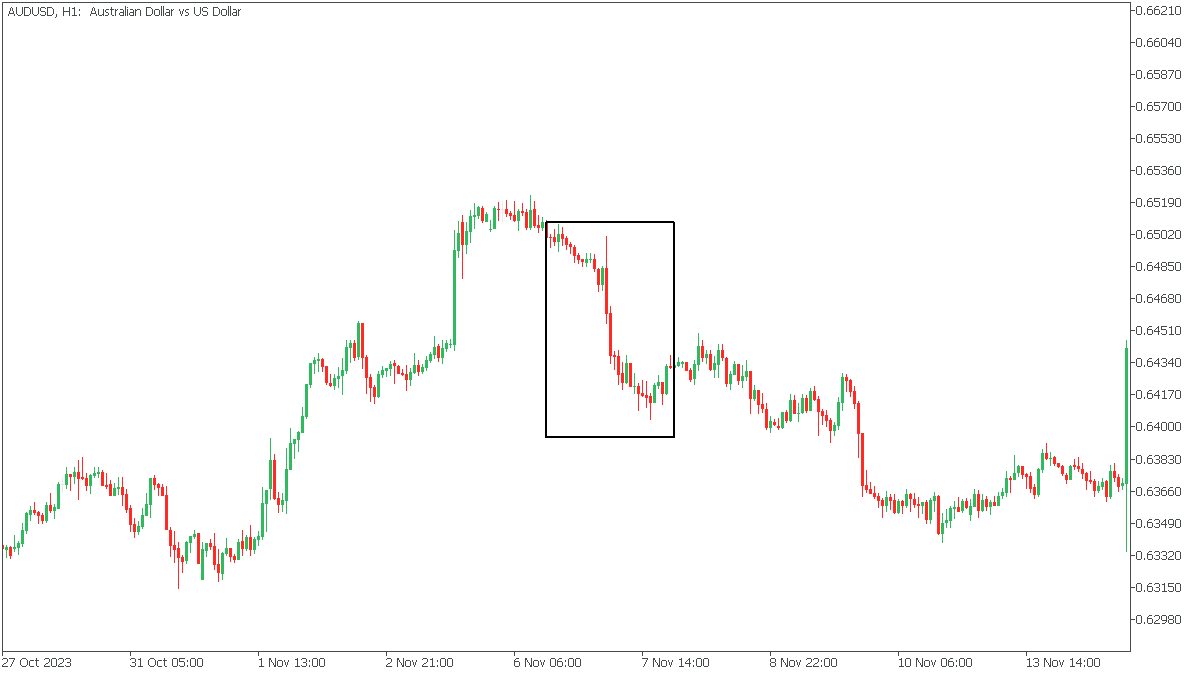

La tasa del Banco de Australia se cambió por última vez el 7 de noviembre de 2023, de 4.10% a 4.35%, ¡causando un pico en el precio!

PIB de EE.UU. trimestral, 26 de septiembre, 14:30 (GMT+2)

Se prevé que el PIB de EE.UU. crezca en un 3.0%, aumentando desde el previo 1.4%. Si la cifra real del PIB supera esta previsión, indicando una expansión económica aún más fuerte, puede que el dólar estadounidense gane más fuerza. En este escenario, puede que el par AUDUSD decline a medida que el dólar estadounidense se fortalezca, eclipsando al dólar australiano. Por el contrario, el dólar estadounidense podría perder impulso si el PIB disminuye más de lo esperado. Esto probablemente llevaría a un movimiento ascendente en el par AUDUSD.

En la temporalidad diaria, el AUDUSD formó un patrón de cuña ascendente en un impulso alcista a corto plazo. El precio alcanzó la línea de tendencia superior, con %R indicando una condición muy sobrecomprada. Sin embargo, al mismo tiempo, el momentum subió por encima del nivel 100.0.

Si el precio rompe la línea de tendencia por encima de la resistencia en 0.6820, el alza será de 0.6950, correspondiente al 161.8 de Fibonacci.

Un rebote y la ruptura de la línea de tendencia inferior por debajo del soporte de 0.6780 iniciarán un escenario bajista hacia 0.6650.