Technical Analysis

- BoE Decision: Held Bank Rate at 4.75% as expected, with an 8-1 vote split (vs. expected 7-2).

- Rate Cut Outlook: BoE may stick to a quarterly pace of rate cuts, with May still in play despite reduced odds.

Fundamental Factors Affecting GBP

- Economic Growth Concerns: The UK economy remains sluggish, putting pressure on the BoE to ease policy later in 2024.

- Vote Split & Sentiment Shift: The unexpected 8-1 vote signals less urgency for immediate cuts, but markets still price in loosening later this year.

- Spring Statement Impact (26th March): BoE may wait for further fiscal clarity before adjusting its stance.

Key Takeaway for Traders

- GBP remains sensitive to BoE policy shifts—reduced May rate cut odds could offer short-term support.

- Markets still expect gradual easing in 2024, limiting GBP upside.

- Spring Statement (26th March) could provide key fiscal insights impacting BoE policy outlook.

GBPCHF – H4 Timeframe

.png)

The SBR (Sweep Break Retest) pattern is a critical trading signal in my books, as I’ve often written about it. In the case of the GBPCHF 4-hour timeframe chart, the perks are even better – we see the SBR pattern occurring right off the trendline support. The demand zone of the SBR pattern falls within the critical zone of the Fibonacci retracement tool and is found to overlap the trendline support once again. The sentiment here is readily bullish.

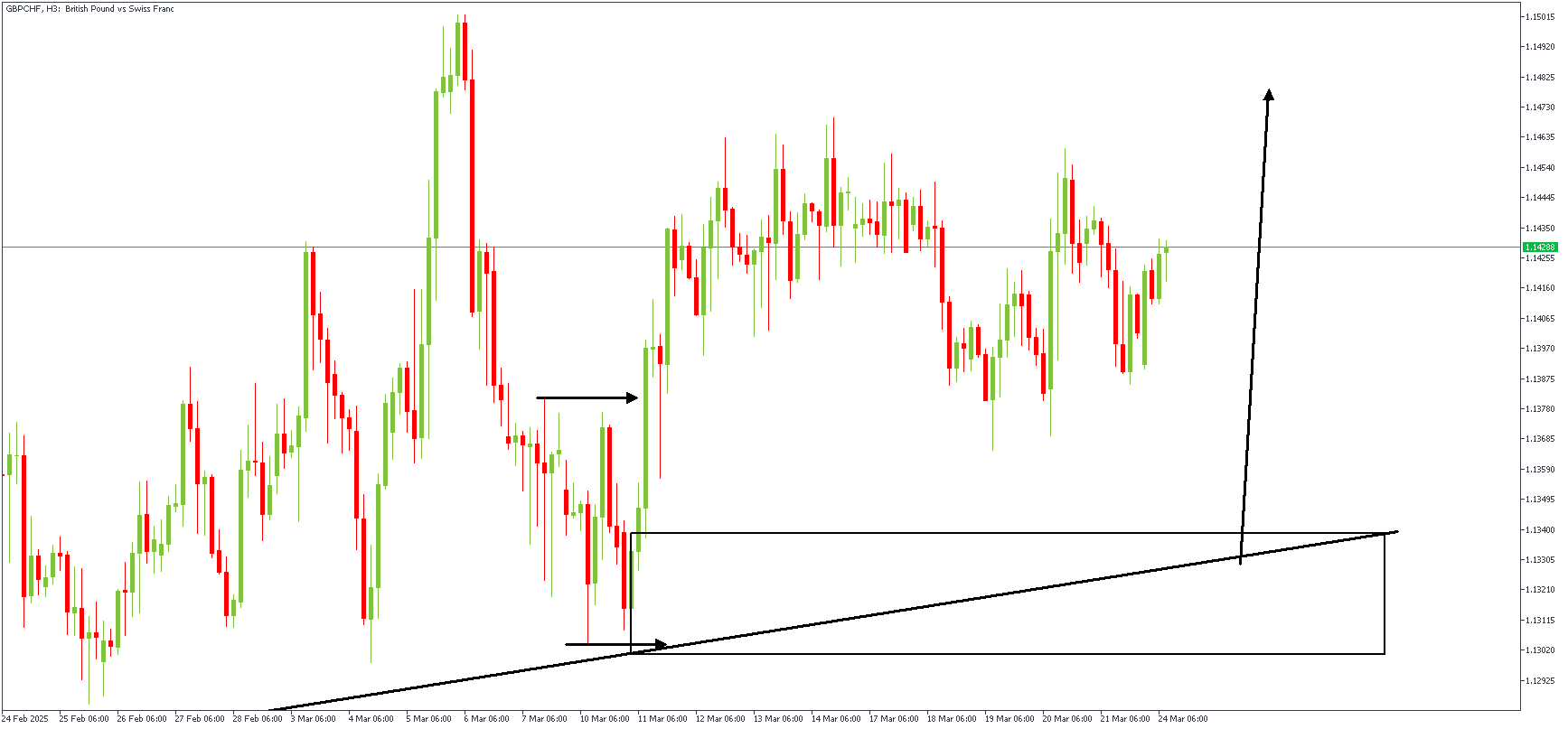

GBPCHF – H3 Timeframe

The 3-hour timeframe chart of GBPCHF shows the FVG area and the inducement from where we expect the price to sweep liquidity into the demand area.

Analyst’s Expectations:

Direction: Bullish

Target- 1.14810

Invalidation- 1.12876

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.