¿Qué es una pin bar?

La pin bar es un tipo de vela que señala una reversión en los precios. Consiste en una sombra larga, una sombra pequeña y un cuerpo entre ellas. Dato curioso: el nombre de este patrón es la abreviatura de Pinocho, ya que tiene una mecha larga similar a la nariz del famoso personaje.

Sin embargo, además de una sombra larga, también existen condiciones de mercado especiales para llamar a un patrón de velas pin bar.

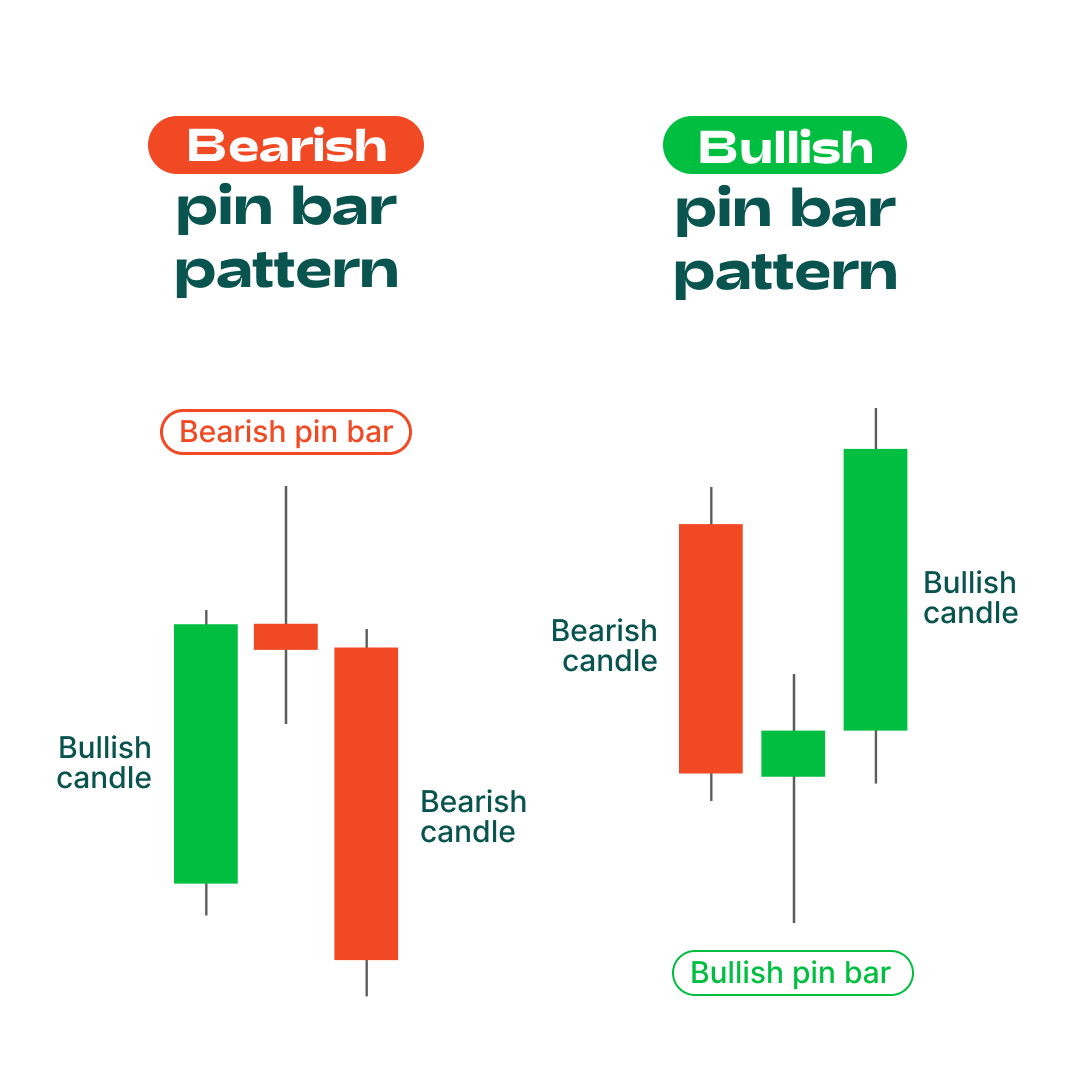

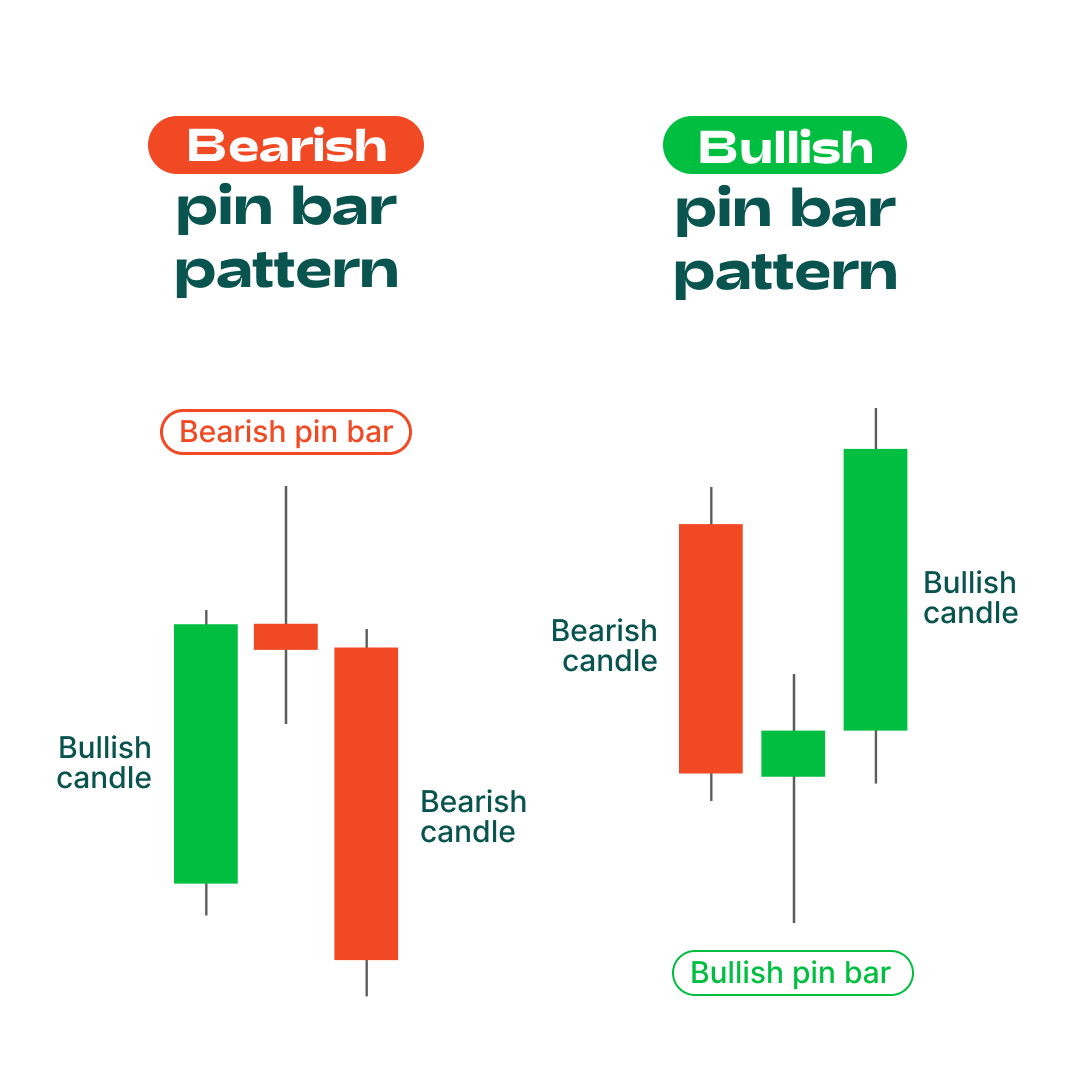

En la imagen de arriba, puedes ver dos tipos de pin bars: bajista y alcista.

La pin bar bajista se forma después de un movimiento sólido hacia arriba o al final de una tendencia alcista. Su cuerpo está completamente contenido dentro del cuerpo de la barra alcista anterior. Tiene una cola superior larga que puede ser tres o más veces más larga que el tamaño del cuerpo. Puede ser bajista o alcista, pero se cree que la bajista proporciona una señal más fuerte. El patrón debe ser confirmado por una vela bajista que abra por debajo del cuerpo de la pin bar. Esta señal muestra que los toros intentaron subir el precio, pero sus intentos fueron rechazados.

La pin bar alcista aparece al final de un movimiento bajista o tendencia bajista. Abre dentro del cuerpo de la vela bajista anterior y tiene una cola inferior larga y un cuerpo pequeño. El patrón debe ser confirmado por una vela alcista que abra por encima del precio de cierre de la pin bar.

Ahora, ya que conoces el principal elemento de la estrategia, pasemos a las configuraciones.

Requisitos de la Estrategia

Instrumentos: Pares de divisas principales con spreads ajustados y alta liquidez están disponibles en la cuenta Standard. Ya que hablaremos de una estrategia de scalping, debemos estar atentos a este detalle.

Temporalidad: M15 o M30.

Configuraciones técnicas: niveles clave, líneas de tendencia, formación de pin bar.

Reglas para una entrada corta

Marca los niveles clave e identifica las líneas de tendencia.

Cuando se forme una pin bar en el nivel de resistencia importante, coloca una orden de "Venta" 10-20 puntos por debajo del mínimo de la pin bar.

Coloca un Stop Loss 20-30 puntos por encima de la línea de resistencia que provocó el rechazo de los precios.

Coloca un Take Profit cuando el precio sea dos o tres veces mayor que tu riesgo para esta operación o salga en el nivel de soporte significativo.

