Fundamental Analysis

Global markets begin the week under the influence of August's Non-Farm Payrolls (NFP), which added only 22,000 jobs. This level is comparable only to December 2020, during the peak of the pandemic, highlighting a sharp slowdown in the U.S. labour market.

The unemployment rate rose to 4.3%, its highest level in nearly four years. As a result, short- and long-term U.S. Treasury yields dropped to multi-month lows, while traders increased bets on a 25-basis-point Fed rate cut on September 17. Some investment banks even consider a more aggressive 50-basis-point cut if the labour weakness persists.

The focus this week will be on the U.S. CPI for August, scheduled for Thursday, which may reflect the impact of recent tariffs on consumer prices. On the same day, the ECB will hold its monetary policy meeting, where the consensus expects the policy rate to remain at 2%, although Christine Lagarde’s tone will be key for the euro’s direction.

In Europe, political tension in France is rising: Prime Minister François Bayrou faces a likely failing confidence vote, while Fitch will review the country’s credit rating on September 12, with a downgrade possible if instability persists.

In Asia, the resignation of Japanese Prime Minister Shinzo Abe, not Shigeru Ishiba, weakened the yen and sparked speculation about more expansionary fiscal policies. Nevertheless, Japan’s Q2 GDP surprised on the upside with +2.2% annualised growth, supported by private consumption.

Technical Analysis

Dollar Index (DXY) | H4

Supply Zones (Sell): 98.23

Demand Zones (Buy): 97.30, 96.89

The DXY has maintained a corrective bearish bias since late July. After approaching the POC at 97.30, a corrective rebound is expected before resuming sales. If the price stays below the POC at 97.76, new selling entries could push the index toward 97.00 and 96.89.

- Sell setups: USDCAD, USDJPY, USDCHF

- Buy setups: EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD

A decisive break above 97.76 would trigger a weekly correction toward 98.00–98.23, a supply zone for bears, with a potential extension toward 98.39–98.57, reversing the H4 bearish bias.

- Sell setups: EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD

- Buy setups: USDCAD, USDJPY, USDCHF

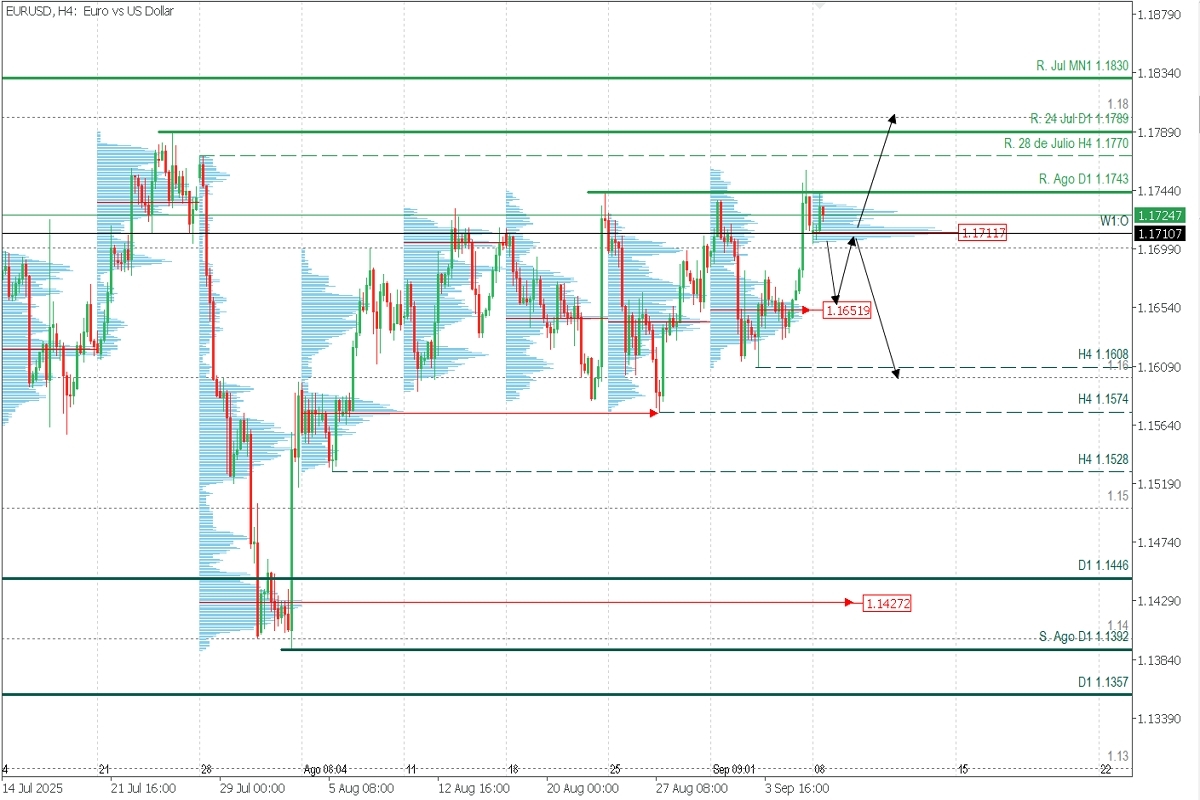

EURUSD | H4

Supply Zones (Sell): 1.1789

Demand Zones (Buy): 1.1651, 1.1574

Following Friday’s rebound, the pair shows a failure at the 1.1743 resistance and a POC at 1.1711, creating two scenarios:

- Drop below 1.1711 targeting 1.1651, with a potential rebound toward 1.17–1.1743 and extension up to 1.18.

- Failure to decisively break 1.1743 could trigger new selling toward 1.16 this week.

Educational Notes:

- Exhaustion/Reversal Pattern (PAR): always wait for confirmation on M5 before trading key zones.

- POC (Point of Control): the level with the highest volume concentration; acts as support/resistance depending on prior market direction.