Summary

- Current Price: ~$3,320

- Support Levels:

- $3,300: Key psychological level

- $3,288: 38.2% Fibonacci retracement

- $3,260: Recent swing low

- $3,225–$3,200: 50% Fibo & near-term top confirmation if broken

- Resistance Levels:

- $3,367–$3,368: 23.6% Fibo and key pivot

- $3,400: Round-number target

- $3,425–$3,427: Intermediate resistance

- $3,500: Major psychological ceiling

Gold has bounced after holding the 38.2% Fibo support at $3,288, but upward momentum is currently stalling at the $3,367–$3,368 zone. On the daily chart, oscillators remain bullish, suggesting further upside if $3,368 is reclaimed.

Fundamental Factors Affecting Gold

- Safe-Haven Demand Reignited

- Treasury Secretary Scott Bessent’s firm stance on China tariffs has dimmed hopes for a quick deal. This revives demand for gold as a hedge against policy unpredictability and global trade disruptions.

- Trump’s return to reciprocal tariffs rhetoric reinforces the narrative of prolonged trade tensions.

- Fed Policy Outlook Turning Dovish

- The Fed’s Beige Book pointed to slowing consumer demand, a cooling labor market, and business uncertainty.

- Markets now price in at least three Fed rate cuts by year-end, beginning in June, supporting gold’s non-yielding appeal.

- Mixed Economic Signals

- S&P Global’s PMI: Slowing service sector activity raises concerns about broader demand.

- Durable Goods and Jobless Claims (due today) may provide near-term direction.

- US Dollar Weakness

- The USD has pulled back modestly after a two-day recovery.

- A weaker dollar is gold-positive, reducing the opportunity cost of holding bullion for international investors.

- Tempered Risk Appetite

- Despite a general risk-on mood, uncertainty around Fed independence, tariffs, and global growth risks keep markets cautious.

- This limits risk asset upside and provides underlying support to gold.

Key Takeaway for Traders

- Bullish Bias Holds, but $3,368 is a key ceiling in the short term.

- Traders should watch for a clean break above $3,368 to target $3,400 and $3,425.

- Failure to hold $3,300–$3,288 opens the door to $3,260 and $3,225 on deeper correction.

- For Forex traders:

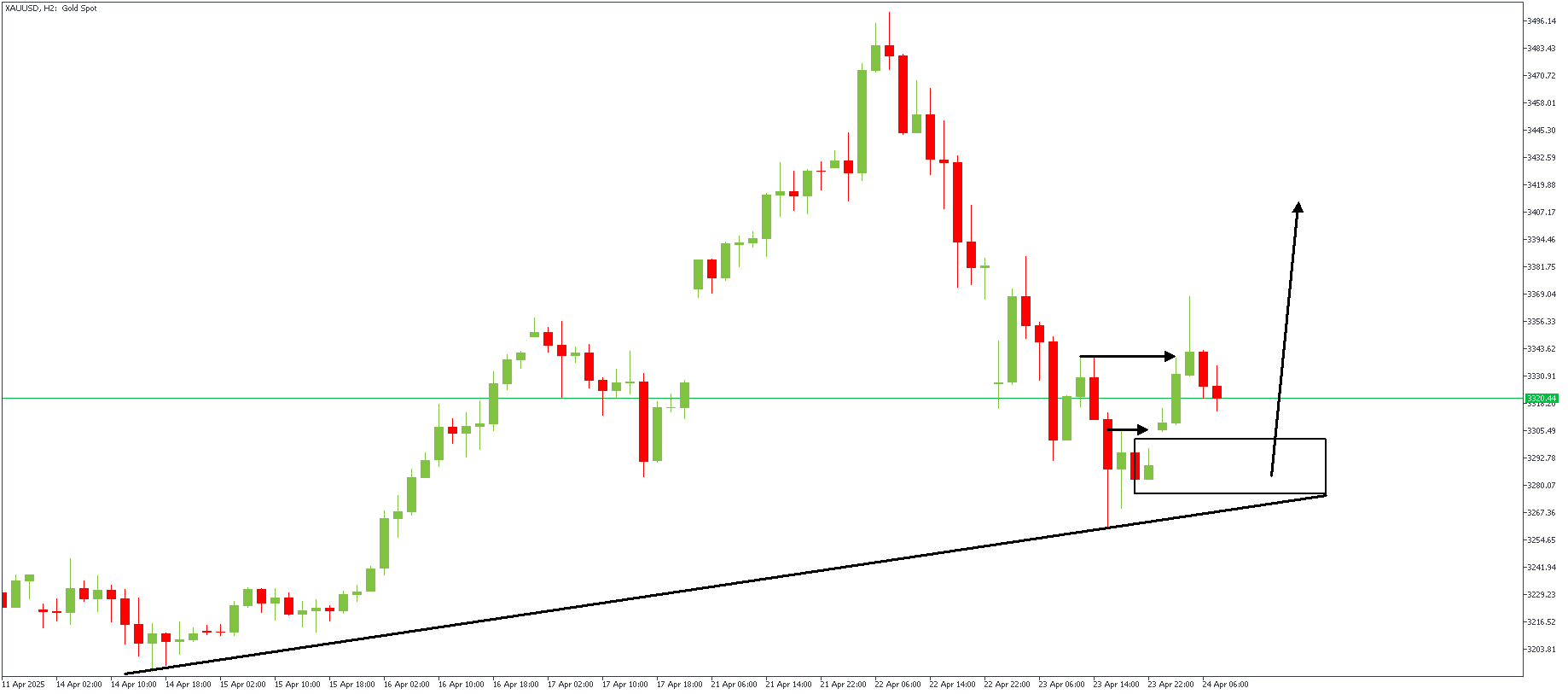

XAUUSD – H2 Timeframe

Reacting to the trendline support, the price action on the 2-hour timeframe chart of XAUUSD gave a bullish break of structure with a gap. This shows that we can expect a show of strength from the highlighted demand zone.

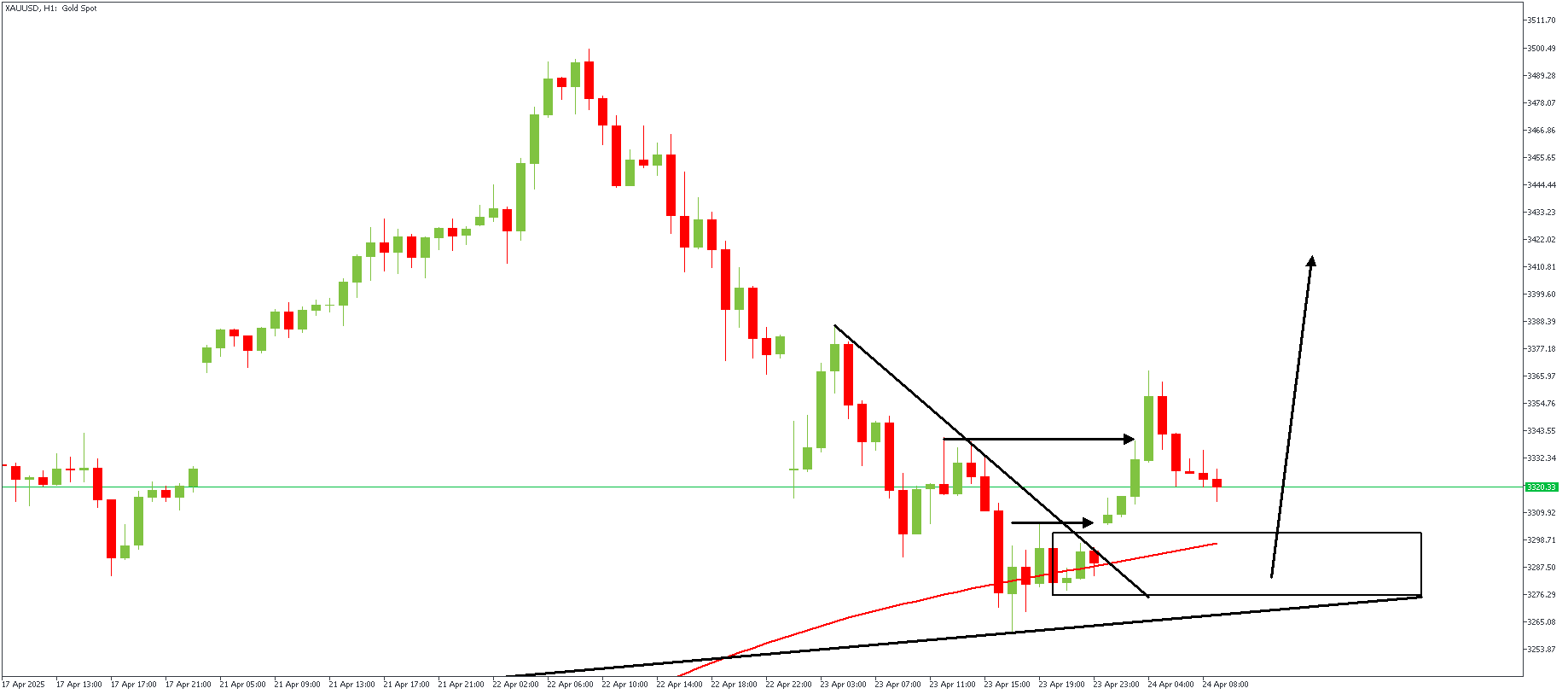

XAUUSD – H1 Timeframe

The 1-hour timeframe chart of XAUUSD shows the SBR pattern formed as the price movement pushed into the 100-period moving average support and the trendline support. In conjunction with the higher timeframe criteria, my conclusion favors continued bullish price action.

Analyst’s Expectations:

Direction: Bullish

Target- 3409.99

Invalidation- 3259.80

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.