04 abr 2025

Estrategia

Qué son las correlaciones de pares en Forex y cómo operarlas

La correlación de divisas en Forex es esencial para que cada trader la entienda porque puede afectar los resultados del trading sin que el trader lo sepa.

Una correlación es una relación mutua entre dos o más cosas. En Forex, una correlación es una conexión entre pares de divisas que revela hasta qué punto se mueven en una misma dirección. Cuanto más fuerte sea la correlación, más relacionados estarán sus gráficos de precios. Hay dos tipos de correlación: positiva y negativa.

Correlación positiva

Una correlación positiva significa que dos pares se mueven en la misma dirección.

Correlación negativa

Una correlación negativa o inversa significa que dos pares se mueven en la dirección opuesta.

Ten en cuenta que si los pares se mueven al azar sin conexión visible, eso significa que no hay una correlación significativa entre ellos.

¿Qué es el coeficiente de correlación?

Un coeficiente de correlación es una medida que demuestra cuán fuerte o débil es la correlación entre pares de divisas. El coeficiente varía entre -1.0 y +1.0. Casi nunca verás cifras exactas de -1.0 y +1.0: los números cercanos a 1.0, como 0.8 o 0.7, ocurren con más frecuencia.

Cuanto más cerca esté un número de 1.0, más fuerte será la correlación entre pares de divisas (el grado en que sus valores están relacionados). Alternativamente, cuanto más cerca esté el coeficiente de correlación a 0.0, más débil será la relación entre los pares de divisas.

El signo ‘+’ muestra una correlación positiva, mientras que el signo ‘-’ señala una correlación negativa entre pares.

¿Qué correlación se considera fuerte?

Si el coeficiente está por debajo de -0.7 y por encima de +0.7, la correlación entre pares de divisas se acepta ampliamente como fuerte. De lo contrario, si está entre -0.7 y +0.7, indica que los pares están débilmente correlacionados. Los coeficientes de correlación cercanos a 0 demuestran que los pares de divisas no tienen una relación detectable.

Pares de divisas altamente correlacionados en Forex

Esta tabla revela los pares de divisas más operados con fuertes correlaciones negativas o positivas.

Par 1 | Par 2 | Tipo de correlación |

AUDUSD | NZDUSD | Positiva |

AUDUSD | GBPUSD | Positiva |

EURUSD | GBPUSD | Positiva |

GBPUSD | GBPJPY | Positiva |

USDJPY | GBPJPY | Positiva |

EURUSD | USDCHF | Negativa |

GBPUSD | USDCAD | Negativa |

GBPUSD | USDCHF | Negativa |

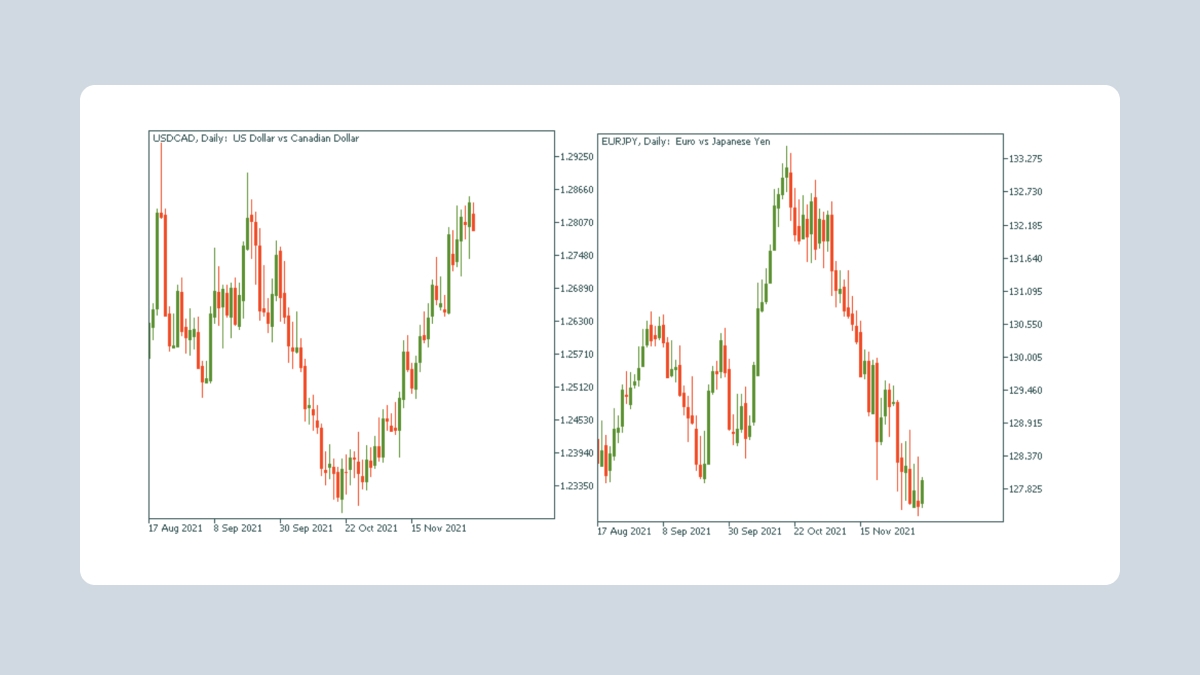

USDCAD | EURJPY | Negativa |

USDCAD | AUDUSD | Negativa |

Es significativo para cada trader monitorear las correlaciones en el mercado Forex.

