The Japanese Yen (JPY) is trading weakly in the European session but is not falling sharply because many traders believe that the Bank of Japan (BoJ) will raise interest rates again. Additionally, the gap between Japanese and US bond yields is narrowing as investors expect the US Federal Reserve (Fed) to cut interest rates soon. This has helped to limit losses for the Yen.

On the other hand, positive news about a delay in US President Donald Trump's reciprocal tariffs and ongoing peace talks between Russia and Ukraine are reducing demand for the safe-haven JPY. At the same time, rising US Treasury bond yields support the US Dollar (USD), helping it recover from a three-day losing streak and keeping the USDJPY pair positive.

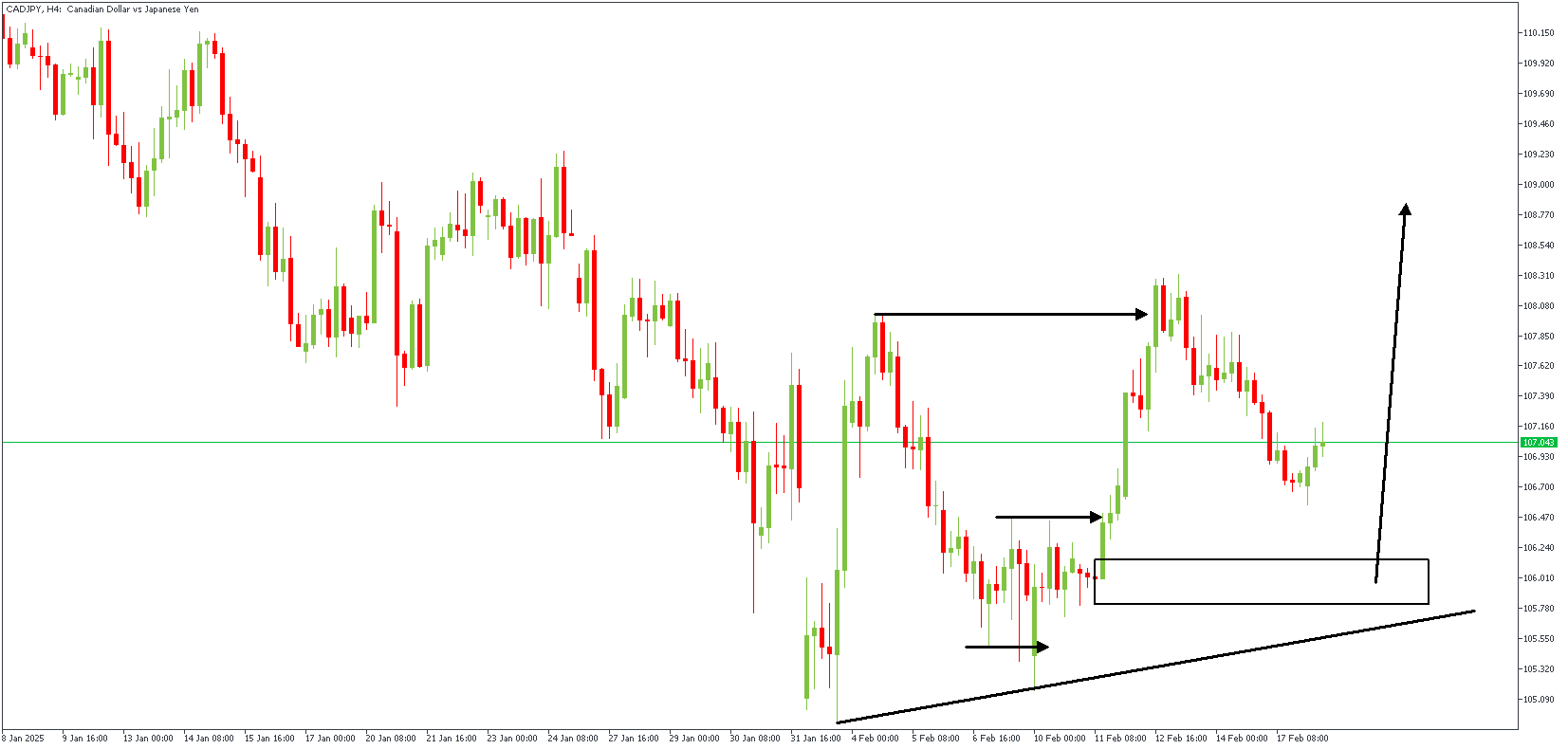

CADJPY – H4 Timeframe

CADJPY has recently broken above the previous high on the 4-hour timeframe chart, leaving an FVG (Fair Value Gap) and a drop-base-rally demand zone behind, near the origin of the bullish momentum. The presence of a trendline support further affirms the bullish sentiment.

