Fundamental Analysis

The British Pound faces bearish pressure against the Dollar and Euro, driven by weak UK economic data and expectations of looser monetary policy from the Bank of England (BoE). UK GDP rose only 0.1% in November, below the 0.2% forecast, while industrial and manufacturing production contracted.

This economic weakness has fueled bets on a 25-basis-point rate cut in February, with up to four cuts expected in 2024, according to a Reuters poll. Meanwhile, UK gilt yields have eased from recent highs, further reducing the Pound's appeal.

Upcoming U.S. employment and retail sales data will play a key role in shaping the Dollar's trajectory, while BoE expectations remain the primary driver for Sterling.

Technical Analysis

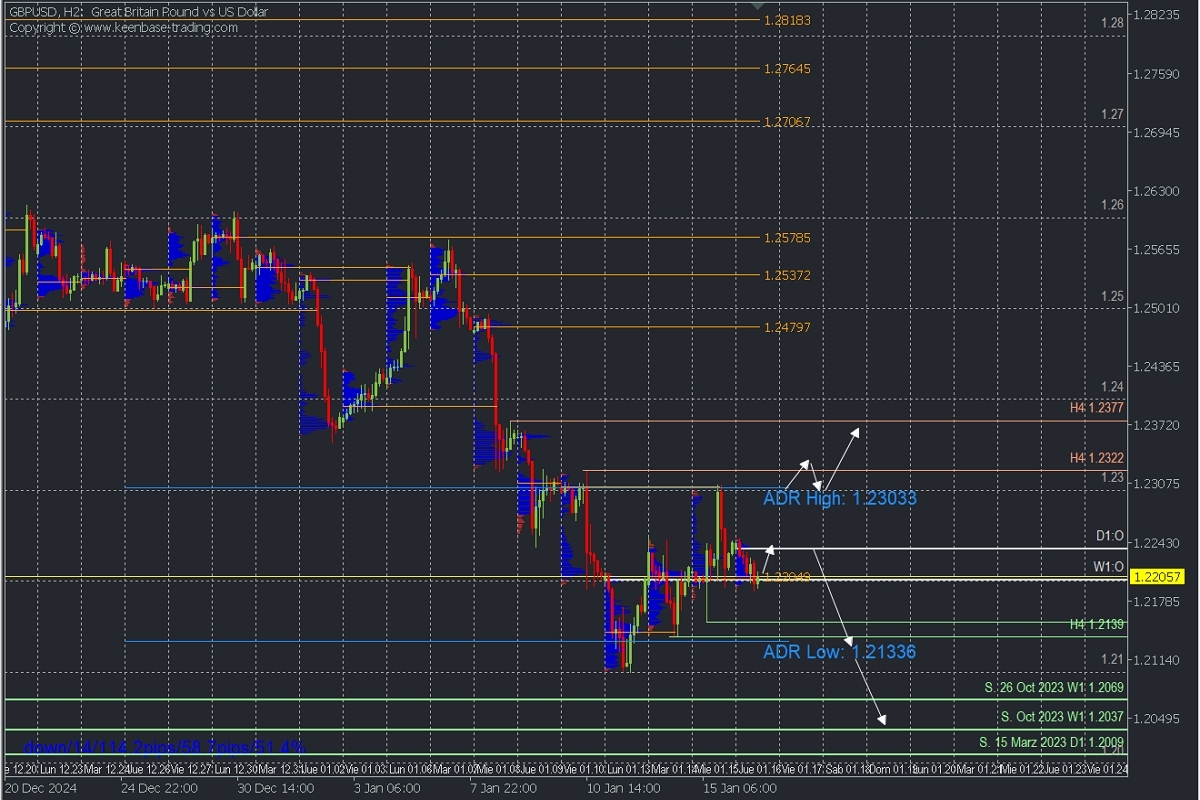

GBPUSD, H2

- Supply Zone (Sell): 1.23

- Demand Zone (Buy): 1.2140

The intraday bullish correction is consolidating, with volume clustering around 1.22, aligning with yesterday’s POC (Point of Control). This demand zone could support buying toward the daily open at 1.2235, or even attempt a broader rally toward 1.23.

The last validated intraday resistance of the bearish trend is at 1.2322. As long as this level holds, the trend remains intact. A moderate rally below the daily open may pave the way for another drop toward the key correction support at 1.2155, yesterday’s low. A break of this level would signal further downside toward 1.2133, 1.21, and October/March 2023 supports in the coming days.

Technical Summary:

- Bearish Scenario: Sell below 1.2235 or earlier at 1.2190, targeting 1.2155, 1.2133, 1.21, and 1.2070 in the short term.

- Bullish Scenario: Buy above 1.2245, targeting 1.23, with extended targets at 1.2360 and 1.2370 only after a decisive break above 1.2322.

Always wait for a *Reversal/Exhaustion Pattern (REP) on M5 as taught here https://t.me/spanishfbs/2258 before entering trades in the key zones indicated.

*POC Explained: The Point of Control (POC) is the level or zone with the highest volume concentration. If followed by a bearish move, it acts as a resistance zone. If followed by a bullish move, it acts as a support zone, often near lows.