Indicadores de tipo oscilador

¿Qué es un oscilador?

Un oscilador es una herramienta de análisis técnico, un indicador que contribuye a predecir las tendencias del mercado y, por lo tanto, los precios. Bots especiales ayudan en el trading con osciladores: al notar el movimiento del mercado a través del indicador, proporcionan una señal para comprar o vender un activo.

¿Cómo funcionan los osciladores?

Por lo general, estos indicadores de trading se utilizan junto con otras herramientas de análisis técnico para tomar decisiones al operar. Según la experiencia de los analistas, los osciladores funcionan bien cuando es difícil encontrar una tendencia obvia, por ejemplo, cuando una acción opera horizontalmente.

La mejor estrategia de trading con osciladores dependerá de las circunstancias. Sin embargo, los más conocidos son:

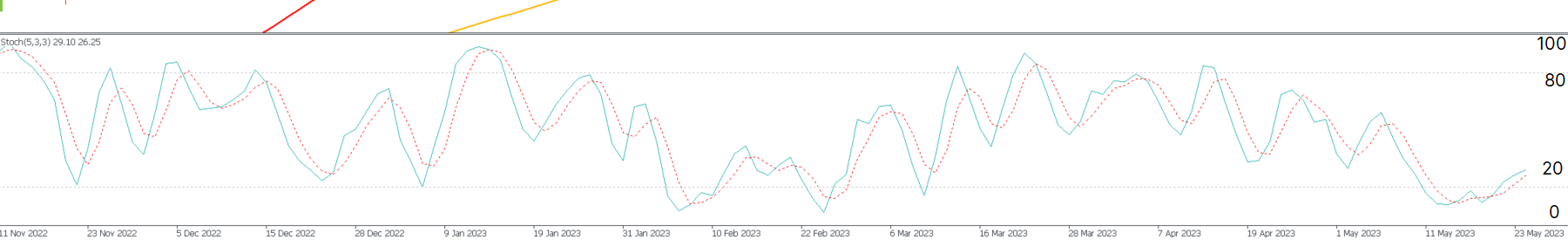

- El oscilador estocástico

- El indicador de fuerza relativa (RSI)

- El oscilador asombroso

- El índice de flujo de dinero (MFI)

- La tasa de cambio (ROC)

Si decides utilizar un oscilador, debes elegir dos valores. Luego, colocar un oscilador entre ellos para crear un indicador de tendencia. Este indicador muestra las condiciones actuales del mercado para el activo específico que hayas seleccionado. Cuando un oscilador se acerca al valor más alto, se considera que el activo está sobrecomprado. De lo contrario, se considera que el activo está sobrevendido.

La mecánica de un oscilador

En el análisis técnico, los osciladores se miden en una escala de porcentaje de 0 a 100. Estos se encuentran en un gráfico interactivo separado.

El indicador tiene una línea constante: la línea cero. También hay dos líneas, las de sobrecompra y sobreventa, que se deben seleccionar por separado. Para encontrarlas, un trader debe analizar el historial y en qué rango se mueven las medidas del indicador.

A pesar de su relativa simplicidad, los osciladores pueden proporcionar varias señales, además de compra o venta. Las más comunes son:

- La entrada de la línea del oscilador en las zonas de sobrecompra y sobreventa

- La línea del oscilador cruza el nivel cero

- La desviación de la línea del oscilador respecto al gráfico de precios

- La intersección mutua de las líneas lentas y rápidas del oscilador

Las señales son precisas solo cuando el precio del valor subyacente se encuentra dentro del rango especificado. Sin embargo, parecen ser engañosas cuando ocurre una ruptura de precio. Esto puede ocasionar que el mercado lateral actual sobrepase el rango en el que se encuentra o puede provocar el comienzo de una nueva tendencia.

Tipos de osciladores

Para entender qué osciladores se adaptan mejor a una situación particular, es necesario conocer sus fortalezas y debilidades.

Existen dos tipos de osciladores:

- Osciladores líderes. Funcionan de manera proactiva, dando señales antes de que ocurra una nueva tendencia. La oportunidad de predecir los cambios de precio representa un beneficio para ti. Desafortunadamente, los indicadores líderes son conocidos por dar señales falsas de vez en cuando.

- Osciladores rezagados. Por el contrario, dan señales después de comenzada una nueva tendencia. No te alertan de antemano, pero indican lo que realmente sucede con los precios. Lamentablemente, no es raro que las mayores ganancias se obtengan en las pocas primeras barras de una tendencia, por lo que los indicadores rezagados no te brindarán esta oportunidad.

En general, los indicadores líderes funcionan mejor en mercados laterales, mientras que los indicadores rezagados deben usarse durante los mercados en tendencia, ya que dan señales después de que el cambio de precio forme claramente una tendencia. El uso de indicadores rezagados ocasiona compras y ventas tardías, pero reduce bastante los riesgos.

Beneficios del trading con osciladores

Los beneficios de una herramienta técnica incluyen:

- El usuario puede seleccionar la indicación más conveniente para cada tipo de mercado de una amplia selección de indicadores.

- La capacidad de recibir señales líderes sobre cambios en la transacción permite responder a tiempo y obtener el máximo beneficio (o evitar pérdidas).

- Cada usuario puede ajustar la precisión de la señal en las configuraciones flexibles.

- Hay una amplia gama de tipos de señales adecuados para diversas situaciones del mercado.

- Los osciladores son la herramienta más comprensible para operar en la bolsa de valores, ya que indican el mejor momento para abrir órdenes de compra o venta.

