Stop Dinámico

Una orden Stop Loss Dinámico establece el precio stop en un porcentaje fijo o número de puntos por debajo o por encima del precio de mercado del activo. Este artículo te dirá cómo usar un stop loss dinámico o de arrastre y cómo esta estrategia puede influir en su estrategia de trading.

¿Qué es un stop dinámico?

Un stop dinámico o de arrastre es una modificación de una orden stop típica que se puede establecer en un porcentaje específico o una cantidad de dinero del precio de mercado actual de un activo. Para una posición larga, el trader coloca un stop dinámico por debajo del precio de mercado actual; para una posición corta, el trader coloca un stop dinámico por encima del precio de mercado actual.

El stop dinámico está diseñado para proteger las ganancias al permitir que la operación permanezca abierta y continúe obteniendo ganancias siempre que el precio se mueva a favor del inversor. La orden cierra la operación si el precio cambia de dirección en el porcentaje o cantidad de dinero especificado.

El stop dinámico generalmente se coloca al mismo tiempo que la operación inicial, aunque también se puede colocar cuando la operación ya está abierta.

¿Cómo funciona el stop dinámico?

Los stops dinámicos solo se mueven en una dirección porque están diseñados para asegurar ganancias o limitar pérdidas. Si se agrega un stop loss dinámico del 10% a una posición larga, se cerrará la operación de compra si el precio cae un 10% desde su precio máximo posterior a la compra. El stop dinámico se mueve hacia arriba únicamente después de que se haya establecido un nuevo máximo. Una vez que el stop dinámico se ha movido hacia arriba, ya no puede moverse hacia abajo.

El stop dinámico es más flexible que la orden Stop Loss fija porque hace seguimiento automáticamente a la dirección del precio del activo y no necesita restablecerse manualmente como un Stop Loss fijo.

Los inversores pueden utilizar un stop dinámico para cualquier clase de activo si el broker proporciona este tipo de orden para un mercado negociado. Los stops dinámicos se pueden establecer como órdenes Limit u órdenes de mercado.

Cómo establecer un stop dinámico en MetaTrader 5

Para establecer un stop dinámico en MT5, debes realizar varios pasos:

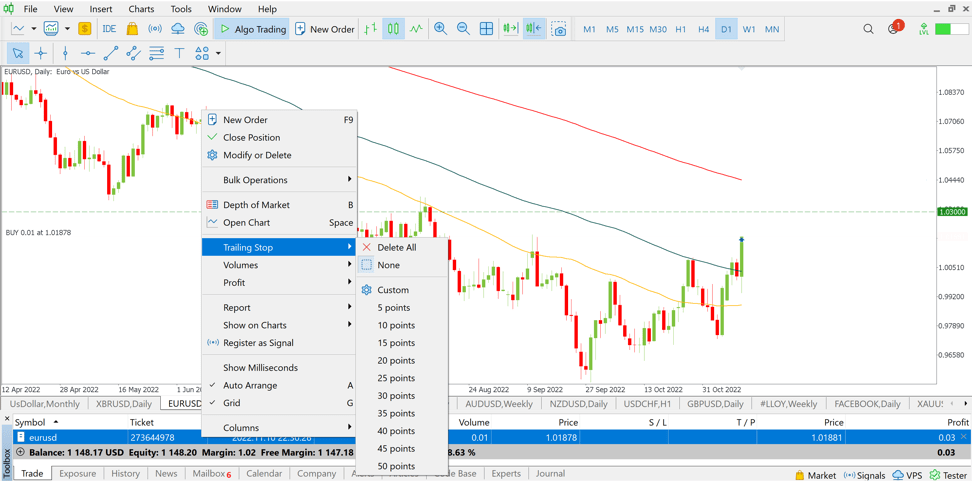

- Dirígete al panel de control y selecciona la operación para la que deseas establecer el stop loss dinámico.

- Haz click derecho en la operación para abrir el menú de opciones.

- En el menú, haz click en "stop dinámico".

- Aparecerá un nuevo menú donde podrás seleccionar puntos de stop loss preestablecidos o establecer tu propio valor.

- Para establecer un valor personalizado, selecciona la opción personalizable.

- Aparecerá una nueva ventana donde podrás ingresar tu propio valor de stop dinámico.

- Introduce el nivel del stop dinámico y haz click en OK.

Pros y Contras del stop dinámico

Pros del stop dinámico

Uno de los mayores beneficios de un stop dinámico es la flexibilidad, ya que no tienes que mover manualmente tu stop si tu posición se mueve a tu favor y deseas ajustar tu exposición en consonancia.

Si dejas un stop dinámico en una posición abierta que luego no ajustas si tu operación es rentable, tu posición solo se cerrará automáticamente si vuelves a donde colocaste originalmente tu stop. Cualquier ganancia que pudiste haber obtenido de la posición si la hubieras cerrado antes se perderá.

El stop dinámico ayuda a prevenir esto al proteger las ganancias de una operación exitosa y al mismo tiempo minimizar las pérdidas.

Contras del stop dinámico

Cuando estableces un stop dinámico, debes tener cuidado de no establecerlo demasiado lejos o demasiado cerca del precio de mercado. Si lo estableces demasiado lejos, corres el riesgo de pérdidas innecesarias, pero si lo estableces demasiado cerca del precio de mercado, es posible que se cierre antes de que tu operación tenga la oportunidad de generar ganancias.

Ejemplo de un stop dinámico

Supongamos que crees que el XAUUSD está ingresando a un mercado alcista, por lo que decides comprarlo en 1650 con un stop dinámico en 1600.

Dado que se trata de un stop dinámico, también deberás ingresar un paso dinámico. El paso dinámico decide cuánto debe avanzar el XAUUSD para que tu stop se mueva con él. Por lo tanto, si estableces tu stop para que se mueva cada vez que el XAUUSD se mueva cinco puntos, entonces se moverá a 1605 cuando el XAUUSD llame a 1655 y así sucesivamente.

Supongamos que el oro saltó a un máximo de 1700 antes de retroceder – stop dinámico subiría a 1650 y se activaría si el mercado cayera por debajo de ese precio. Tu posición en este caso se cerraría en el nivel de equilibrio, es decir, sin pérdidas.

Conclusión

El stop dinámico es una gran función para tratar de salvaguardar tus ganancias durante el trading. Practicar su uso mejorará tus habilidades para el trading.