Observa de cerca el EURGBP: ¡datos clave podrían provocar un gran movimiento!

El par EURGBP, conocido como el "Chunnel" por los traders, es un par de divisas muy operado que refleja la relación económica entre la eurozona y el Reino Unido. El euro está influenciado principalmente por datos económicos de los principales países de la eurozona, como Alemania, Italia y Francia, así como por las decisiones sobre tasas de interés y políticas monetarias del Banco Central Europeo.

Por otro lado, la libra esterlina se ve afectada por indicadores económicos internos del Reino Unido, como la inflación, el empleo y los datos del PIB. El Banco de Inglaterra desempeña un papel clave en la fijación de tasas de interés y sus decisiones impactan con fuerza el vigor de la libra.

Índice de precios al consumidor (IPC) del Reino Unido interanual: 16 de octubre, 08:00 (GMT+2)

Se prevé que el IPC del Reino Unido se mantenga sin cambios en el 2,2% interanual. Si la cifra real supera las expectativas y es mayor, indicará que las presiones inflacionarias en el Reino Unido están aumentando. Esto podría llevar al Banco de Inglaterra a considerar mantener la tasa en su nivel actual, lo que probablemente fortalecerá a la GBP y, como resultado, el par EURGBP podría disminuir.

Por otro lado, si los datos del IPC son peores de lo esperado y muestran una inflación inferior a la prevista, esto podría indicar una desaceleración en la economía del Reino Unido, debilitando a la libra. Esto podría llevar a un movimiento al alza en el par EURGBP.

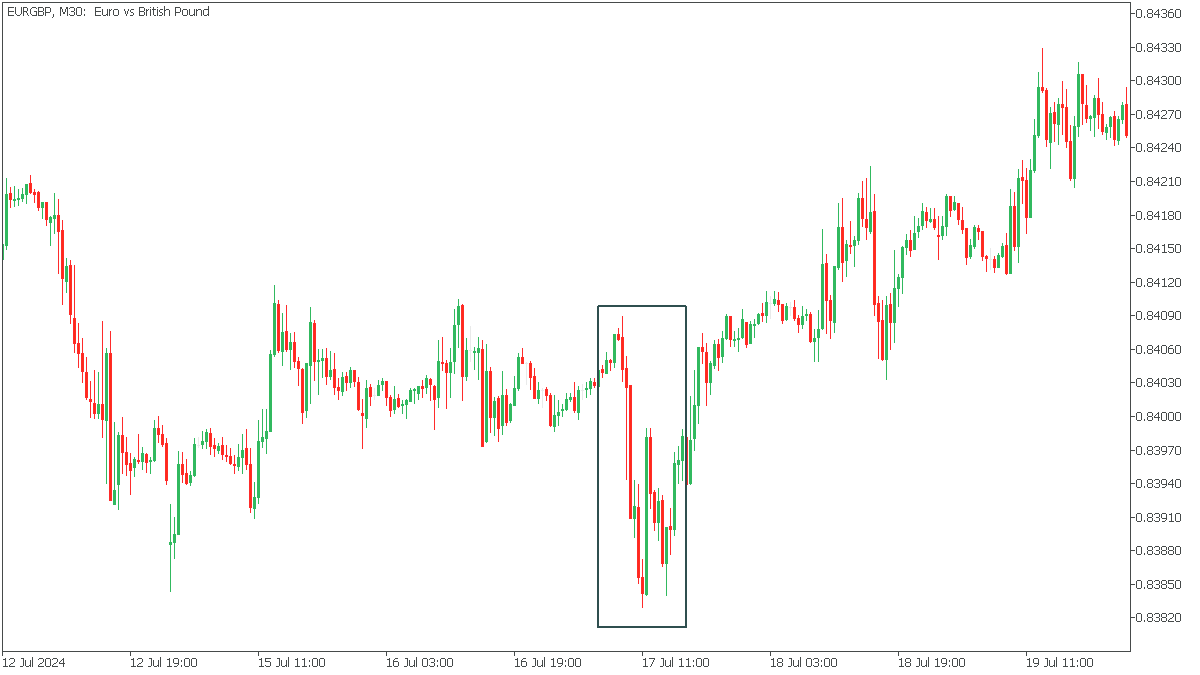

La última vez que la inflación del Reino Unido superó las expectativas de los analistas fue el 17 de julio de 2024, lo que provocó una fuerte caída del EURGBP.

