Incluso con toda la controversia sobre la comida chatarra, la Big Mac es conocida y querida por muchas personas en todo el mundo. Pero, ¿sabías que el Big Mac también es un indicador económico?

Lee este artículo para aprender sobre el índice Big Mac, lo que significa, cómo se creó y cómo puedes utilizarlo en el trading.

Dos hamburguesas de carne de res

Dondequiera que vivas, Tokio, Moscú, Colombo u Oslo, puedes salir, dirigirte al McDonald's más cercano y comer dos hamburguesas de carne, lechuga, queso, encurtidos y cebollas, todo cubierto con una salsa especial y entre dos panes. Puedes disfrutar de una Big Mac: aproximadamente 500 calorías de alegría. O no, dependiendo de tus hábitos alimenticios.

Las Big Mac difieren ligeramente de un país a otro en apariencia, tamaño y calorías, pero la fórmula básica de la hamburguesa más famosa del mundo sigue siendo la misma.

Los ingredientes de la Big Mac incluyen algunos de los productos alimenticios más comunes disponibles en la mayoría de los países. Algo que los clientes habituales compran diariamente en las tiendas de comestibles locales: cebollas, carne, lechuga, queso, pepinillos, etc. Así que podríamos decir que es una canasta de bienes lista para llevar. Por eso, a mediados de los años 80, The Economist eligió el precio de esta hamburguesa como una herramienta sencilla para analizar las divisas.

Presentamos el índice Big Mac

El índice Big Mac fue inventado en 1986 por The Economist: una de las revistas más influyentes en negocios internacionales, política, tecnología y cultura.

Con una historia de más de 170 años, The Economist es acertadamente considerado como el estándar de oro para las noticias económicas y los informes de asuntos mundiales. El personal de la revista incluye periodistas talentosos y altamente capacitados.

A lo largo de su existencia, The Economist ha introducido varios índices, incluidos el índice de Democracia, el índice del Techo de Cristal, el índice de las Ciudades Más Peligrosas, el índice de Precios de Materias Primas y el índice de Big Mac. Basado en los precios de las Big Mc en diferentes países, el índice debería ofrecer una valoración de divisas más precisa.

Supongamos que tenemos dos países: Estados Unidos y China. Comparamos los precios de la Big Mac en estos dos países, en divisas locales. La diferencia en los precios nos dará una tasa de cambio de Big Mac, que suele diferir de lo que obtenemos de fuentes oficiales. Luego, podemos saber si la moneda en cuestión está sobrevaluada o subvaluada.

Con el tipo de cambio Big Mac dólar-yuan, obtenemos una proporción aproximada de 1:4 – 5.29 USD para la famosa hamburguesa en los Estados Unidos y ¥ 25.63 en China. El resultado nos da una idea alternativa de cuánto debería costar el yuan chino: ¥4.84 por 1 USD frente a la tasa oficial de ¥7.28 por un dólar.

Este enfoque gastronómico también se llama Burgernomics. Se basa en la teoría de la PPP, que significa “paridad del poder adquisitivo”: la idea de que los tipos de cambio deberían moverse hacia la igualación de los precios de cestas idénticas de bienes y servicios en dos países. En este caso, la canasta de bienes mencionada es una Big Mac.

¿Qué muestra el índice Big Mac?

Si bien el Índice Big Mac no puede considerarse una herramienta precisa para indicar el valor de una divisa, los datos pueden ofrecer resultados e ideas inesperadas.

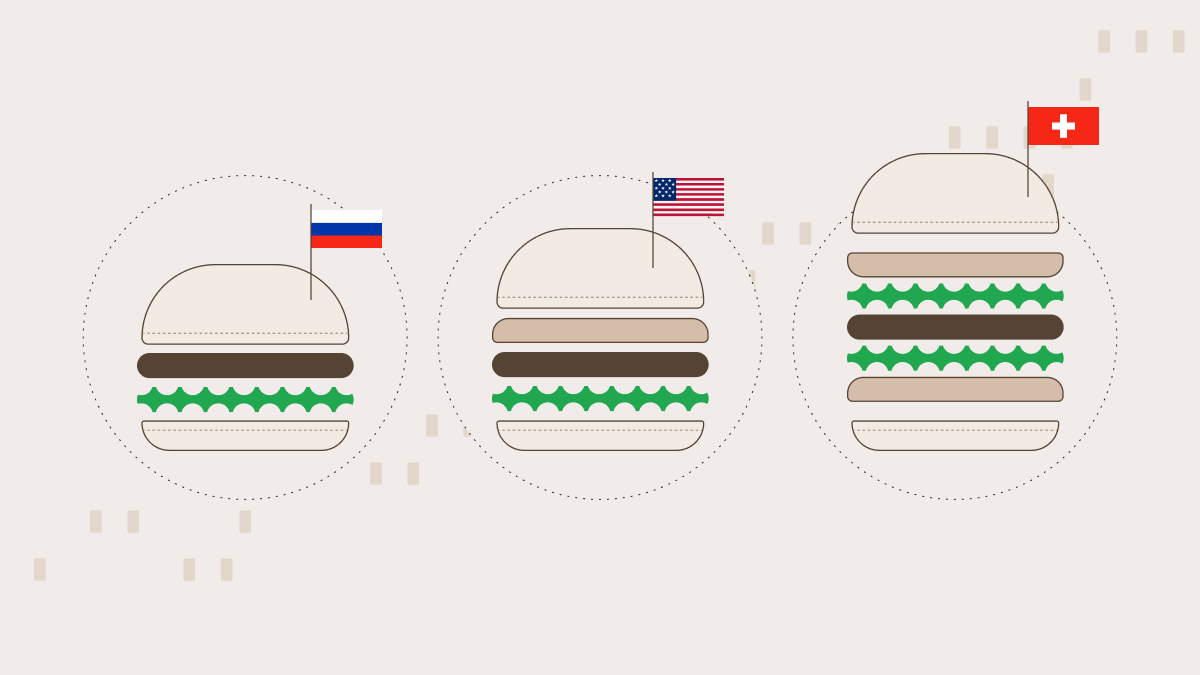

Por ejemplo, según el índice Big Mac, el rublo ruso está infravalorado en aproximadamente un 59%. A partir del último lanzamiento, un dólar cuesta alrededor de 85 rublos, mientras que una Big Mac en Rusia te costará solo 2.18 USD. Desde la perspectiva del índice Big Mac, un dólar debería costar solo 35 rublos.

El precio más bajo del mundo de la hamburguesa se encuentra en Taiwán, seguido de Indonesia, India, Egipto, Sudáfrica y Filipinas.

Otras monedas infravaloradas incluyen la lira turca, la libra libanesa, el ringgit malasio, la rupia indonesia y el leu rumano.

El índice Big Mac muestra que el franco suizo es la moneda más sobrevaluada del mundo. Una Big Mac te costará 8.98 dólares estadounidenses en Suiza, con una tasa de índice Big Mac de 1.7 francos por dólar. Sin embargo, los mercados de divisas muestran que la tasa USDCHF es 0.88. Esto significa que la divisa suiza está sobrevaluada en un 49.3%. Nuevamente, eso es si elegimos simplificar la economía, dejando de lado todos los datos y factores correlacionados.

¿Podemos utilizar la comparación de precios de Big Mac para operar?

A pesar del nombre gracioso, el índice Big Mac y Burgernomics no son solo formas divertidas de jugar con la economía. Se han convertido en un estándar global a lo largo de los años. Hoy en día, varios libros de texto económicos y una amplia variedad de estudios académicos los incluyen como una herramienta útil para la comparación de divisas.