The USDJPY pair fluctuated around the 156.15-156.20 level on Monday. The pair recently bounced off the lower boundary of a long-term upward channel but faced resistance near 156.55-156.60. If the pair breaks above this level, it could rise toward 157.00 and potentially higher to 158.00 or the recent high of 158.85. On the downside, strong support is seen near 155.25 and 155.00, with a break below these levels possibly triggering further declines toward 154.00 or lower. The Japanese Yen gained some support from improving machinery orders and expectations of a Bank of Japan rate hike. At the same time, uncertainty around US trade policies and upcoming events keeps traders cautious.

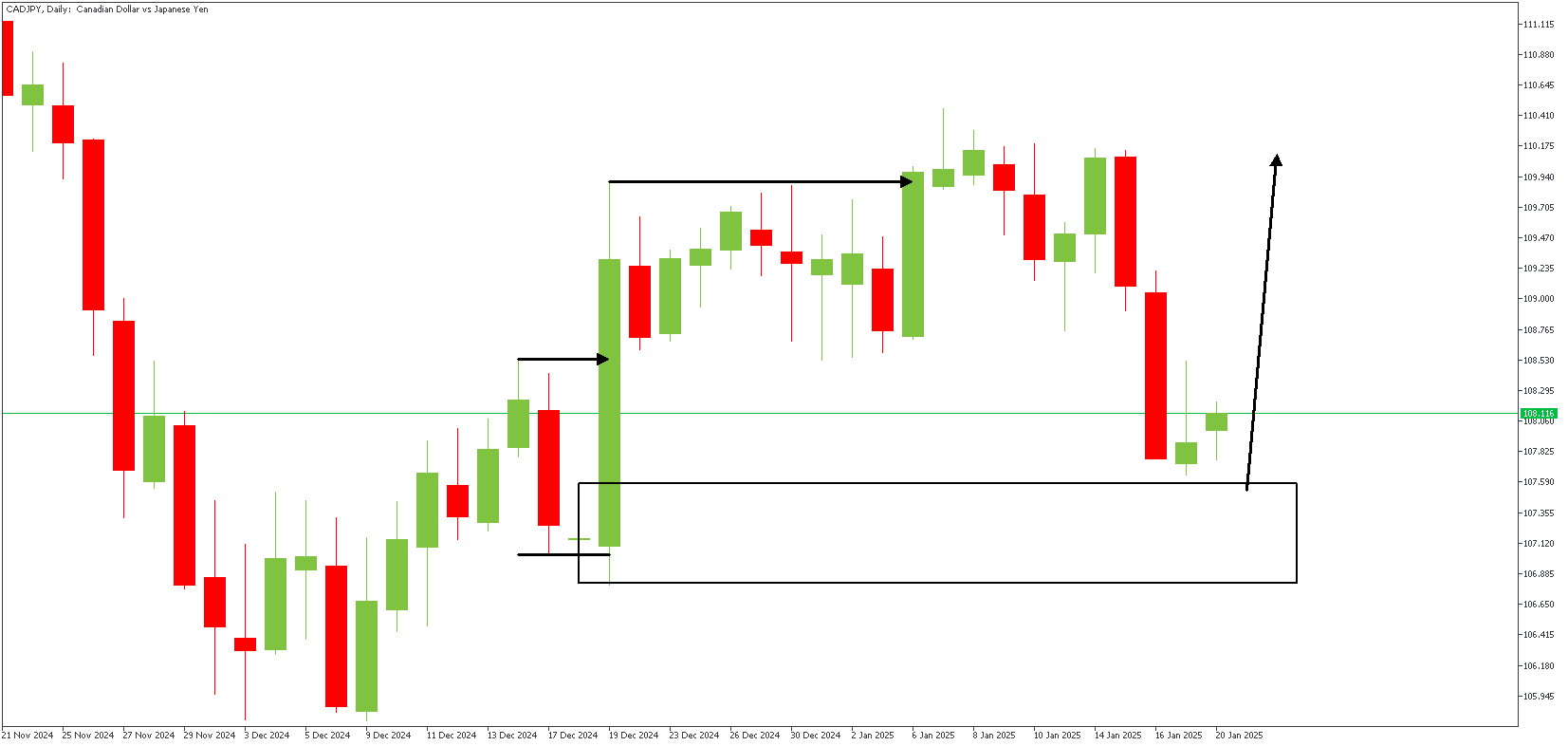

CADJPY – D1 Timeframe

Having an SBR (Sweep-Break-Retest) pattern on the daily timeframe chart often indicates a long-term opportunity. This case is fascinating because of a fair-value gap at the initial break of structure. In any case, the retest of the demand zone is necessary for the bullish sentiment.

