Gold received additional push last week after US CPI figures showed that inflation is still increasing despite Fed efforts to cap inflation between 2.00% and 2.5% levels as favored by the central bank.

In addition to that, Trump recent tariffs war has created instability among trading flow between major production countries. The new elected president for a second term, keeps waiving and sending warnings to major countries such as Canada, China, Mexico, and EU countries by adding more taxes over imports into the USA. All of which has created turbulence and additional fear of where the tariff war can end or to what it can lead through global markets.

Metalor, one of Switzerland's leading refineries, recently imposed a per-ounce surcharge on all its gold products due to shortages. Another major Swiss refinery, Argor-Heraeus, has suspended orders for all 50-gram and 100-gram minted gold bars due to huge demand.

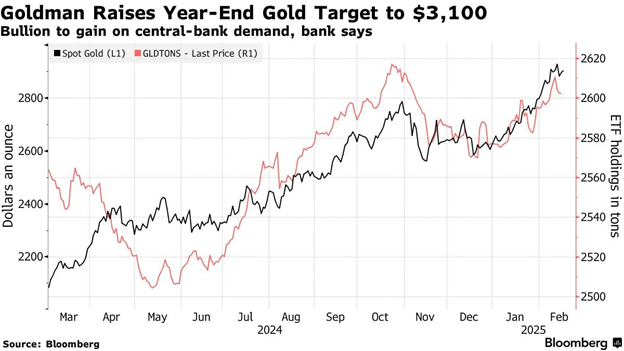

Goldman Sachs has raised their expectations for gold benchmark to $3100 by end of 2025, but gold is already trading above $2940 during first two months of 2025.

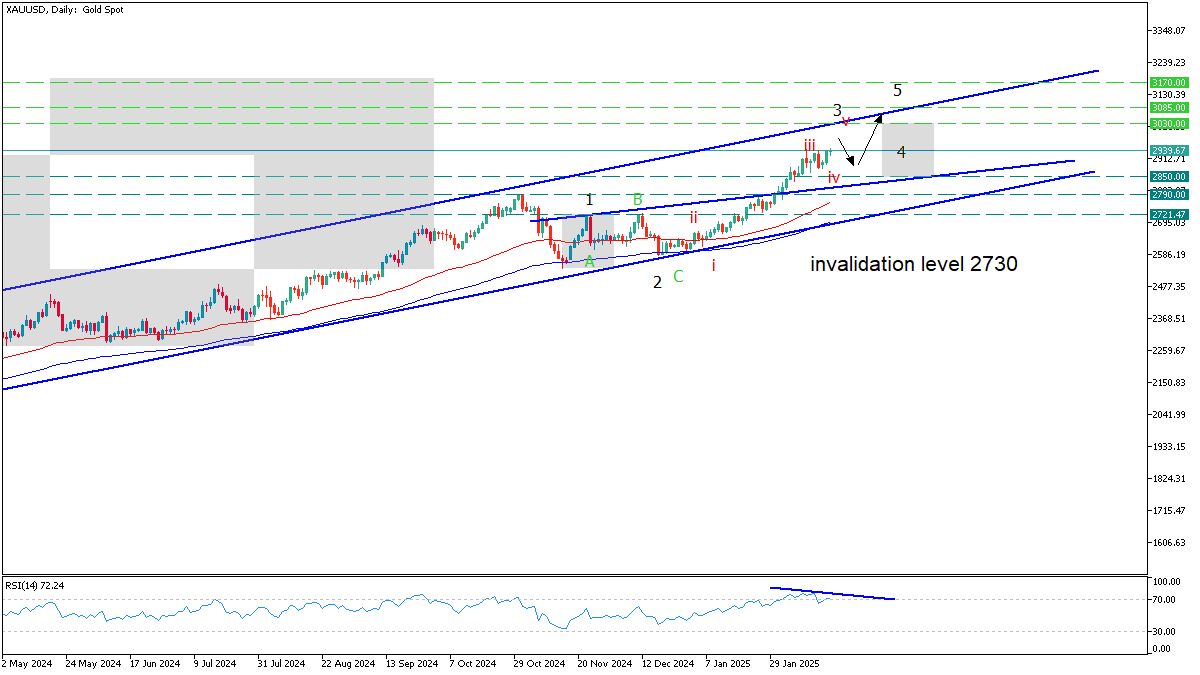

From the Elliott Wave perspective, in the short term, as long as gold is trading above 2875 level, chances that we can push higher to 2090 to 3000 level. But looking at daily RSI, as price breaks higher and RSI fails to record a new high, the divergence can set gold into a correction phase that can take the shape of triangle or ABC pattern due to the strong bull trend.

Gold can correct to 2850, 2830 or even retest the breakout level at 2790 with a potential bounce up again. Our targets for gold in the medium term are 3030, 3085, 3170 after seeing a correction. We prefer not to see the gold break below 2730 in the short term to stay positive on our view of the bull trend.