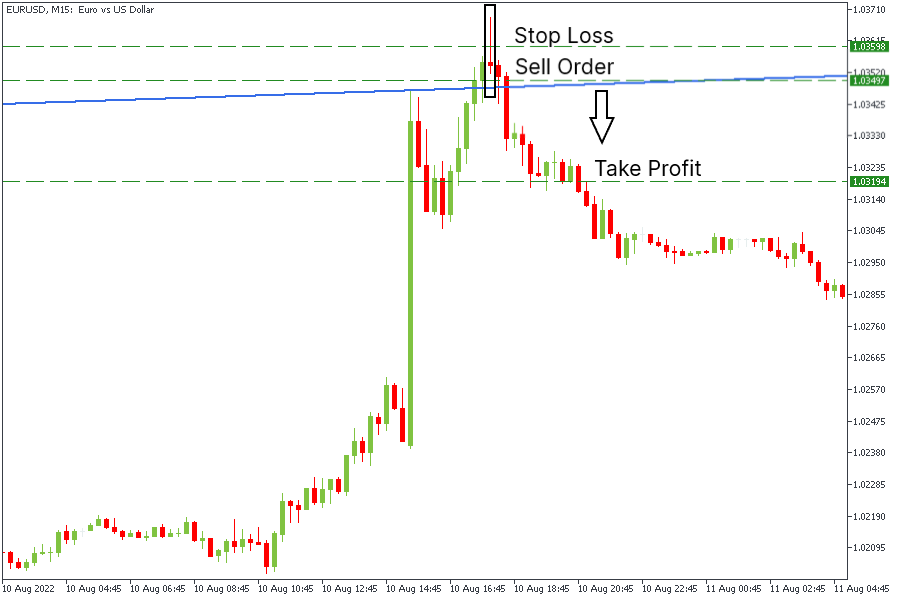

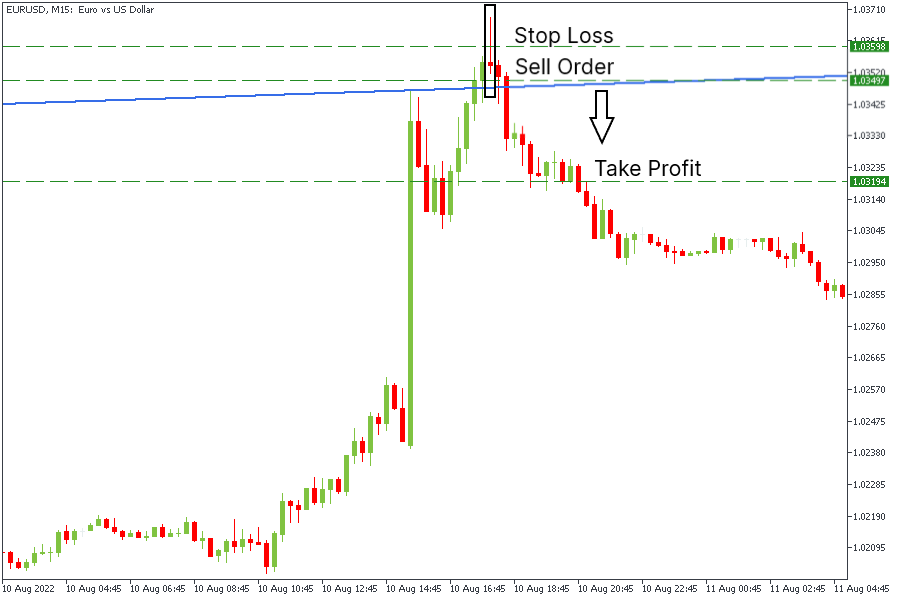

Ejemplo

El gráfico de arriba muestra que el EUR/USD intentó subir después de alcanzar la línea de tendencia local en el gráfico M15. Sin embargo, los toros no pudieron mantener las posiciones durante mucho tiempo. Como resultado, se formó una pin bar. Después de confirmarlo, colocamos una orden de venta por debajo del mínimo de la pin bar en 1,03497 y un Stop Loss por encima de la línea de resistencia reciente en 1,03598. Ponemos un nivel de Take Profit en 1,03194. Como resultado, ganamos 302 puntos.

Reglas para una entrada larga

Marca los niveles clave e identifica las líneas de tendencia.

Cuando se forme una pin bar en el nivel de soporte importante, coloca una orden de "Compra" 10-20 puntos por encima del máximo de la pin bar.

Coloca un Stop Loss 20-30 puntos por debajo de la línea de soporte que provocó el rechazo de los precios.

Coloca un Take Profit cuando el precio sea dos o tres veces mayor que tu riesgo para esta operación o salga en el nivel de resistencia significativo.

Ejemplo

En el mismo gráfico del EUR/USD, consideramos un escenario de compra. Después de que el precio se deslizó por debajo del nivel psicológico en 1,2000 y testeó el área cercana a la zona de soporte en 1,1900, se formó un patrón pin bar. Abrimos una orden de compra por encima del máximo de la pin bar en 1,20058 y colocamos un Stop Loss en 1,19870. Con una relación riesgo-recompensa de 1:3, establecimos el Take Profit en 1,20619. Con esta estrategia ganamos 560 puntos.

Conclusión

Ahora conoces una nueva estrategia de scalping para operar. Para testear la estrategia primero, puedes probarla en una cuenta Demo.