Decisión sobre la tasa de interés de la eurozona: 17 de octubre, 14:15 (GMT+2)

La próxima decisión sobre la tasa de interés de la eurozona resultará en un pequeño recorte del 3,65% al 3,4%. Si el BCE recorta las tasas más de lo previsto, podría señalar un enfoque cauteloso hacia la recuperación económica, indicando que el banco central está más preocupado por los riesgos de estancamiento o deflación. En tal escenario, es probable que el euro se debilite, empujando el par EURGBP a la baja.

Sin embargo, si el BCE decide recortar las tasas menos de lo esperado o no hacerlo en absoluto, esto podría indicar confianza en la resiliencia de la economía de la eurozona. En este caso, el euro podría fortalecerse, llevando a una subida en el EURGBP.

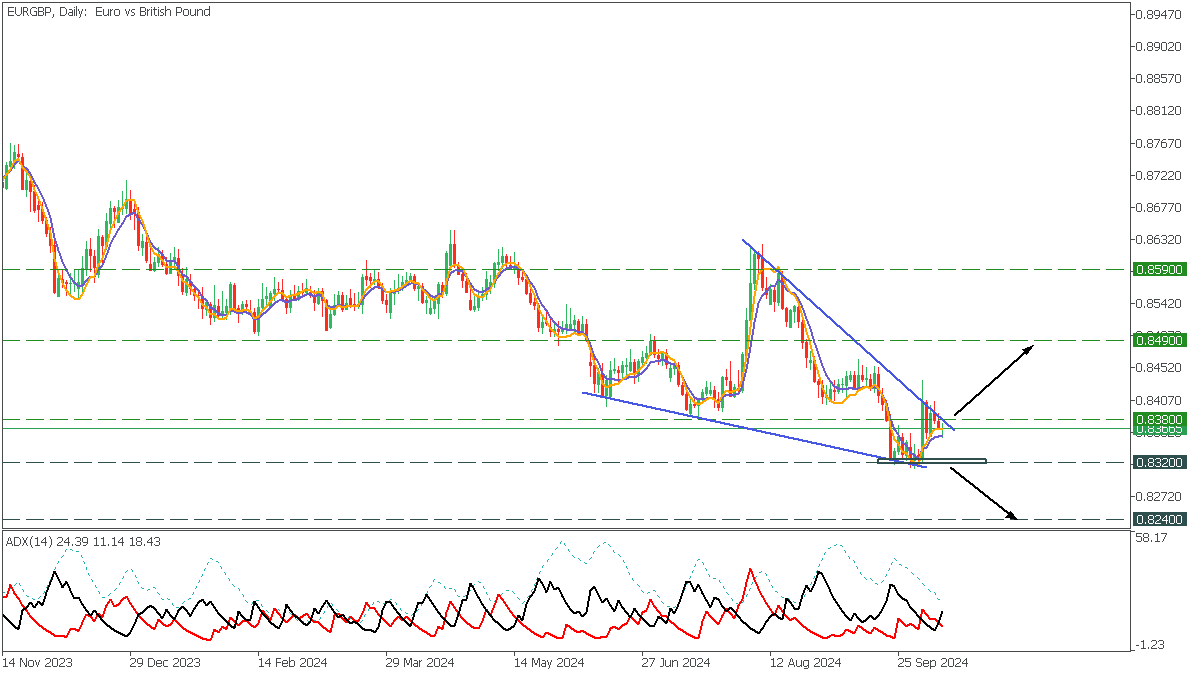

En la temporalidad diaria, el EURGBP formó un patrón de cuña descendente con una tendencia bajista a largo plazo. El precio cruzó el DEMA y TEMA, pero rebotó en la línea de tendencia superior. Al mismo tiempo, -DI cruzó +DI en el indicador ADX, lo que es una señal bajista.

Si el precio rompe la línea de tendencia superior por encima de 0,8380, el objetivo al alza será 0,8490.

Sin embargo, si rompe por debajo del soporte de 0,8320, el EURGBP caerá a 0,8240.