Investors interested in buying Zebra Technologies (ZBRA) stock but hesitant to pay the current price of $405.02 per share might consider selling a put option instead. A notable option is the August put, with a $400 strike price recently priced at $30.20. By selling this put, an investor could earn a 7.5% return on the $400 commitment, or about 13.8% annually, if the option expires without exercise.

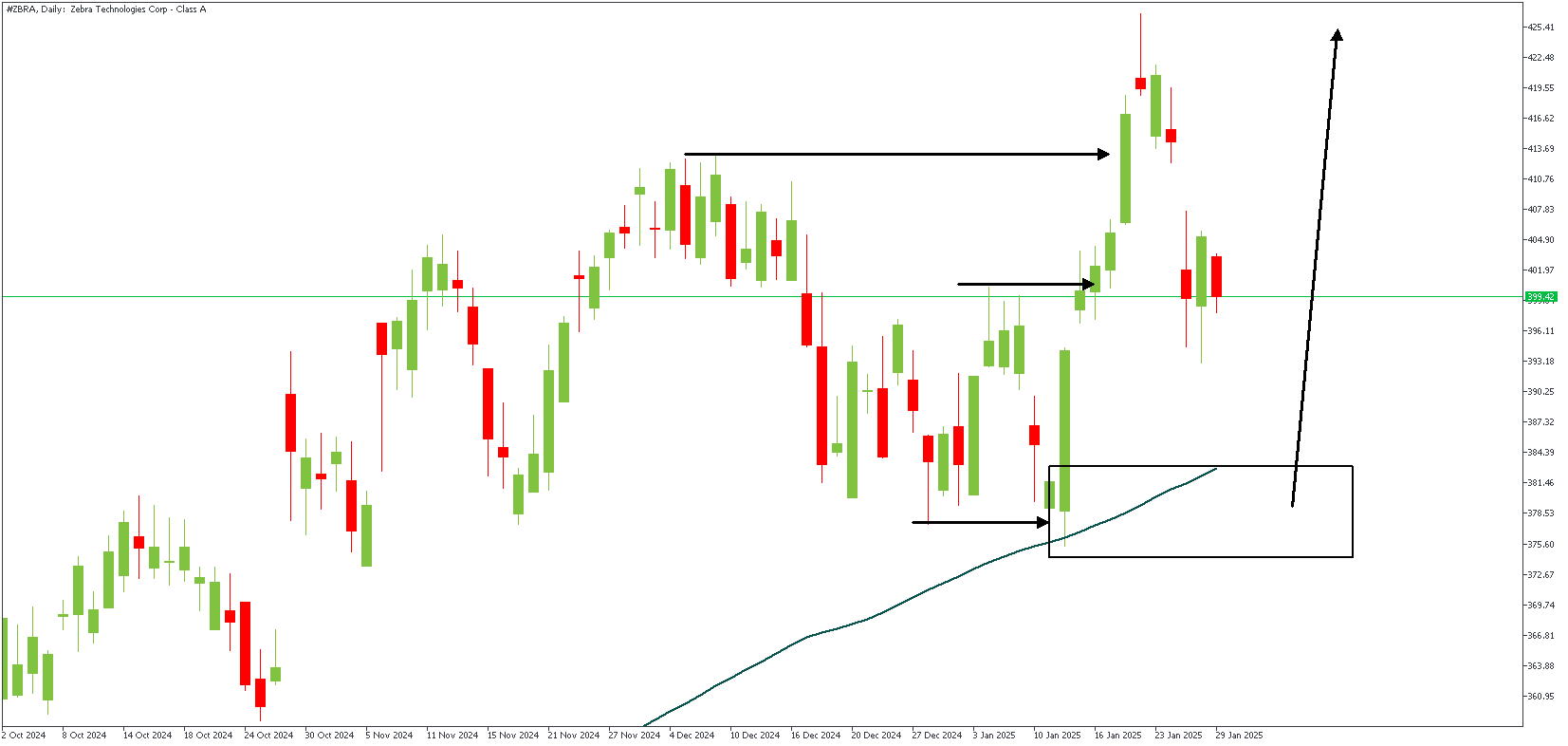

ZBRA – D1 Timeframe

The daily timeframe chart shows a series of broken highs, with the retracement move in full effect and fast approaching the drop-base-rally demand at the origin of the impulse move. The 100-day moving average also provides a critical level of support.

