23 may 2025

Gestión de riesgos

Explicación del ROI en el trading

ROI significa "retorno de la inversión", y es un concepto financiero que muestra la ganancia o la pérdida generada por una inversión. Este concepto se aplica a cualquier sector en el que se pueda realizar una inversión y obtener ganancias (o pérdidas). El trading en línea y Forex no son la excepción, así que hablemos del ROI en este artículo.

Cuando pensamos en el rendimiento de la inversión en trading, tenemos que entender ambas partes: la inversión y el rendimiento. ¿Qué consideramos una inversión? Básicamente, cualquier dinero que ingrese en tu cuenta de corretaje. Usas ese dinero para abrir tus posiciones. Esto es lo que consideramos tu inversión.

El saldo de tu cuenta de trading cambia para reflejar los resultados de tus posiciones abiertas: tus ganancias o pérdidas. Puedes usar los dos números para calcular tu ROI.

Cómo calcular el ROI

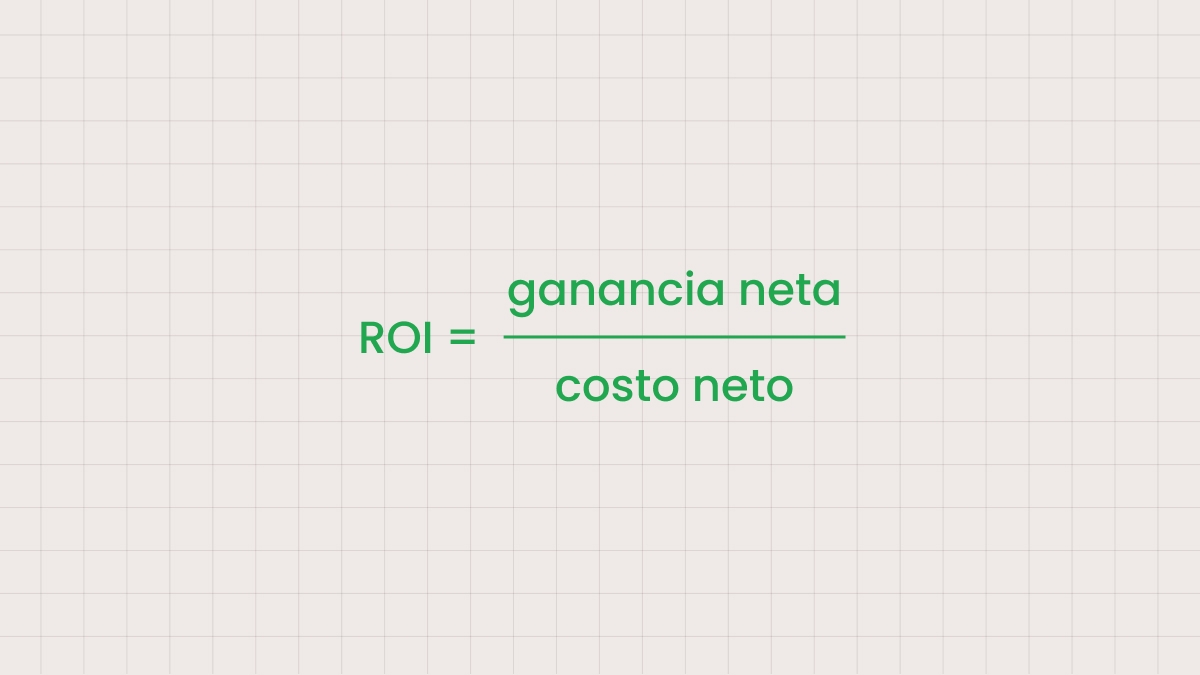

El rendimiento de la inversión es el porcentaje que nos permite conocer la rentabilidad o eficiencia de la inversión que hiciste. Se puede representar como un ratio absoluto (0.3) o un porcentaje (30%).

Aquí, el beneficio neto representa todo el dinero que ganas durante un periodo, mientras que el costo neto es toda tu inversión inicial, es decir, todo el dinero que aportas a un proyecto.

Un valor alto muestra una inversión muy rentable, algo que funcionó bien y demostró ser muy eficiente. Y viceversa, si la cifra es negativa, muestra que el inversor tuvo pérdidas en lugar de ganancias.

Por qué es importante el ROI

El ROI es muy importante, ya que nos permite evaluar los resultados reales del trading. Dado que el ROI se calcula mediante una fórmula sencilla, es una métrica práctica y directa que pueden utilizar los traders independientemente de su nivel de experiencia.

Por ejemplo, es muy difícil comparar el rendimiento de diferentes inversiones en industrias que, por lo general, no son fáciles de comparar, como acciones, bienes raíces o inversiones en una startup de TI. Si bien no se pueden comparar de manera directa porque son de naturaleza totalmente diferente, sí se puede calcular el ROI de cualquiera de ellas y comparar activos que no se pueden comparar de otra manera.

