NVIDIA is a leading technology company, primarily recognized for its graphics processing units (GPUs) used in gaming, data centers, and artificial intelligence (AI). The company has experienced significant growth in recent years due to the rising demand for AI solutions.

Recent Events:

NVIDIA is facing a notable challenge due to the launch of "R1," an AI application developed by the Chinese startup DeepSeek. This app, built on older NVIDIA chips, offers performance comparable to advanced models like ChatGPT but at a significantly lower cost. Although this innovation has raised concerns about NVIDIA's dominant position in the AI market, it triggered an 18% drop in its stock value, wiping out approximately $593 billion of its market capitalization.

What to Expect Before Earnings Release:

NVIDIA Corporation is scheduled to release its Q4 fiscal 2025 financial results on February 26, 2025, after the market closes. (NVIDIA's fiscal year ends in January 2025, so Q4 covers the three months leading up to this date).

Several key indicators will be under focus as investors evaluate these results:

- Total Revenue: NVIDIA is expected to report revenue of approximately $33.1 billion for this quarter.

- Earnings Per Share (EPS): The consensus estimate is an adjusted EPS of $0.71.

- Data Center Segment: This sector is critical for NVIDIA due to the growing demand for AI and machine learning solutions. A significant increase in revenue from this segment is expected, with projections showing a 133% rise in fiscal 2025.

- Future Outlook: Investors will also pay attention to the company's projections for the upcoming quarters, especially concerning the demand for its GPUs in AI applications and other emerging markets.

Key Issues for the Upcoming Earnings Release:

- Emerging Competition: The recent emergence of the Chinese startup DeepSeek, which has allegedly developed an efficient AI model with lower hardware investment, has raised concerns. This situation could influence future demand for NVIDIA's GPUs and its competitive position.

- Regulatory Scrutiny in China: Chinese authorities have initiated an antitrust investigation into NVIDIA's 2019 acquisition of Mellanox Technologies. This scrutiny could have implications for NVIDIA's operations in the Chinese market.

- Market Volatility: After a significant 18% drop in its stock price on January 27, 2025, NVIDIA experienced a 5% rebound in pre-market trading on January 28, reflecting the current market volatility and investors' sensitivity to news related to the company.

- Innovation and Product Development: NVIDIA's ability to innovate and develop new products will be crucial to maintaining its leadership in the tech sector and meeting the increasing demand for AI and high-performance computing solutions.

Conclusion: When evaluating NVIDIA as an investment opportunity, it’s essential to consider these financial and contextual factors, as well as monitor market trends and the company's strategies to address emerging challenges. The market's reaction to DeepSeek's progress highlights the AI sector's competitive nature and rapid evolution. While DeepSeek's technology represents a significant innovation, it’s important to recognize that NVIDIA remains a key player in the industry. It demonstrates its historical ability to innovate and maintain a solid position in the market with a strong track record in innovation and adaptability.

Technical Analysis:

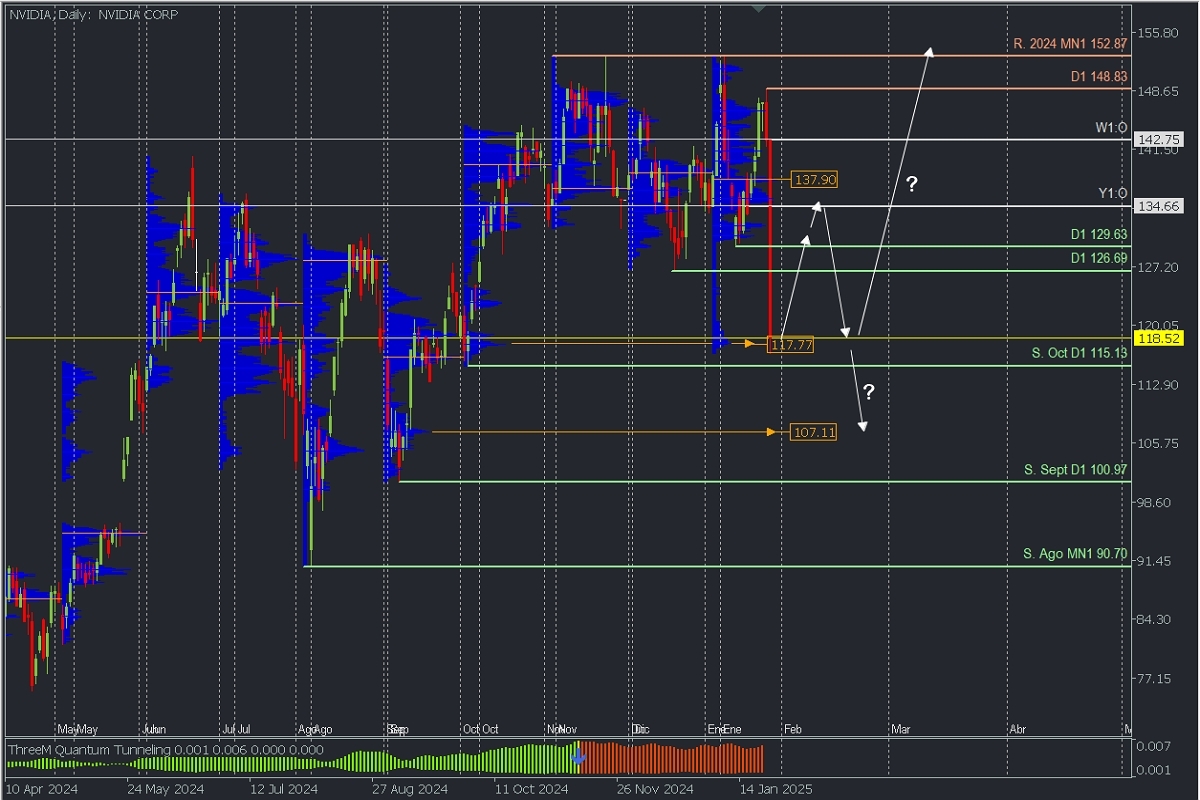

NVIDIA, Daily

The drop on January 27 highlights technical weakness, confirming a daily reversal after breaking support near the annual open (Y1:O) at $134.00. A moderate recovery is expected towards the broken support levels at $126.69 and $129.63, looking for key volume areas (supply = sell) around the annual open (Y1:O) and the current point of control (POC) for January at $137.90 (which may change until the month ends).

If these selling zones are surpassed with enough strength on an initial rise or after a pullback to $117.00, a rapid price recovery is expected with targets at $150.00, $155.00, and $160.00 in the coming weeks.

However, if the area around $135.00 acts as resistance, the price may still fall below yesterday’s lows at $117.00 towards $115.00, $110.00, and $107.00, the latter being a demand zone from September.