Por ejemplo, los traders podrían accidentalmente ir largo (comprar) USDCAD e ir en corto (vender) EURJPY pensando que han abierto dos operaciones diferentes. Pero, en cambio, estos pares tienden a moverse en direcciones opuestas, ya que estos pares de divisas tienen una fuerte correlación negativa. En este caso, el trader abriría operaciones casi iguales en direcciones opuestas. Por un lado, el trader puede ganar en ambas operaciones, pero, por otro lado, corre el riesgo de perder en ambas, ya que el USDCAD y el EURJPY están altamente correlacionados.

Estrategias de correlaciones en Forex

Estrategia de afrontamiento

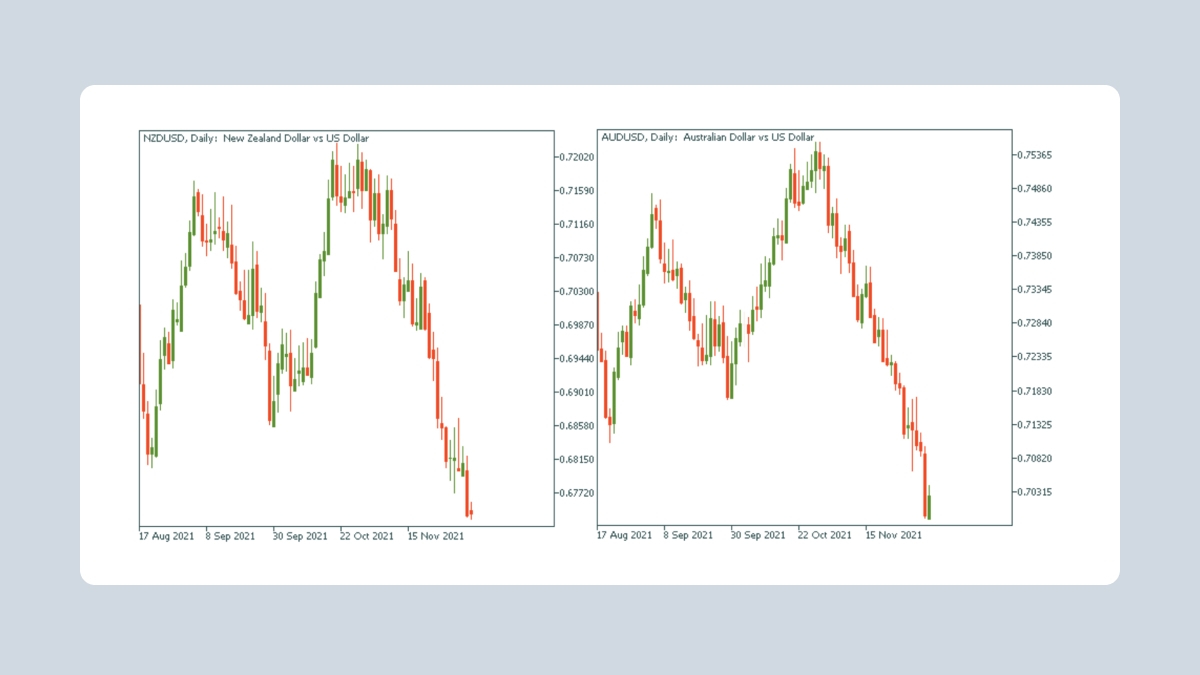

Del gráfico anterior, sabes que el AUDUSD y el NZDUSD correlacionan positivamente. Si observas sus gráficos de precios, verás imágenes casi idénticas. Aquí está el truco: cuando uno está rezagado, se puede predecir con gran probabilidad su movimiento futuro con solo mirar a su gemelo.

Estrategia de doble verificación

Si abres órdenes con pares correlacionados, ten cuidado, ya que puedes aumentar el nivel de riesgo que asumes. Por ejemplo, digamos que compras dos pares de divisas que están correlacionados positivamente: AUDUSD y NZDUSD. Si tu pronóstico es correcto, obtendrás una doble ganancia. Sin embargo, si el precio va en contra de tus expectativas, también duplicará tu pérdida. ¿Cómo puede un trader minimizar este posible riesgo? ¡Usa señales de pares correlacionados!

