The Federal Reserve is widely expected to cut interest rates soon, which has boosted the appeal of gold. However, Daniel Ghali, a Senior Commodity Strategist at TDS, warns that a potential correction in gold prices is becoming more likely. Current investor positioning in gold has reached levels last seen during the pandemic, which often signals a market peak. Additionally, traders in silver are heavily positioned for gains, making both metals vulnerable to a sell-off if prices don’t break higher. Ghali cautions that the crowded market is a risk, hinting that a downturn could be on the horizon.

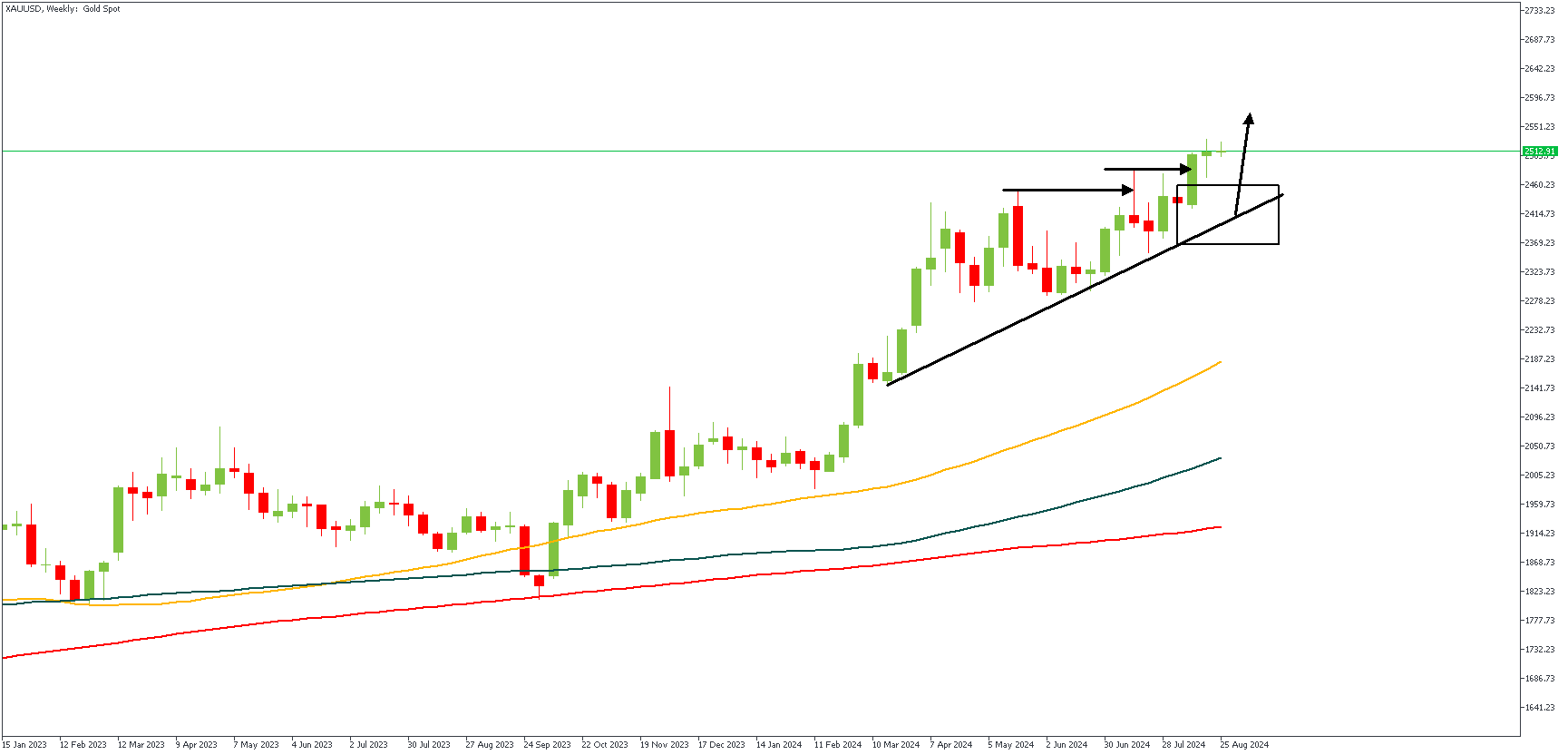

XAUUSD – W1 Timeframe

The weekly timeframe chart of XAUUSD presents a very interesting price action. The previous break of structure to create the new high left behind a demand zone, which I very much expect price to retest in the coming days. The presence of a trendline support provides a much-needed confluence in favor of the bullish sentiment.

XAUUSD – H3 Timeframe

.png)

In spite of the long-term sentiment being bullish, the price action on the 3-hour timeframe suggests that Gold price is likely to retrace over the next few days, in order to bring price into the demand zone. The trendline support, demand zone, bullish array of the moving averages, and the 200-period moving average all align in favor of the long-term bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: $ 2,532.68

Invalidation: $ 2,415

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.