The New Zealand Dollar rose on Wednesday, trading at 0.5721 despite a significant interest rate cut by the Reserve Bank of New Zealand (RBNZ). As expected, the RBNZ lowered rates by 0.50% to 3.75%, the lowest since November 2022. The bank has cut rates by 1.75% since August, but the NZD’s strength was surprising since rate cuts usually weaken a currency. The RBNZ said inflation remains within its 1%-3% target but warned that slow economic growth at home and globally is a concern. It also mentioned trade restrictions as a potential risk, though it didn’t address US tariff threats directly. Governor Adrian Orr expects rates to drop to 3% by year-end, slightly lower than previous projections. Instead of significant cuts, the RBNZ plans to gradually lower rates in the coming months.

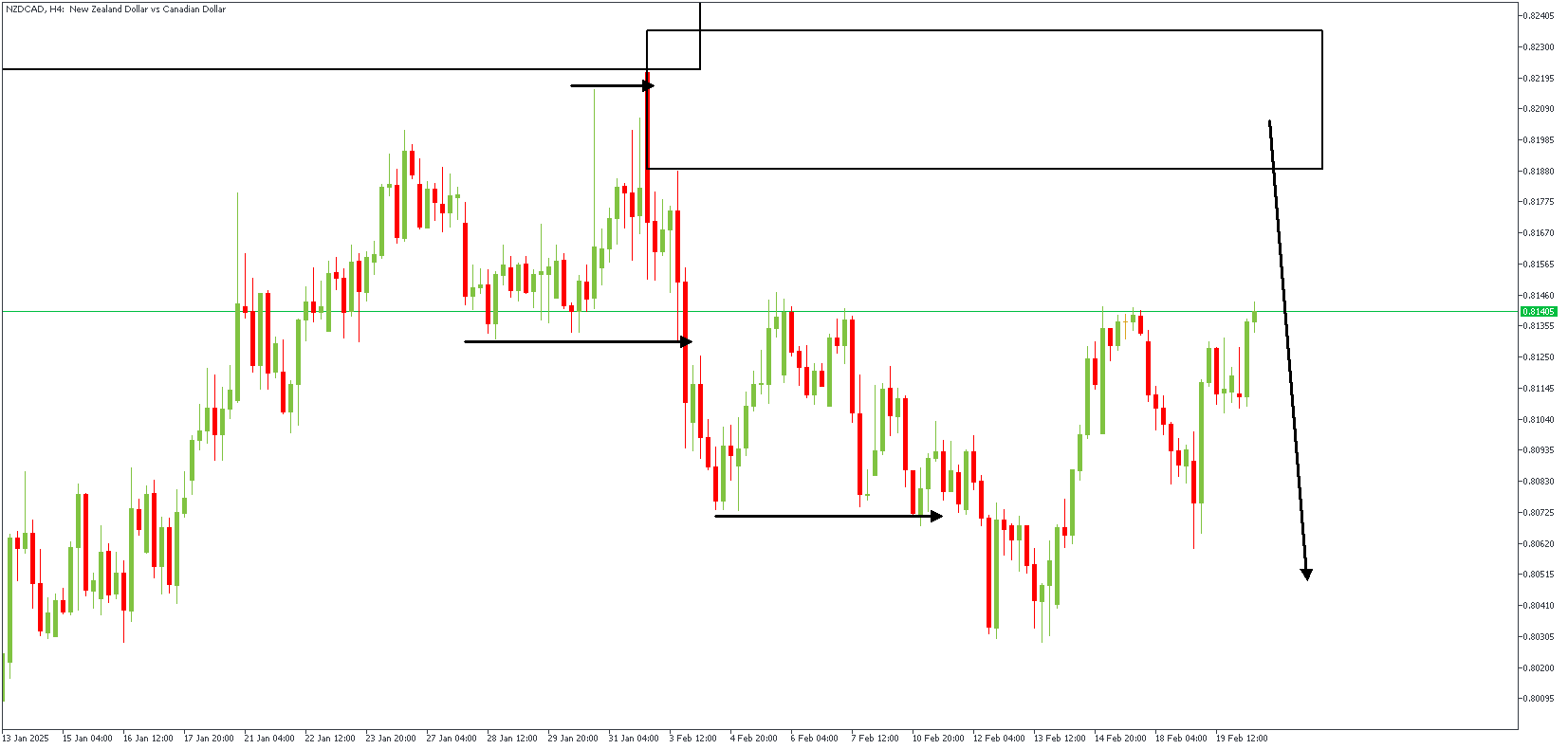

NZDCAD – H4 Timeframe

The daily timeframe chart of NZDCAD shows an initial rejection of the daily timeframe supply zone; the momentum from the rejection was so impulsive that it broke the previous structure and created an SBR pattern. The retest of the highlighted supply area is expected to trigger the next wave of bearish impulse.

