Se acercan movimientos importantes para el NZDUSD. ¡Hora de prepararse!

El par NZDUSD, a menudo llamado "Kiwi", representa el tipo de cambio entre el dólar neozelandés y el dólar estadounidense. El dólar neozelandés se ve influenciado por varios factores, incluyendo datos económicos nacionales, precios de commodities (especialmente productos lácteos, ya que Nueva Zelanda es un importante exportador) y decisiones de política monetaria del Banco de la Reserva de Nueva Zelanda. Por otro lado, el dólar estadounidense se ve afectado por datos económicos de EE.UU., como cifras de empleo, crecimiento del PIB, informes de inflación y decisiones sobre tasas de interés de la Reserva Federal.

Decisión sobre la tasa de interés de Nueva Zelanda: 9 de octubre, 3:00 (GMT+2)

Se prevé que el Banco de la Reserva de Nueva Zelanda reduzca las tasas de interés del 5.25% al 5.0%. Si esta previsión se cumple, es probable que el dólar neozelandés se debilite, ya que las tasas de interés más bajas harán que la moneda sea menos atractiva para los inversores, y el par NZDUSD podría caer. Si la decisión resulta ser mejor de lo esperado, como mantener la tasa actual, significará que el Banco de la Reserva de Nueva Zelanda ve la economía más fuerte, lo que podría llevar a un aumento en el par NZDUSD.

Sin embargo, si el Banco de la Reserva de Nueva Zelanda recorta la tasa drásticamente en un 0.5%, podría indicar más problemas económicos, lo que provocaría una caída en el NZD y un nuevo descenso del NZDUSD.

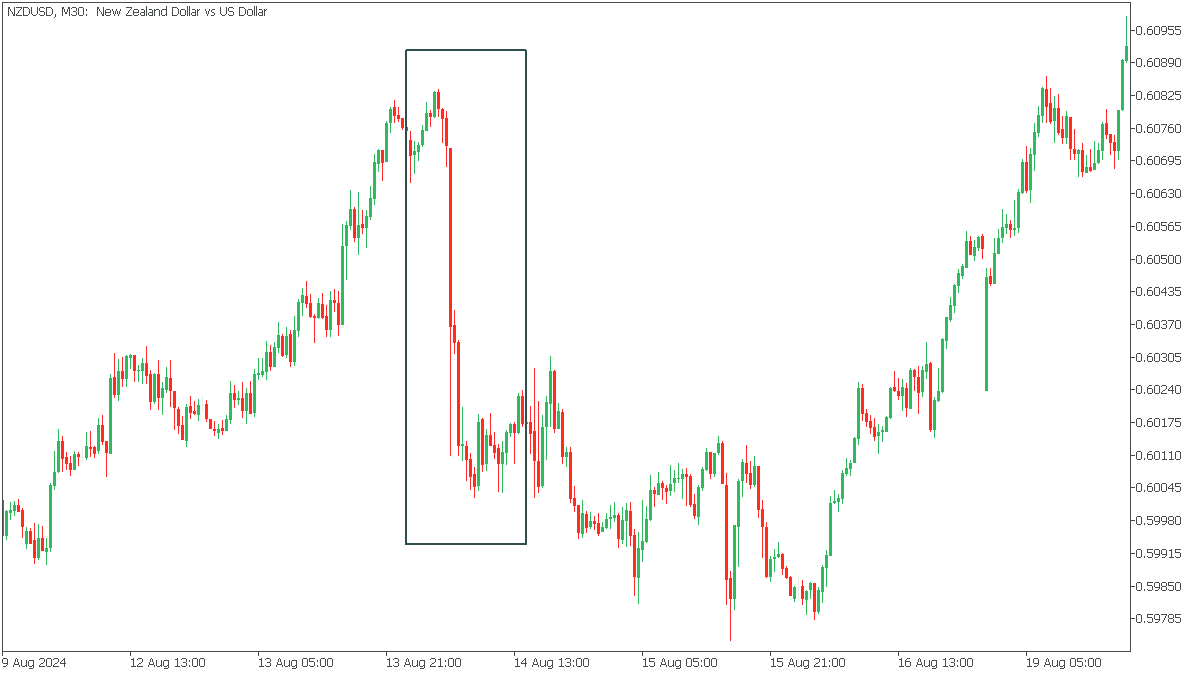

La última vez que el Banco de la Reserva de Nueva Zelanda recortó la tasa fue el 14 de agosto de 2024, lo cual fue inesperado y provocó una fuerte caída del NZDUSD.

