APA Corporation (Nasdaq: APA) has shared key updates about its financial and operational performance for the fourth quarter of 2024. The company reported estimated oil and gas prices, with U.S. crude oil averaging $70.25 per barrel and natural gas at $1.00 per Mcf. APA also completed the sale of non-core assets in the Permian Basin, receiving approximately $774 million in net proceeds. Additionally, the company repurchased 4.6 million shares at an average price of $21.90 per share. Investors can join APA’s earnings call on February 27 at 10 a.m. Central time via the company’s website.

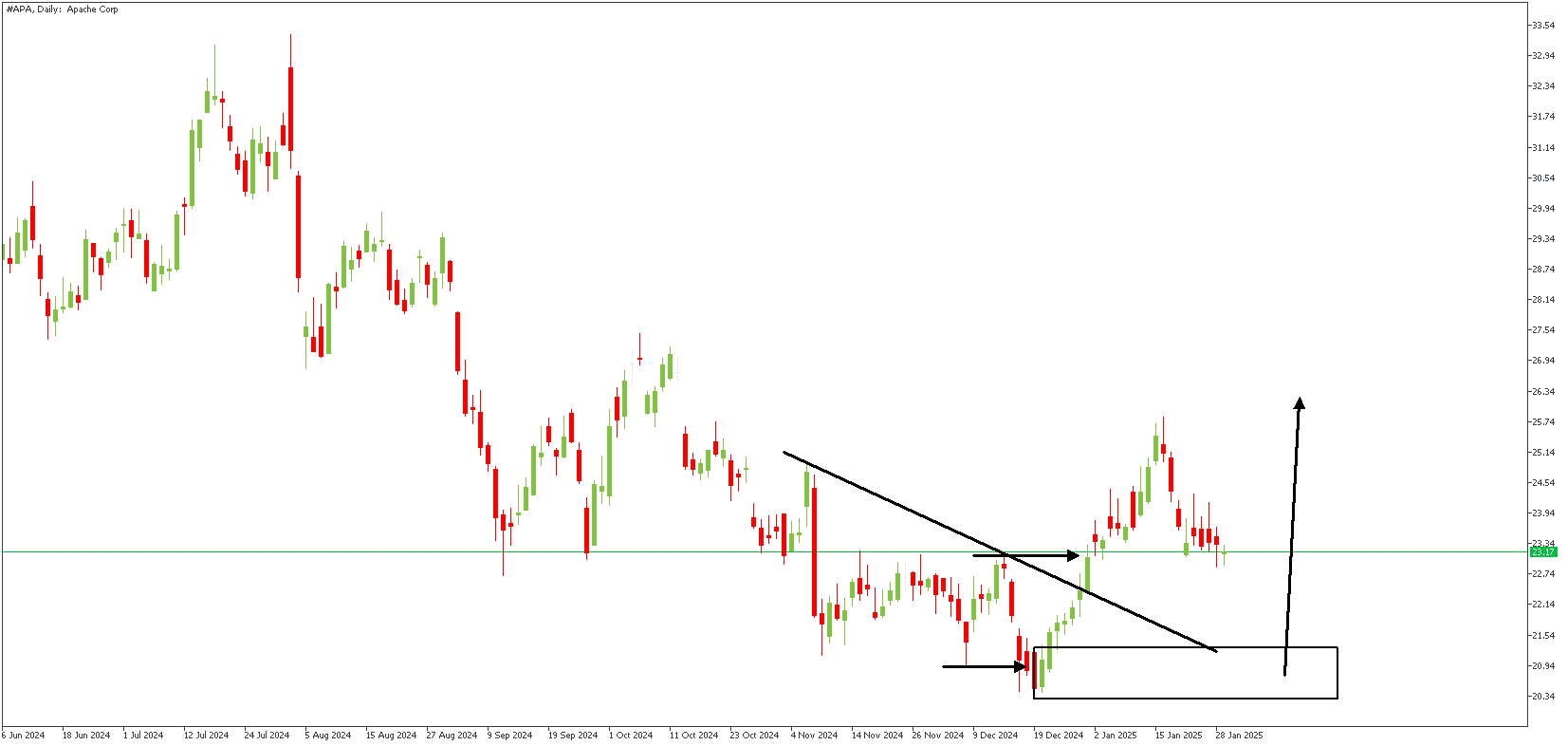

APA – D1 Timeframe

On the daily timeframe chart of APA stock, we see a break of structure above the trendline resistance. The impulse move that broke the structure left behind an FVG (Fair Value Gap) region, one I believe the price intends to fill before aiming for a higher price point. The demand zone of an SBR pattern has been marked out, serving as our area of interest for the bullish sentiment.

