FBS turns 16

May 22, 2025

Basics

How Dividends Work

A corporation will periodically distribute a portion of its profits to its shareholders. These payments are called dividends. They can be a fixed amount of each share, known as the dividend per share (DPS); other times, it’s a percentage of the current share price, in which case it’s called the dividend yield.

Dividend-paying stocks are likely to appreciate over time, which makes them a draw for investors who seek a steady income stream, such as retirees. A company’s ability to pay dividends regularly points to its financial health, which in turn helps it retain its investors long-term, as well as attract new ones.

How are dividends distributed?

Dividends are a certain amount of each share. The more shares a shareholder owns, the more dividends they will receive.

In joint-stock companies, the payments tend to be made on a regular schedule that is adhered to with some flexibility: scheduled payments may be canceled, and unscheduled ones can be made at any time, including as one-time supplements to scheduled payouts. Public companies don’t consider dividends an expense – it is the allocation of after-tax profits to shareholders.

- Co-ops, on the other hand, usually distribute their dividends based on member activity. Consequently, their dividend payouts are seen as a pre-tax expense.

Like the word “divide,” the root of “dividend” is the Latin dividendum - a whole that is to be separated into equal parts.

Dividend payout scenarios

Reasons and times a company pays out dividends, and whether it does at all, are often functions of its financial strategy, as well as its earnings, cash flow, and investment opportunities. Here are some of the scenarios in which dividends might be issued:

Profit distribution

Well-established corporations with stable earnings often choose to distribute its profits to its shareholders in the form of dividends.

Quarterly earnings reports

Many companies pay dividends in conjunction with their quarterly earnings. If they report strong financial results, they may declare dividends to reward shareholders.

Special dividends

Occasionally, companies may issue special one-time dividends, often when they have excess cash due to extraordinary profits or asset sales. This can be a way to distribute surplus funds.

Consistent dividend policies

When a company’s strategy relies heavily on shareholder confidence and attracting income-focused investors, it may choose to pay dividends consistently, regardless of earnings fluctuations.

Tax considerations

Shareholders can benefit from dividends paid out at the end of the fiscal year, as this income will be taxed at a favorable rate. Sometimes, companies like to throw their investors this bone.

Mergers or acquisitions

A company that is being bought by another firm may distribute dividends, especially if the acquiring company seeks to restructure its finances.

What determines dividend frequency

How often a company pays dividends to its shareholders can vary widely among companies and is determined by a number of factors:

Company policy

A firm’s dividend policy is determined by its board of directors. The frequency of payouts may be part of this policy.

Cash flow availability

The more consistent the cash flow a company has access to, the more often it can afford to make dividend payments.

Earnings stability

Corporations with uncertain or fluctuating earnings may prefer not to pay dividends, or to pay them rarely; whereas companies with stable earnings are more likely to commit to paying them regularly.

Investor expectations

Companies may consider investor preferences when determining dividend frequency. For example, income-focused investors often prefer quarterly dividends, which provide a steady income stream.

Market practices

Industry norms can influence how often dividends are paid. Mature companies, especially in certain sectors (such as utilities), typically pay dividends every quarter. Growth-oriented technology firms may, by contrast, only issue annual dividends, or not issue them at all.

Dividend dates

These are the dates when key steps in the paying out of dividends take place:

Declaration date

The board of directors announces that a dividend will be paid out, its amount, and all the relevant dates.

Ex-dividend date

The cutoff date for dividend eligibility. Investors who purchase shares after this date, but before the payment date of the current round of dividends, will not be eligible until the next round.

The ex-dividend date is typically one business day before the record date.

Record date

The company makes its determination of eligible shareholders for the current round of dividend payouts, based on their records of ownership.

Payment date

Payday. Funds are transferred to shareholders by wire or check.

How are dividends calculated?

The percentage of earnings a corporation pays out as dividends is referred to as a payout ratio. The amount the company keeps for itself or reinvests is called retained earnings.

