Fundamental Analysis

The surprising 90-day trade truce between the U.S. and China was met with enthusiasm across U.S. stock markets, triggering an immediate rotation into risk assets. The partial tariff reductions on both sides have eased global slowdown fears and fueled expectations of economic continuity and corporate stability. Reflecting this renewed optimism, the tech-heavy US100 (Nasdaq 100) led the rally with a gain of over 4%, marking its strongest intraday performance in weeks, followed by solid advances in the SP500 and Dow Jones.

Investors interpret the deal as a signal that the threat of a prolonged trade war is easing, supporting valuations in the tech sector, which is particularly sensitive to international supply chains. The prospect of ongoing negotiations, with no signs of a complete breakdown, keeps risk appetite alive—especially in companies with significant exposure to China. However, markets are now shifting their focus to Tuesday’s key inflation data, as a hotter-than-expected CPI print could reignite concerns over U.S. monetary tightening and temporarily cap the current bullish momentum.

Technical Analysis

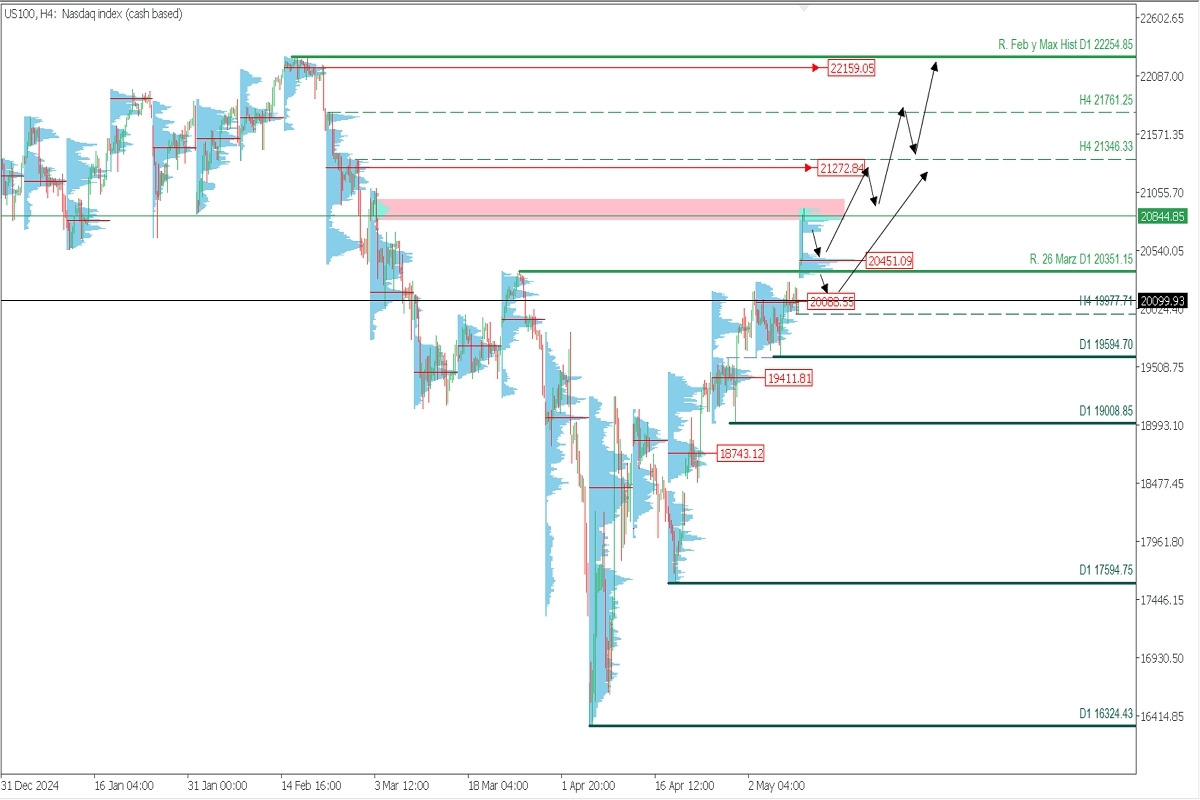

US100 | H4

- Supply Zones: 20845, 21273, 22159

- Demand Zones: 20451, 20088, 19411.81

U.S. indices kicked off the week with optimism, gapping above the last macro daily resistance from March 26 at 20351.15. This was fueled by initial tariff agreement headlines between China and the U.S., triggering more than a 4% rally in the Nasdaq 100 and its derivative, the US100, during the European session.

This surge brought the price up to a key February sell-side volume node around 20845, from where a pullback toward the current demand zone near 20451 is expected. This move also activated 19977.71 as the last validated intraday support—our key reference for the continuation of the current bullish bias.

Buy setups may resume from this demand area, targeting the unfilled POC at 21272.84, and, upon a confirmed breakout, extend further to 21761.25 and 22159.

Technical Summary

- Bearish Scenario: Sell below 20844 → target 20455 → watch for bullish reentry from demand zone.

- Bullish Scenario: Buy above 20451 after correction → targets: 21272, 21346, 21761, 22159.

📌 Exhaustion/Reversal Pattern (ERP): Always wait for the confirmation of an ERP on M5 before entering trades at key zones (examples here 👉 https://t.me/spanishfbs/2258).

📌 Unfilled POC (Point of Control): The level with the highest volume concentration. If followed by a bearish move, it's resistance. If followed by a bullish move, it becomes support.