El valor del ROI te permite comparar diferentes vehículos de inversión para ver cuál funciona mejor para ti. Por ejemplo, puede que te guste operar pares de divisas exóticos, pero el retorno de tu trading en Forex es solo del 5%. Al mismo tiempo, el trading de commodities (oro y petróleo) te reporta un ROI del 15% durante el mismo periodo. Después de este análisis, podrás cambiar tu estrategia y enfocar tu tiempo y tus inversiones en commodities.

Por otra parte, si registras los valores del ROI durante un largo periodo, podrás sacar más conclusiones sobre tu cartera y tu estrategia de trading. Además de las estadísticas de tus posiciones abiertas y cerradas, verás una imagen más amplia de tu desempeño global.

Un ejemplo para ilustrar el uso del ROI

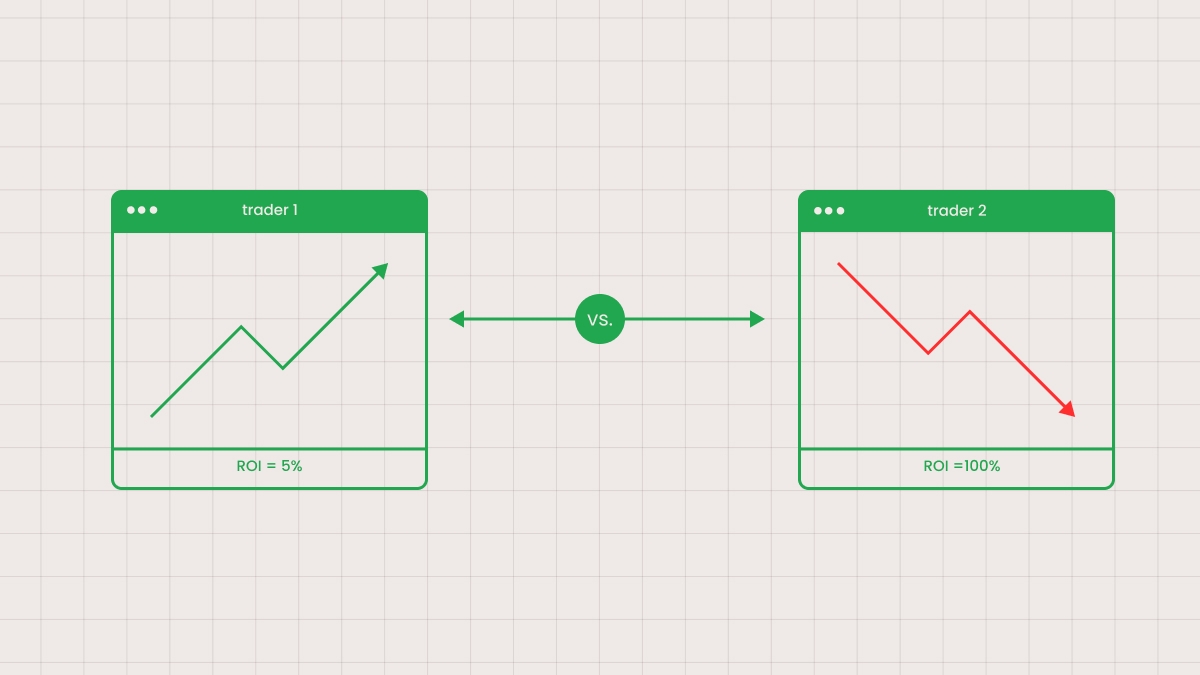

Consideremos dos traders minoristas con diferentes enfoques de trading.

Uno de ellos no calcula el ROI en absoluto y opera al azar. Abre posiciones y solo se fija en los resultados de esa única posición, sin tener en cuenta las pérdidas o ganancias a largo plazo. Este trader espera que su inversión inicial se duplique cada mes. Dado que este es un ROI excepcionalmente alto para el trading, la mayoría de los meses no lo consigue. De hecho, los rendimientos promedio en Forex tienden a ser mucho más bajos, lo cual está bien, ya que es un proceso financiero, no un milagro. Sin embargo, este trader parece estar esperando un milagro. A la larga, se decepciona y deja de operar.

La otra persona opera con cuidado, calcula su ROI para comprender los resultados generales y sigue su propia estrategia de trading. Este trader calcula su valor del ROI mensualmente y compara los valores de un mes a otro. Este trader tiene expectativas muy realistas. Esta persona sabe cuándo está progresando de verdad, por lo que sigue trabajando con confianza hacia sus objetivos realistas. El resultado general será mucho mejor. La confianza y el conocimiento son absolutamente necesarios en el trading.

