Tipos de instituciones financieras

Las instituciones financieras (FI) son corporaciones responsables de suministrar el dinero al mercado a través de transferencias de los fondos de inversionistas a las empresas, en forma de préstamos, inversiones y depósitos.

Los tipos de institución financiera más comunes incluyen bancos comerciales, compañías fiduciarias, bancos de inversión, brokers o agentes de inversión, compañías de seguros y fondos de gestión de activos. Otros tipos incluyen uniones de crédito y firmas financieras.

Las instituciones financieras están reguladas para controlar la oferta monetaria en el mercado y proteger a los consumidores.

Desglosemos "institución financiera" (FI)

Las instituciones financieras cumplen un rol vital en el sistema financiero de cada país, ganando mucha importancia en las economías en continuo desarrollo. Estas instituciones proporcionan requisitos de capital a largo plazo para las industrias primarias.

Las instituciones financieras también cumplen un rol crucial para la mayoría de los ciudadanos al proporcionar todas las necesidades de inversión, transacciones financieras y ahorros. El gobierno considera que es imperativo supervisar y regular los bancos y otras compañías de servicios financieros. Por la misma razón, la potencial quiebra de las instituciones financieras puede causar pánico en la economía. Organizaciones como la corporación federal de seguros de depósitos (FDIC, por sus siglas en inglés) con sede en los EE.UU., controlan las cuentas de depósito regulares para proteger a las personas y a las empresas de diversos riesgos para sus finanzas depositadas con instituciones financieras.

La pérdida de confianza en las instituciones financieras puede causar externalidades negativas adicionales en la economía.

Tipos de instituciones financieras

Casi todo el mundo trata diariamente con varias instituciones financieras. Ya sea para depositar dinero, solicitar préstamos o cambiar divisas, las instituciones financieras están integradas en estas actividades.

Las instituciones financieras pueden dividirse en dos tipos: bancarias y no bancarias. Las instituciones financieras bancarias incluyen bancos comerciales, cuya función principal es aceptar depósitos y otorgar préstamos. Las instituciones financieras no bancarias incluyen bancos de inversión, compañías de seguros, firmas financieras, compañías de leasing, etc. Veamos más de cerca ambos tipos de instituciones financieras.

Instituciones financieras bancarias

El banco es la institución financiera bancaria más conocida. Un intermediario financiero actúa como mediador entre los depositantes o proveedores de fondos y los prestamistas que utilizan los fondos. Las tareas principales de una institución financiera bancaria son aceptar depósitos y luego utilizar esos fondos para ofrecer préstamos a sus clientes, quienes los utilizarán para financiar compras, educación, expandir negocios, invertir en desarrollo, etc.

Un banco también actúa como agente de pago al ofrecer varios servicios, incluyendo tarjetas de débito, tarjetas de crédito, servicios de cheques, servicios de depósito directo, giros bancarios, etc. Los propósitos principales de depositar fondos en los bancos son la conveniencia, el ingreso de intereses y la seguridad. El número de reservas en exceso y la proporción de las reservas de efectivo que se mantienen determinan la capacidad de un banco para prestar fondos. Es relativamente fácil para un banco recaudar fondos, ya que ciertas cuentas, como los depósitos a la vista, no pagan intereses al titular de la cuenta.

Un banco invierte el dinero de los depósitos, a veces en activos y en valores financieros, pero principalmente en préstamos.

Instituciones financieras no bancarias

También hay varias instituciones financieras no bancarias, que incluyen bancos de inversión, compañías de leasing, compañías de seguros, fondos de inversión, firmas financieras, etc. Una institución financiera no bancaria ofrece una gama de servicios financieros.

Los bancos de inversión ofrecen servicios a las corporaciones, incluyendo suscripción de deudas y emisión de acciones, operaciones en el mercado de valores, inversiones, servicios de asesoría corporativa y transacciones derivadas.

Las instituciones financieras, como las compañías de seguros, ofrecen protección contra pérdidas específicas, por las que se paga un seguro especial. Los fondos mutuos y de pensiones actúan como instituciones de ahorro donde los inversores pueden invertir sus fondos en vehículos de inversión colectiva y recibir a cambio intereses.

Los creadores de mercado o instituciones financieras que actúan como brokers y dealers facilitan las transacciones en activos financieros como derivados, divisas, acciones, etc.