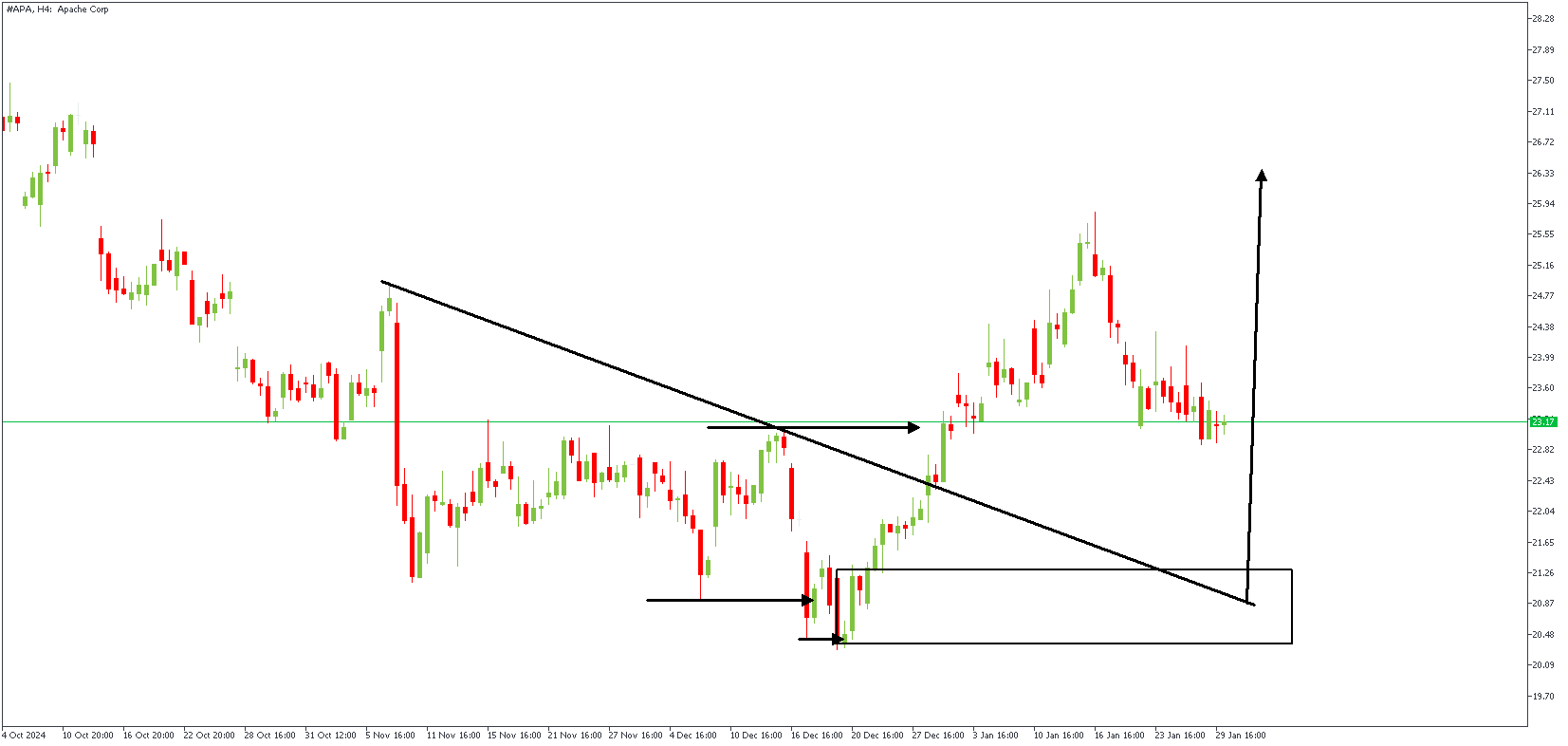

APA – H4 Timeframe

The 4-hour timeframe chart of APA stock reveals in detail the intersection of the trendline support and the demand zone. We can also see that the demand zone sits near the 76% Fibonacci retracement level, thereby ticking all my boxes for a bullish expectation.

Analyst’s Expectations:

Direction: Bullish

Target: 26.47

Invalidation: 19.94

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.