Q2 FY2025 Earnings Recap

On January 29, 2025, Microsoft released its earnings report for the second quarter of fiscal year 2025, ending December 31, 2024. Key highlights include:

Financial Performance

- Total Revenue: $69.6B (+12% YoY)

- Net Income: $24.1B (+10% YoY)

Segment Performance

- Productivity & Business Processes: Revenue grew 14%, driven by a 15% increase in Microsoft 365 Commercial cloud services.

- Intelligent Cloud: Revenue reached $25.5B (+19%), with server and cloud services growing 21% and Azure soaring 31%.

- More Personal Computing: Revenue remained stable at $14.7B, with Windows OEM & devices up 4% and Xbox content & services up 2%.

AI Investments & Market Outlook

Microsoft is doubling down on AI, planning to invest $80B in FY2025, primarily in data centers and specialized AI chips.

Challenges & Future Outlook

Despite solid results, Microsoft expects slower cloud growth due to data center capacity constraints. The AI sector also presents competition risks from emerging players like DeepSeek.

Stock Price Projections

- High: $515

- Median: $490

- Low: $425

These forecasts reflect varying perspectives on Microsoft's AI investments and long-term growth potential.

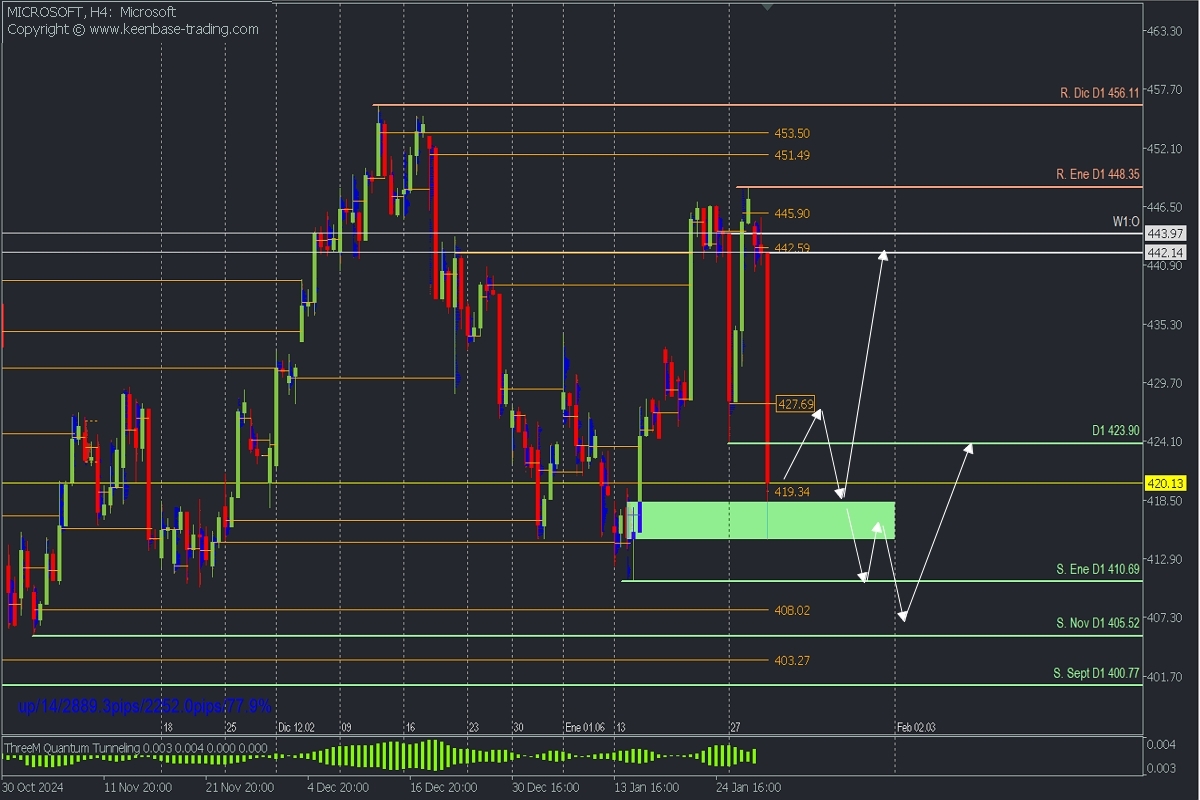

Technical Analysis

Microsoft shares dropped over 6% at today’s market open (Jan 30, 2025), hitting a low of $414.72, due to slower-than-expected Azure growth.

A short-term recovery is likely towards $427.69 or the previous opening levels between $442.14 – $443.97, where significant selling pressure is concentrated.

Failure to reclaim these levels could push the stock lower toward $410.69 – $408.02, key demand zones that may offer support.