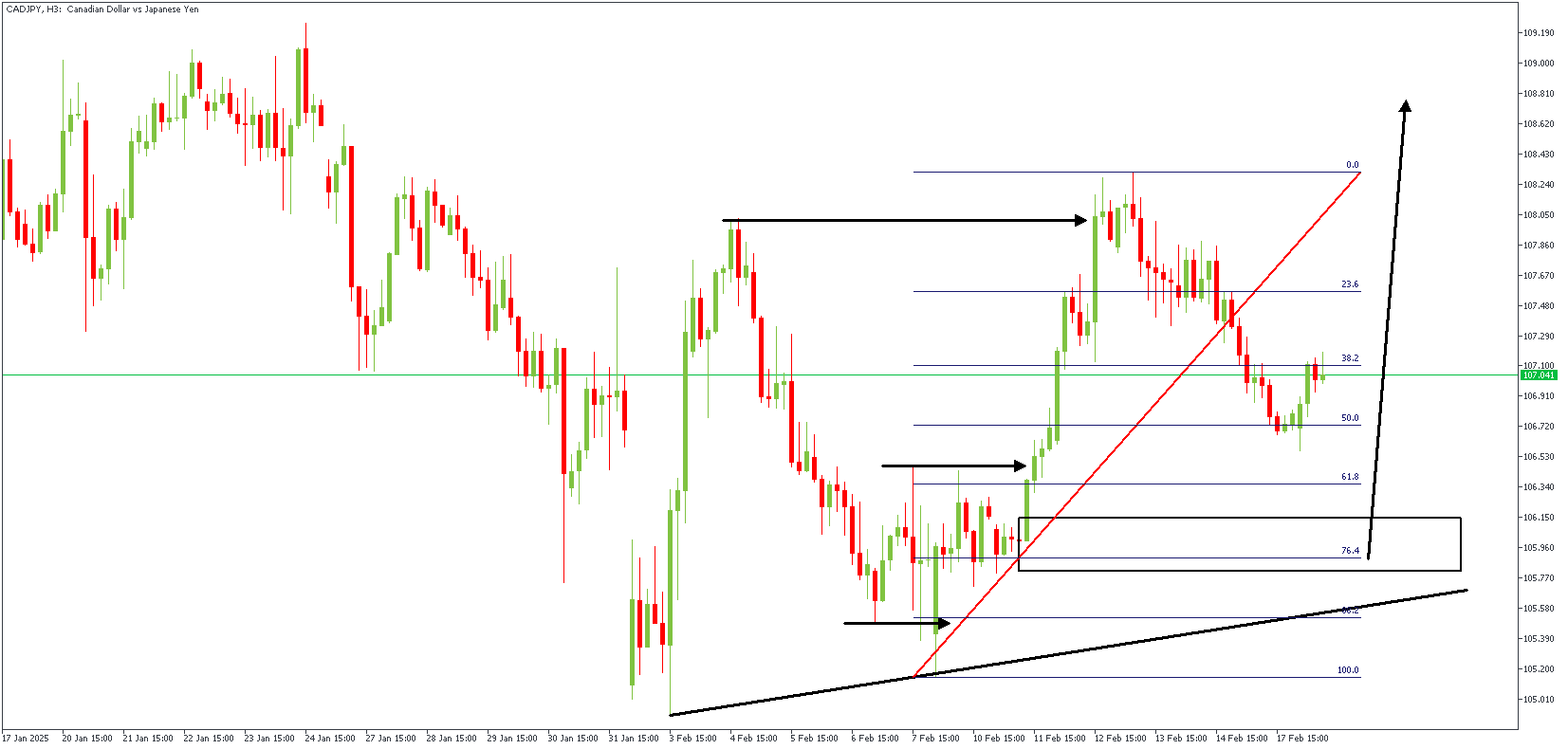

CADJPY – H3 Timeframe

The 3-hour timeframe chart of CADJPY shows the price retracing towards the demand zone at the base of the bullish break. This demand also serves as the order block from the SBR (Sweep Break Retest) pattern and overlaps the 76% Fibonacci retracement level. Considering the trendline support's presence, the price is expected to bounce off the demand to resume the bullish impulse.

Analyst's Expectations:

Direction: Bullish

Target- 108.667

Invalidation- 105.088

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.