Ejemplo de un oscilador

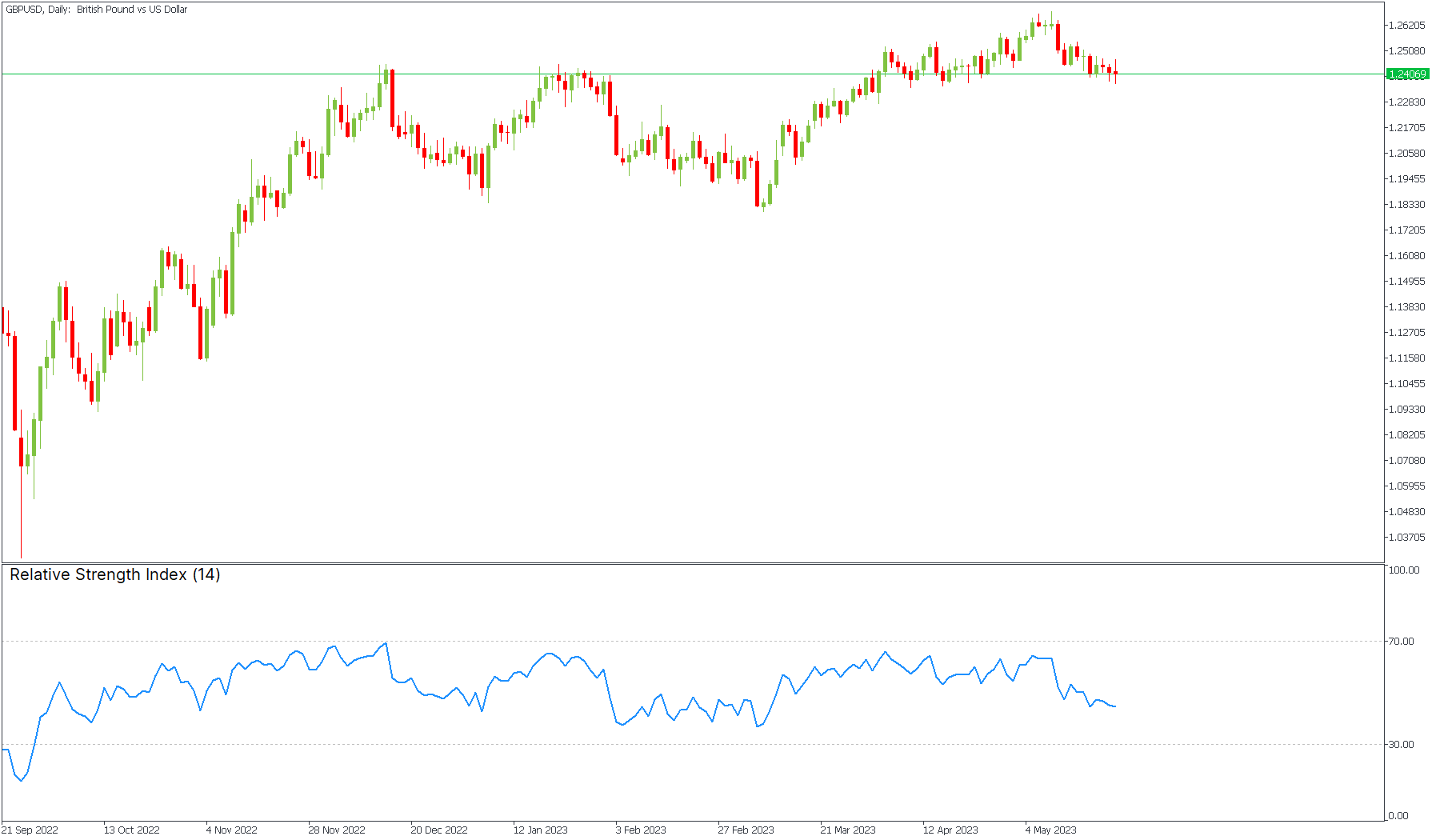

Veamos uno de los osciladores más utilizados en el trading: el índice de fuerza relativa (RSI).

El RSI contrasta el tamaño de las ganancias recientes con la dinámica de las nuevas caídas. Como en el caso de la estrategia del oscilador estocástico, por ejemplo, el RSI puede identificar los estados de sobrecompra y sobreventa de un activo. Además, se considera uno de los mejores osciladores para el trading intradía.

El indicador RSI tiene un rango de 0 a 100. Cuando el valor del indicador alcanza o se acerca a 70, se dice que un activo está sobrecomprado. En estas situaciones, los traders suelen operar en corto para obtener beneficios. El RSI muestra un importante activo sobrevendido que probablemente valga la pena comprar si está cerca del nivel 30. Por lo tanto, cuando el RSI está por encima del nivel de sobrecompra, no es prudente comprar un activo. Cuando este oscilador esté por debajo del nivel de sobreventa, evita vender.

Este indicador también se puede utilizar para seguir la tendencia. Mientras el RSI se mueva al alza, el precio del activo continuará subiendo. Si el RSI disminuye, entonces reinicia su tendencia bajista.

Conclusión

El uso de los osciladores es muy útil para identificar los puntos de entrada y salida cruciales, en especial cuando se combinan. Pueden considerarse como la esencia de la experiencia de operar, ya que típicamente fueron desarrollados por administradores que eran traders activos. Utilizando estos indicadores, puedes localizar un rango cómodo para operar y puedes comprender cómo los traders experimentados son capaces de entrar y salir del mercado antes que el inversor típico.