Por ejemplo, si analizas el EURUSD y piensas que puede subir, no abras la orden larga de inmediato. En su lugar, realiza el análisis adecuado del par correlacionado (por ejemplo, GBPUSD) para confirmar tu señal de trading. Entonces, solo si el análisis del GBPUSD o de cualquier otro par correlacionado positivamente también da una señal alcista, ¡puedes abrir una posición larga en EURUSD con mayor confianza!

Estrategia de cobertura

¿Qué pasa con las divisas negativamente correlacionadas? ¡Los traders pueden usarlas para fines de cobertura! Por ejemplo, un trader compra dos pares de divisas que están correlacionados negativamente. Si la previsión es incorrecta y el primer par se mueve en sentido contrario a las expectativas del trader, la segunda operación compensará las pérdidas

Una cobertura es una inversión que un trader realiza para disminuir el riesgo de movimientos de precios opuestos en un activo.

Tomando una operación más que tiende a moverse en la dirección opuesta a la primera posición es una estrategia de cobertura. Por ejemplo, si los pares de divisas están positivamente correlacionados y los traders quieren hacer cobertura, deberían considerar comprar el primero y vender el segundo. Alternativamente, si los pares de divisas están negativamente correlacionados, y los traders desean hacer cobertura, deberían considerar comprar o vender ambos pares (abriendo órdenes convergentes).

Entender las correlaciones es una cosa; ver cómo se manifiestan en gráficos reales es otra. Ahí es donde los tutoriales en video de FBS resultan muy útiles.

Ejemplo de trading de correlación de Forex

Por ejemplo, abres el gráfico de NZDUSD y notas dos señales para ir en largo (comprar): el par cayó por debajo de la línea inferior de las bandas de Bollinger, y la vela formó un pin bar. Luego cambias al par de divisas correlacionado: AUDUSD. ¡Genial! También muestra la señal para comprar: la línea de señal del oscilador estocástico cruza la línea discontinua de abajo hacia arriba. Usando esta señal, podrías haber obtenido la doble ganancia de NZDUSD y AUDUSD.

Correlación en el mercado de acciones y commodities

¡No solo los pares de divisas están correlacionados, sino también las commodities, acciones e índices de acciones! Todos pueden correlacionarse entre sí, así como con los pares de divisas.

Por ejemplo, el oro (XAUUSD) tiende a tener una correlación negativa con el dólar estadounidense y una fuerte correlación positiva con la plata (XAGUSD).

Mientras tanto, el petróleo crudo (XBRUSD y XTIUSD) se correlaciona positivamente con el dólar canadiense, ya que Canadá es el mayor proveedor de petróleo para los EE.UU. Por lo tanto, cuando el petróleo sube, el CADJPY tiende a subir, mientras que el USDCAD tiende a bajar.

Además, los índices de acciones de EE.UU. como S&P 500 (US500) y Nasdaq 100 (US100) tienen una fuerte correlación positiva. Además, las criptomonedas como el bitcoin y el Ethereum tienen una máxima correlación positiva. Finalmente, hablando de acciones, cuando una acción de gran capitalización sube, todas las otras acciones similares de su sector también suben.

Cómo operar pares de correlación en Forex

Has aprendido varios enfoques para utilizar la correlación. Para operar activos correlacionados, sigue estos pasos:

-

Descarga la app de FBS o MetaTrader 4/5.

-

Abre una cuenta en la app de FBS o una cuenta de MT5 en tu Trader Area. Realiza un análisis de mercado adecuado y selecciona un activo que te interese: par de divisas, acción o commodity.

-

Elige una estrategia de arriba y selecciona un activo correlacionado.

-

Administra correctamente tu riesgo con herramientas especiales como stop loss y take profit, que pueden ser especialmente útiles en momentos de alta volatilidad en los mercados. Recuerda, aunque estas herramientas no te protegen al 100%, te ayudan a minimizar los posibles riesgos.

-

¡Abre una orden y monitoréala!

Conclusión

Es crucial saber cómo varios pares de divisas se correlacionan entre sí. Como hemos explicado anteriormente, algunos pares de divisas y otros activos se mueven en una dirección, mientras que otros lo hacen en direcciones opuestas. ¡Comprender la correlación en los mercados financieros ayuda a los traders a gestionar sus riesgos de manera más adecuada y proporciona una herramienta poderosa para aumentar la ganancia!

Para principiantes

Si eres nuevo en el trading, una cuenta demo será un comienzo perfecto para ti, ya que te permite practicar el trading sin ningún riesgo. Cuando lo abras, recibirás 10,000 dólares virtuales. Además, ten en cuenta que el depósito mínimo en FBS comienza desde solo 5 USD en cuentas reales. ¡Puedes comenzar una carrera de trading con muy poco dinero y limitar tus riesgos mientras tienes la oportunidad real de obtener ganancias en una cuenta real!