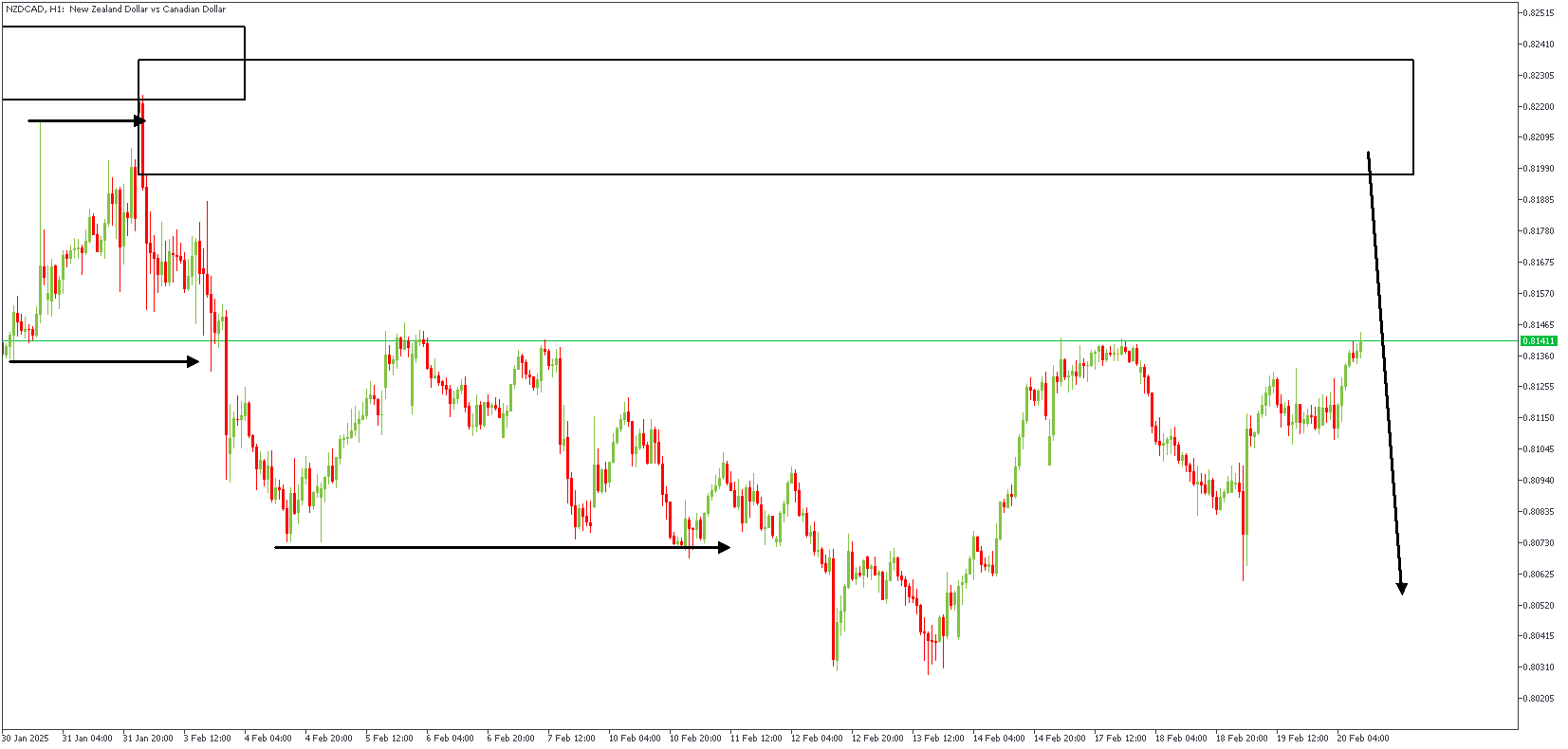

NZDCAD – H1 Timeframe

One of the most striking details on the 4-hour timeframe chart of NZDCAD is the FVG (Fair Value Gap), as seen right below the highlighted supply zone. The presence of an inducement lends further credence to the bearish sentiment since the said supply overlaps the 76% Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bearish

Target- 0.80569

Invalidation- 0.82474

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.