Una estrategia de trading contratendencia es un intento de obtener una pequeña ganancia al abrir una operación en contra de la tendencia principal. El trading contratendencia es una forma de swing trading que asume que la tendencia actual del mercado experimentará reversiones o retrocesos, y entonces intenta obtener una ganancia con esos retrocesos mientras la tendencia subyacente continúa. Se trata de una estrategia a mediano plazo, en la que las posiciones se mantienen abiertas durante unos pocos días o semanas.

Algunos traders que utilizan esta estrategia para generar ganancias recurren a los retrocesos mientras mantienen sus posiciones principales en la dirección de la tendencia. Las estrategias de contratendencia usan indicadores de momentum, patrones de velas y niveles de soporte y resistencia para identificar posibles puntos de entrada en el mercado. Sin embargo, es necesario que los traders que apliquen este método se preparen para la reanudación de la tendencia vigente, la cual puede ocurrir en cualquier momento y sin previo aviso. Por lo tanto, para limitar las pérdidas al operar con esta estrategia, se deben usar técnicas adecuadas de gestión de riesgos, como órdenes stop loss y tamaños de posición mínimos.

Los traders que emplean este enfoque se guían por los patrones de velas de reversión (pin bars, estrellas de la mañana y estrellas de la tarde, entre otros). También aplican osciladores como MACD (media móvil de convergencia/divergencia) o RSI para ver si el mercado se encuentra en estado de sobrecompra/sobreventa y si existe una divergencia entre el precio y el indicador. Si estas señales están presentes, los traders abren posiciones contrarias a la tendencia anterior.

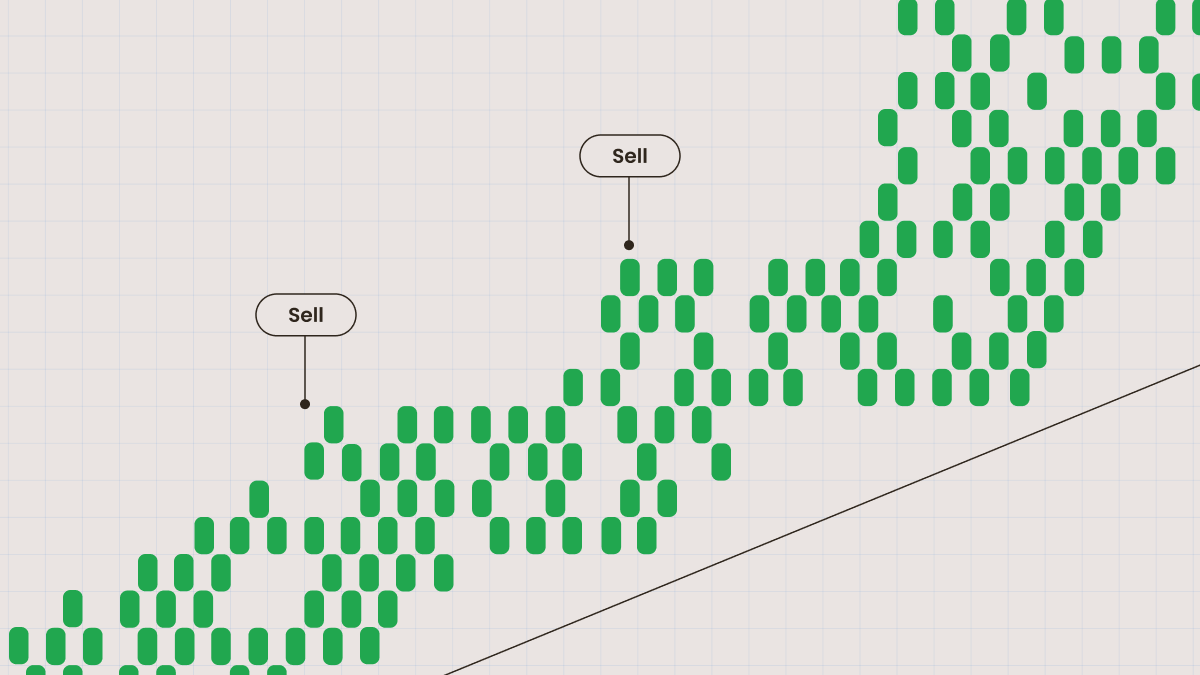

Un trader puede decidir vender en el punto 1, ya que el precio ha formado una vela con una sombra superior larga (una señal negativa) y el indicador MACD no confirmó el máximo del precio.

Take profit

Es más difícil encontrar un lugar donde asegurar ganancias cuando se opera en contratendencia. El reto es evitar el exceso de codicia. Recuerda que estás apostando contra el mercado. Algunas tendencias pueden convertirse en un mercado lateral y limitar las ganancias de una posición de contratendencia. La tendencia inicial también puede reanudarse rápidamente y no dejar que el precio corrija demasiado. Ten cuidado y gestiona tus riesgos.

Stop loss

Colocar una orden stop loss en una operación de este tipo es la opción natural. Los traders colocan sus órdenes stop loss por detrás del punto extremo del precio desde el que empezó una corrección. Es probable que el stop loss sea menor que el que usarías si operaras siguiendo la tendencia principal.

Scaling in

No es buena idea alterar el tamaño de tu posición cuando operas en contratendencia. La operación puede ser a muy corto plazo, por lo que corres el riesgo de ponerte en una situación incómoda si intentas añadir algo. Y nunca agregues a una posición perdedora, ya que puedes provocar una pérdida mayor.

En nuestro nuevo video, hablaremos con más detalle del trading de tendencias y contratendencias.

Resumen