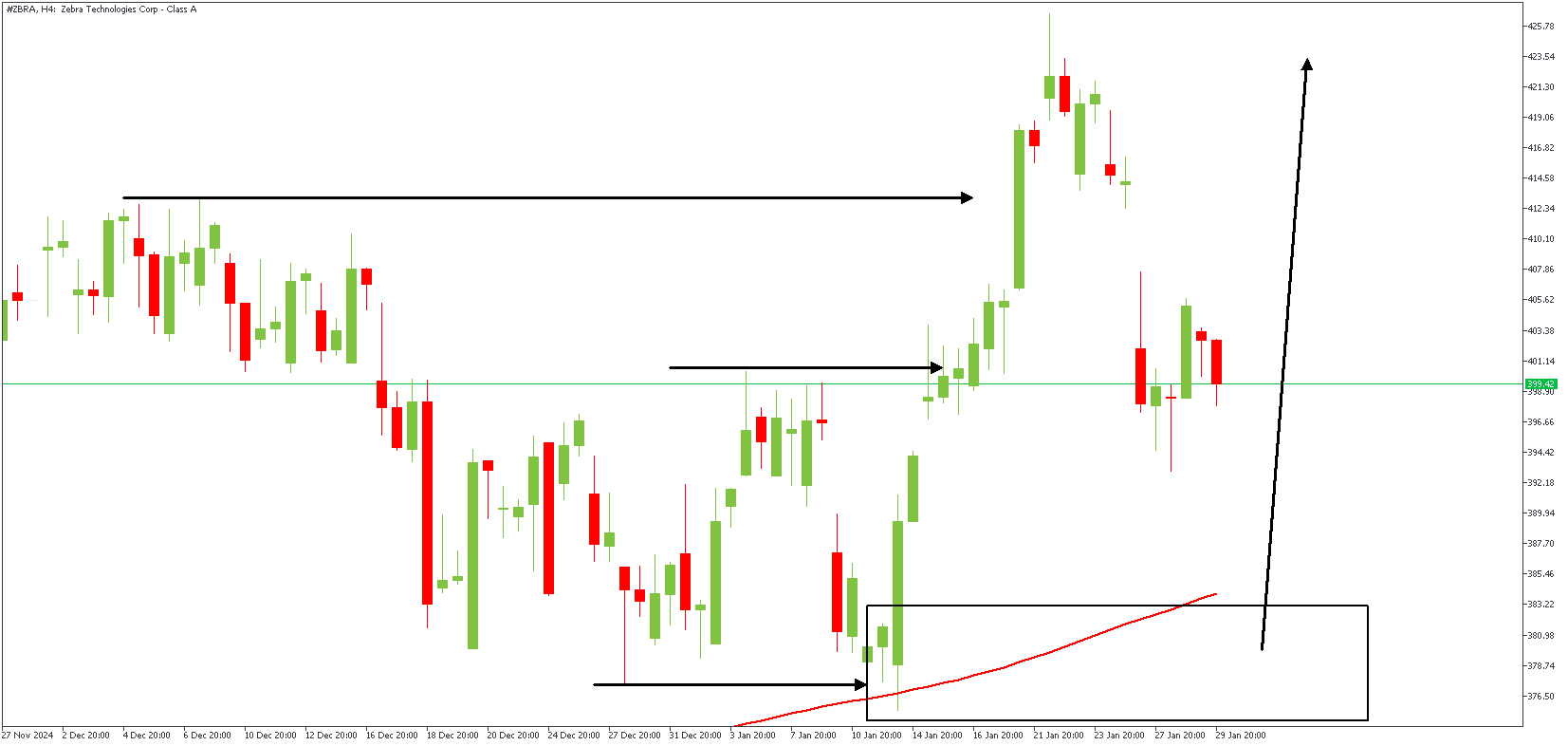

ZBRA – H4 Timeframe

On the 4-hour timeframe chart of Zebra Technologies stock price, we see a clear SBR pattern aligning perfectly with the 200-period moving average support near the 76% Fibonacci retracement level, confirming the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 423.91

Invalidation: 373.27

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.