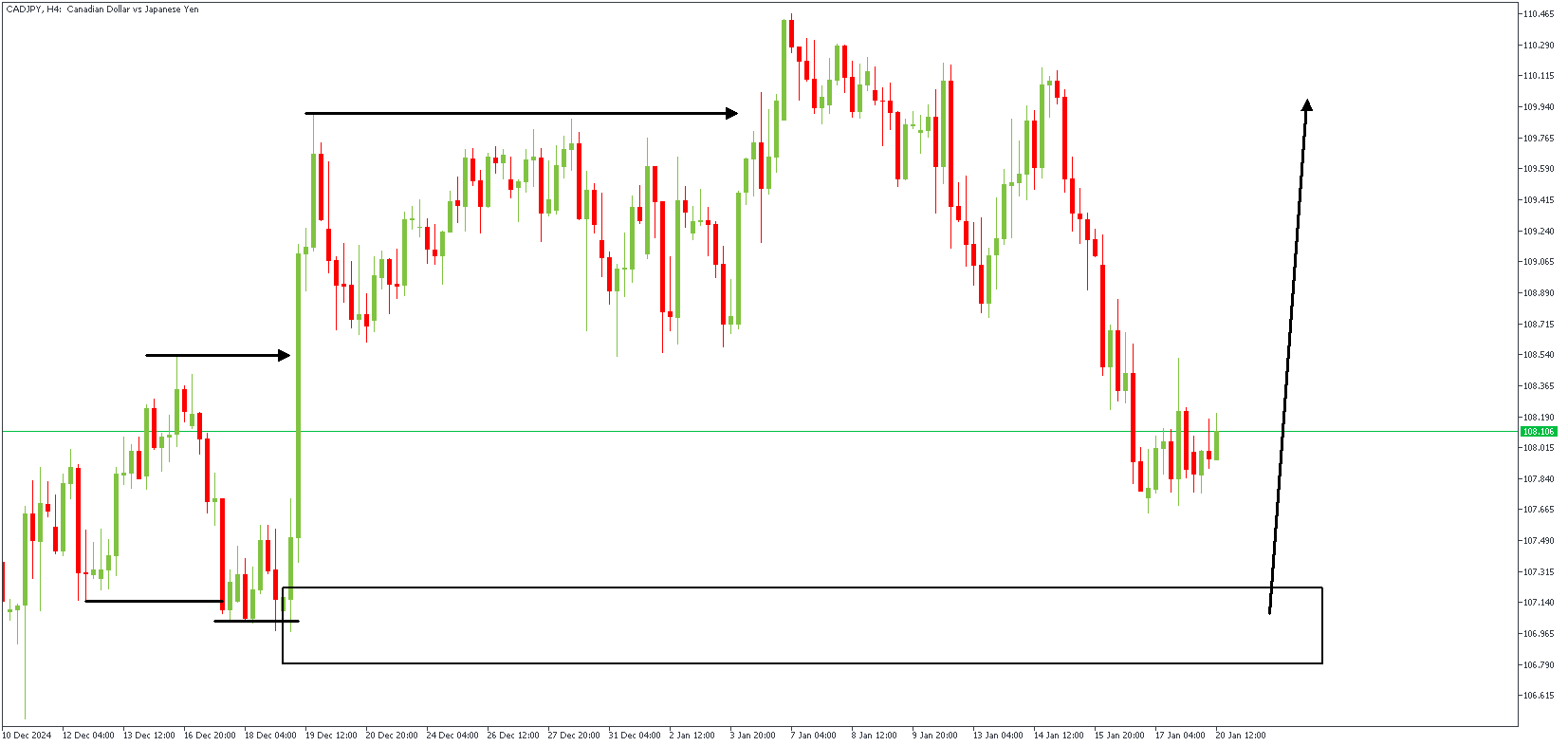

CADJPY – H4 Timeframe

The price action on the 4-hour timeframe chart shows a much clearer picture of the price action. At this point, the SBR pattern is a lot clearer, too. As mentioned earlier, the trigger for the bullish entry is the demand zone, as highlighted by the rectangular shape.

Analyst’s Expectations:

Direction: Bullish

Target: 109.919

Invalidation: 106.193

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.