Índice de precios al consumidor (IPC) intermensual de EE.UU.: 10 de octubre, 14:30 (GMT+2)

Se prevé que el índice de precios al consumidor (IPC) de septiembre en EE.UU. se desacelere al 0.1%, en comparación con la lectura anterior del 0.2%. Si el IPC cumple con esta previsión, la inflación se debilitará, lo que podría reducir la probabilidad de nuevas subidas de tasas por parte de la Reserva Federal. Esto podría debilitar al dólar estadounidense, lo que llevaría a un aumento en el par NZDUSD.

Sin embargo, si los datos de inflación son más débiles de lo previsto, podría indicar una postura más suave de la Fed, debilitando al dólar estadounidense y llevando al par NZDUSD al alza.

Por el contrario, si el IPC es más fuerte de lo esperado, lo que indica un aumento de la inflación, esto podría generar expectativas de un mayor endurecimiento de la política de la Fed y una continuación más prolongada de la tasa actual, llevando a una caída del NZDUSD.

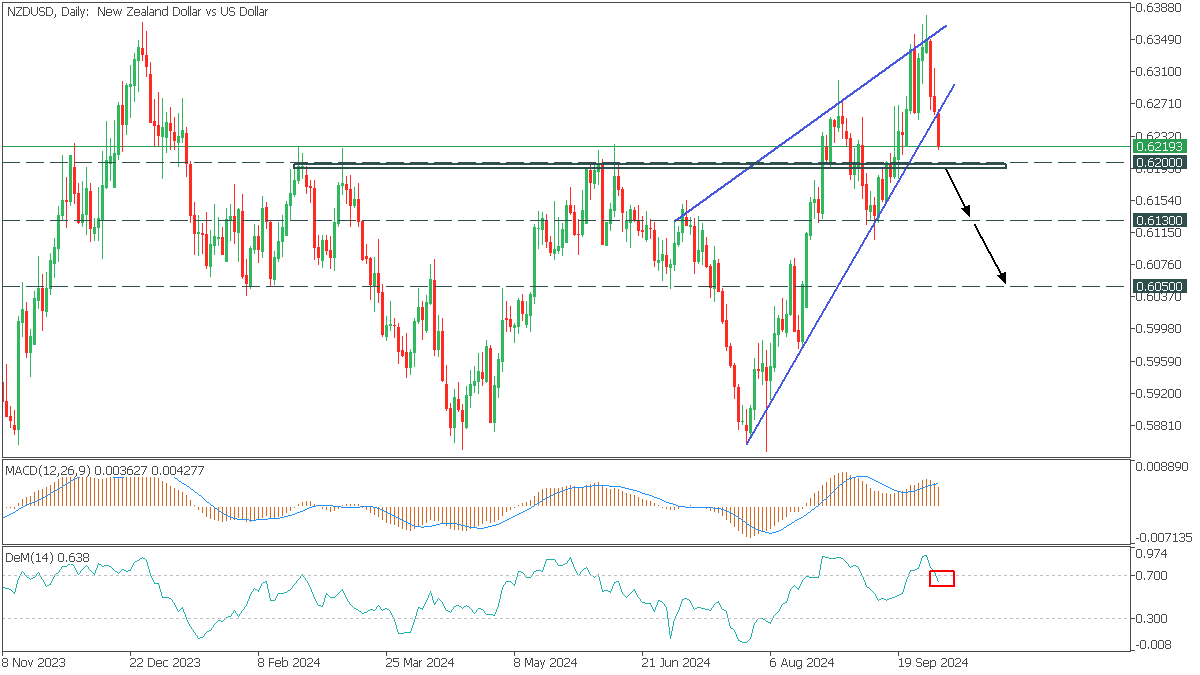

En la temporalidad diaria, el NZDUSD formó un patrón de canal ascendente. El precio rompió la línea de tendencia inferior, con la línea de señal MACD subiendo por encima del histograma y DeMarker saliendo de la zona de sobrecompra.

Cabe la posibilidad de que el NZDUSD caiga aún más en una ruptura por debajo del soporte en 0.6200, con objetivos en 0.6130 y 0.6050.