Limitaciones del ROI

El ROI es una métrica muy útil que puede mostrar mucho sobre tu enfoque, tu estrategia y tu comprensión general del mercado. Sin embargo, hay ciertas limitaciones del ROI que debes comprender para analizar mejor la situación.

En primer lugar, el ROI no considera el valor temporal del dinero. Para calcular el ROI, solo toma tu inversión y compárala con la ganancia. Las ganancias pueden parecer impresionantes, pero si tomas en cuenta el tiempo, puedes ver la situación bajo una luz totalmente diferente. Por ejemplo, un ROI del 20% es excelente, pero si lo es en el transcurso de 5 años, es mucho menos impresionante.

Además, los cálculos del ROI no tienen en cuenta los riesgos en absoluto. Los riesgos son naturales para cualquier inversión y en Forex, el rendimiento depende de los riesgos más que en muchos otros campos, como los bienes raíces o los depósitos bancarios. A menudo, las inversiones de riesgo tienen altos valores potenciales de ROI, pero la razón es simple: están destinadas a compensar riesgos más altos. Si quieres ver el panorama completo, tendrás que considerar los riesgos junto con los rendimientos en Forex.

Otro aspecto es que el ROI simplifica mucho el concepto de rentabilidad. No considera inversiones continuas, como si solo invirtieras de una vez por todas, sin más gastos. Esto no es cierto en la mayoría de las industrias, incluido el trading. Es posible que quieras agregar fondos a tu cuenta una y otra vez para poder operar lotes más grandes, o que te encuentres con comisiones o gastos adicionales cuando pruebes algunos instrumentos nuevos para tu cartera. De hecho, es posible que quieras pagar para formarte y esto también puede considerarse una inversión en tu trayectoria de trading.

También debemos recordar que el ROI es una métrica histórica, es decir, solo muestra los resultados de una inversión pasada. No se puede utilizar para predecir la rentabilidad futura. Puedes optar por creer que si generalmente tienes un ROI del 15% durante un período de 5 años, el sexto año será lo mismo. Sin embargo, esto no siempre es cierto, ya que muchos otros factores importantes pueden afectar al valor en un año.

Todo lo anterior muestra que el ROI no se puede utilizar como la única métrica para determinar el éxito o el fracaso en las inversiones. Para ver realmente dónde se encuentra en términos de éxito financiero, el trader debe agregar más capas de análisis y tener en cuenta otros factores, como el tiempo o las inversiones continuas. Una vez que conoce el ROI de los distintos instrumentos de trading, puede diversificar su cartera para minimizar los riesgos y centrarse en los instrumentos más rentables.

Preguntas frecuentes

¿Qué es el ROI en el trading?

En trading, el ROI (retorno de la inversión) es el ratio que muestra cuánto ganó o perdió un trader frente a su inversión inicial. Este valor demuestra la rentabilidad de una determinada inversión realizada. Si depositas 500 USD en tu cuenta de trading con un broker, como FBS, y recibes 100 USD de ganancia, tu ROI es del 20%.

¿Se puede garantizar un determinado ROI en el trading?

Por desgracia, en el trading no hay garantías, ni siquiera garantías de rendimientos o ganancias concretas. Operar es arriesgado. Por lo tanto, si bien el ROI puede ser impresionante aquí en comparación con los negocios más tradicionales, como los bienes raíces o los bonos del gobierno, también implica mayores riesgos.

El trading puede ofrecer ingresos asombrosos para algunos instrumentos muy volátiles, en especial cuando se producen eventos importantes en el mercado. Sin embargo, las pérdidas también son muy posibles, incluso para los mismos activos o instrumentos. No hay garantías, siempre debes estimar y gestionar tus riesgos.

¿Qué ROI promedio puede generar el trading?

No existe un ROI promedio para el trading en general ni para Forex en particular. Con una buena estrategia de trading y algunas buenas decisiones durante la alta volatilidad, un ROI del 50% no es algo inaudito, pero sigue siendo bastante inusual. De hecho, la mayoría de los inversores están de acuerdo en que cualquier número positivo es un buen ROI. Un ROI excelente es del 20%, mientras que la mayor parte de los traders activos se conforman con un 10-15%.

Resumen

El trading es una opción de inversión atractiva para quienes desean ganar dinero en línea. Muchos de los activos que se operan en línea (y varios derivados, como los pares de divisas de Forex) pueden tener rentabilidades muy atractivas. Sin embargo, hay que recordar que una rentabilidad alta suele ir acompañada de riesgos altos. Si bien el ROI se puede utilizar para comparar diferentes oportunidades de inversión y para decidir sobre la diversificación de la cartera, también se deben utilizar otras métricas y herramientas para evaluar mejor los riesgos, tener en cuenta el tiempo y considerar los costos continuos de una inversión.