Otros proveedores de servicios financieros, como las compañías de leasing, facilitan la compra de equipamiento, las empresas de financiación de bienes raíces facilitan capital para la compra de bienes inmuebles, y los asesores y consultores financieros ofrecen asesoramiento a cambio de una tarifa.

La principal diferencia entre los dos tipos de institución financiera es que las instituciones financieras bancarias pueden aceptar depósitos en varias cuentas de ahorro y de depósito a la vista, mientras que las instituciones financieras no bancarias no pueden hacerlo.

Ejemplos de instituciones financieras

Instituciones financieras bancarias

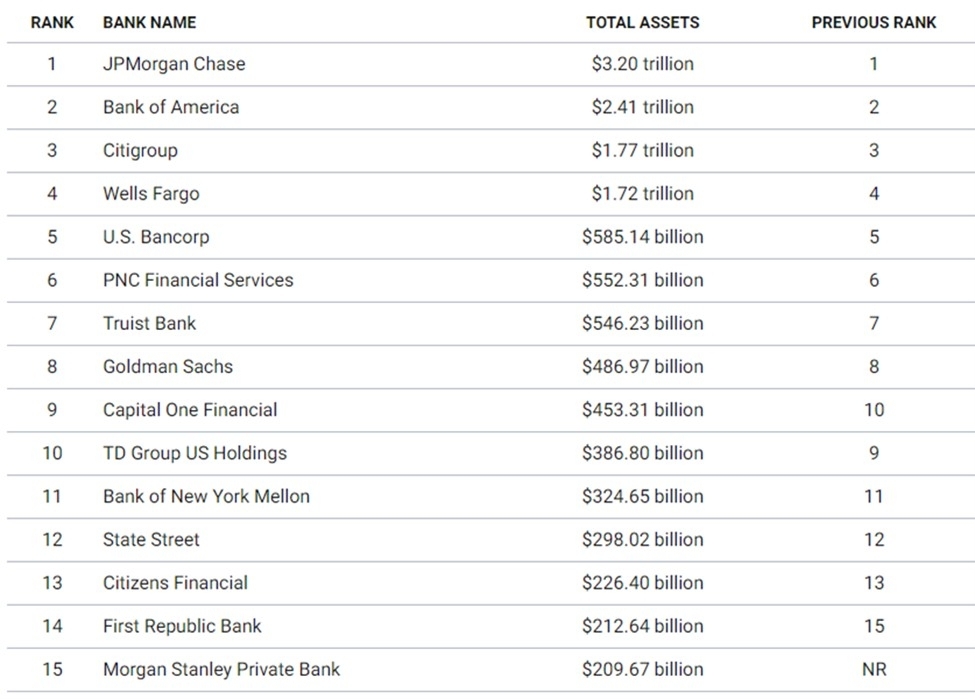

Aquí tenemos algunos ejemplos de instituciones financieras bancarias. La lista de los 15 principales bancos estadounidenses según el total de activos:

Instituciones financieras no bancarias

Aquí está la lista de algunas instituciones financieras no bancarias:

loanDepot Inc. (LDI)

Es una compañía proveedora de solicitudes de hipotecas online.

Se estableció en 2010 en California.

Los activos totales de la empresa superan los 6.6 mil millones de dólares. Las acciones se negocian en NYSE.

PennyMAC

Esta es una compañía hipotecaria de California. Fue fundada en 2008 y ahora es uno de los prestamistas más conocidos de los EE.UU.

Las acciones de la empresa cotizan en NYSE.

American International Group (AIG)

Esta es una empresa famosa de Nueva York que provee productos de seguros para clientes institucionales o no institucionales.

Sus activos totales superan los 500 mil millones de dólares.

La compañía paga dividendos estables a los inversores y, desde mayo de 2020 hasta abril de 2022, sus acciones aumentaron un 230%.

PayPal Holdings Inc.

Es una compañía que brinda soluciones de pagos digitales. Funciona en 150 países y tiene cuentas en 56 divisas diferentes.

Por cierto, el fundador de la empresa es Peter Thiel, quien creó su imperio con el dueño de X.com, Elon Musk.

La sede de la empresa está en San José, y sus activos superan ahora los 78.7 mil millones de dólares.