Componentes de una cartera

La diversificación es clave para invertir con éxito. Una cartera bien diversificada generalmente incluye una combinación de acciones, bonos e inversiones alternativas, cada una trabajando en equilibrio para administrar los riesgos y lograr los objetivos de inversión que establezcas.

Acciones | Bonos | Inversiones alternativas |

Las acciones representan la propiedad de acciones en una empresa y, por lo general, son de alto riesgo. Proporcionan potencial de crecimiento a través de la apreciación del capital y, a veces (pero no siempre), de los ingresos por dividendos. Si estás interesado en activos de mayor rendimiento, busca acciones de primera línea, de crecimiento y de dividendos. | Los bonos a menudo funcionan como un contrapeso a las acciones o a otros valores de riesgo. Son instrumentos de deuda que los gobiernos, municipios o corporaciones emiten para recaudar capital. Si tu enfoque es la estabilidad y los ingresos estables, los bonos gubernamentales o corporativos son tu mejor opción. | Los bienes raíces, los commodities, el capital privado y los fondos de cobertura son inversiones alternativas. Son menos líquidos, pero perfectos para protegerte contra la inflación. Cuando se combinan con activos tradicionales como bonos o acciones, proporcionan la diversificación necesaria a una cartera. |

Tipos de carteras de inversión

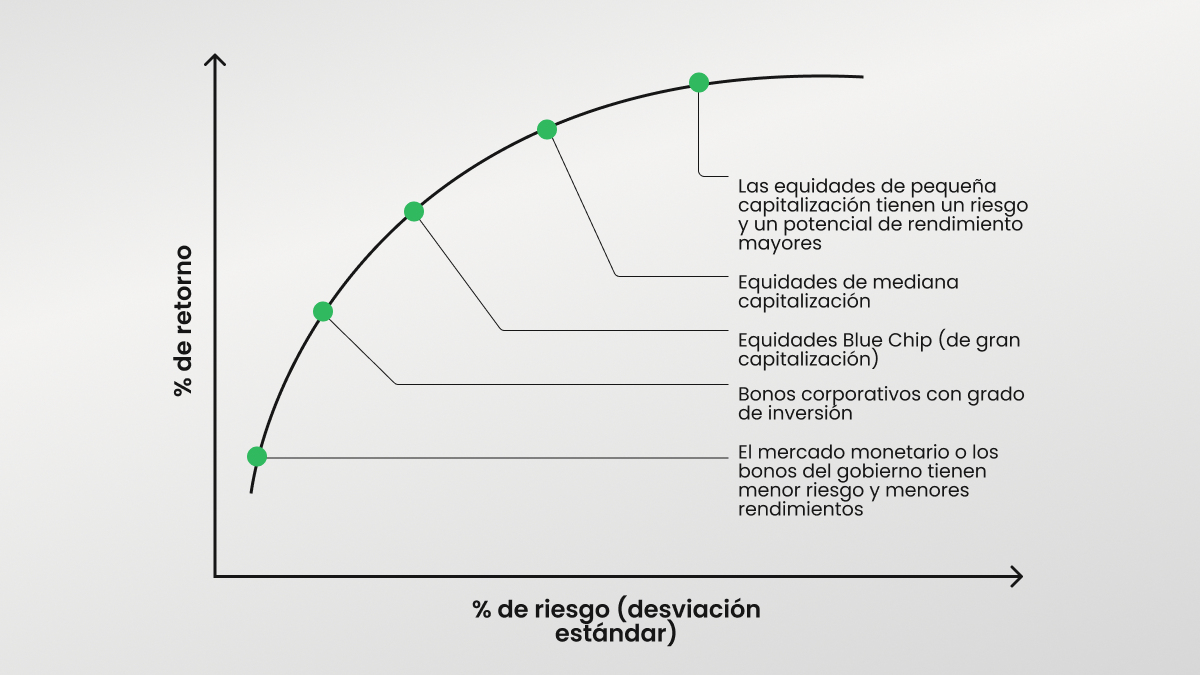

Hay varios tipos de carteras de inversión, cada una de ellas sirve para diferentes propósitos y se centra en diferentes aspectos financieros. Hay dos estrategias principales: agresiva y defensiva. Una estrategia agresiva tiene como objetivo maximizar los rendimientos asumiendo mayores riesgos, a menudo invirtiendo en activos con un fuerte potencial de crecimiento. Un inversionista que adopte esta estrategia podría favorecer los activos a largo plazo, como las acciones o los activos especulativos. Una estrategia defensiva se centra en ahorrar dinero y garantizar rendimientos estables, con un menor énfasis en un alto crecimiento. Alguien que prefiera este curso podría evitar activos altamente volátiles y tratar de protegerse contra las recesiones del mercado. Por supuesto, hay una gama completa de estrategias que combinan elementos de ambos enfoques.

El enfoque de cartera híbrida

Un ejemplo perfecto de equilibrio, una cartera híbrida es una combinación de activos para una persona que tiene como objetivo el crecimiento, los ingresos y la estabilidad. El enfoque híbrido combina elementos de estrategias tanto agresivas como defensivas. Incluye acciones que proporcionan potencial de crecimiento y asigna a bonos, efectivo u otros activos de bajo riesgo para garantizar ingresos consistentes. Por ejemplo, puede consistir en un 50% de acciones (acciones de diversos sectores o fondos indexados), un 30% de bonos (gubernamentales o corporativos) y un 20% de equivalentes de efectivo o inversiones alternativas como bienes raíces. Es una decisión óptima si buscas un equilibrio entre riesgo y rentabilidad y estás dispuesto a invertir en activos a medio y largo plazo.

Cartera de equidad agresiva

Si eres una persona más audaz y te concentras en aumentar tus ganancias, es posible que desees invertir en acciones de alto crecimiento que proporcionen altos rendimientos. Sin embargo, prepárate para enfrentar una volatilidad y riesgos significativos. Una cartera de acciones agresiva puede incluir acciones tecnológicas, biotecnológicas u otros sectores innovadores con una asignación mínima o nula a bonos o activos defensivos. Puede verse así: 90% de acciones orientadas al crecimiento y 10% de activos especulativos (por ejemplo, criptomonedas).

Cartera de equidad defensiva

Los inversionistas conservadores a menudo eligen construir una cartera de acciones defensiva, que consiste en acciones de baja volatilidad, acciones con un historial de crecimiento constante de dividendos y bonos para mayor seguridad. Su objetivo es minimizar los riesgos. Una cartera de acciones defensivas podría incluir 60% de acciones (acciones de primer orden o que pagan dividendos), 30% de bonos y 10% de efectivo o equivalentes, una combinación que garantiza estabilidad y rendimientos consistentes.

Cartera de equidad centrada en los ingresos

Una cartera de acciones centrada en los ingresos está diseñada para generar ingresos estables, principalmente a través de acciones que pagan dividendos y otras inversiones que producen ingresos. Esta estrategia es adecuada para los inversionistas que priorizan los rendimientos confiables sobre la apreciación del capital, a veces durante la jubilación, cuando los ingresos de la inversión deben reemplazar los ingresos del trabajo. Esta es la principal diferencia entre la renta variable agresiva y las carteras de renta variable centradas en los ingresos: en este último caso, el inversionista busca un flujo de caja regular en lugar de un crecimiento del capital.

Una cartera de acciones centrada en los ingresos, por lo general, incluye acciones de dividendos, REIT y acciones preferentes con énfasis en altos rendimientos de dividendos y baja apreciación del capital. También puede incluir algunos valores de renta fija para la diversificación.

.png)

.png)