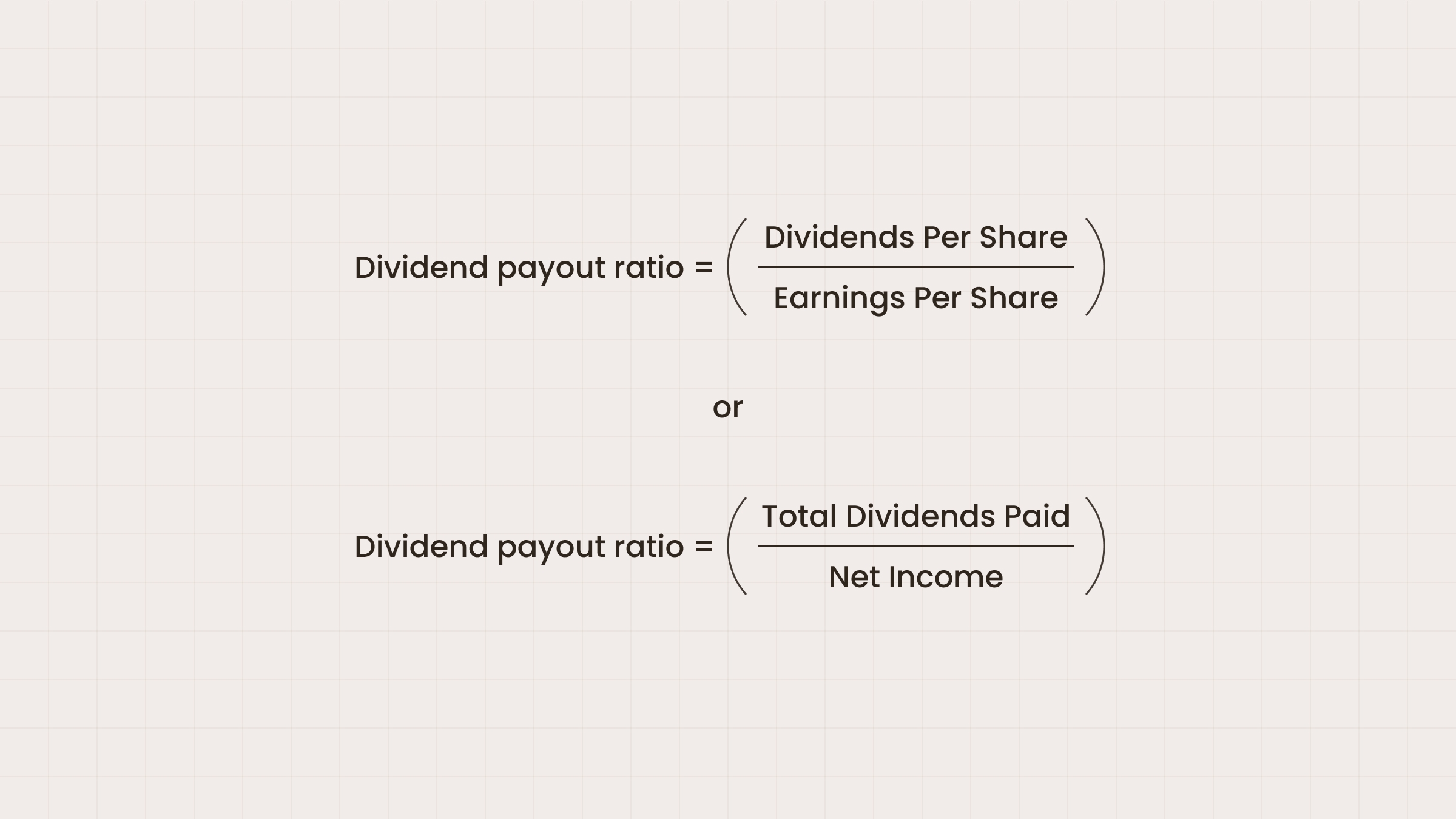

To calculate the payout ratio, the company divides its dividends by its net income. This is done using one of two formulas:

This metric helps investors evaluate a company’s dividend sustainability. A low payout ratio may indicate that a company has room to increase dividends, while a high payout ratio could suggest that the company is distributing a large portion of its earnings, which may not be sustainable in the long term. Investors often use the payout ratio to compare companies within the same industry and assess the attractiveness of dividend-paying stocks.

A very high payout ratio might raise concerns about sustainability. While dividends are a sign of financial health, investors should also consider the company’s growth potential. Some firms reinvest earnings for expansion rather than distributing them. Overall, dividends can enhance total investment returns by providing both income and potential appreciation in stock value.

The earliest record known to us of a company paying regular dividends goes back hundreds of years and covers an uninterrupted period of two centuries. The Dutch East India Company practiced regular dividend payment from 1602 to 1800.

How dividends affect stock price

Investor perception | Investor confidence can receive a boost from dividend announcements, especially if the dividends show an increase. This confidence can in turn lead to increased demand for the stock, driving up its price. |

Income attraction | Increases in demand from income-focused investors can put upward pressure on the stock price. The better a company’s reputation as a reliable payer of dividends, the more this effect is felt. |

Value adjustment | The ex-dividend date tends to see a downward adjustment in the stock of a company that is in the middle of a dividend payout process. Since the now known value of the dividends about to be paid out is effectively no longer part of the company’s assets, its stock price adjusts by about the amount the company is paying out. |

Market conditions | Broader market trends can influence how dividends impact stock prices. In a bull market, the effect of dividends on stock prices might be muted by overall investor optimism. Conversely, in a bear market, a strong dividend might provide a cushion for the stock price as investors seek safety in reliable income. |

Payout ratio and growth expectations | High payout ratios tend to act as red flags for investors because they may signal that a company has limited growth potential and is trying to attract investors with fast cash. If investors believe a firm is prioritizing paying out dividends over reinvesting in its own growth, they will run, driving the price of the company’s stock even lower. A balanced approach to dividends and growth can attract a broader base of investors. |

What entities pay dividends

Dividends are primarily paid out by corporations, but other organizations may also sometimes pay them. Here are the main types of entities that pay dividends:

Publicly traded corporations

These are the most common entities that pay dividends. Established companies in sectors such as utilities, consumer goods, and financial services often distribute a portion of their profits to shareholders as dividends.

Real estate investment trusts (REITs)

These entities invest in income-producing real estate and are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them attractive to income-focused investors.

Master limited partnerships (MLPs)

Similar to REITs, MLPs provide dividends, often referred to as distributions. They primarily operate in the energy sector and are required to distribute a significant portion of their earnings to unit holders.

Mutual funds and exchange-traded funds (ETFs)

Some funds that invest in dividend-paying stocks will pass on the dividends received from their holdings to investors as dividend distributions.

Private companies

While less common, some private companies may pay dividends to their shareholders, particularly if they have consistent profits and a strategy focused on returning value to investors.

Banks

Many banks periodically pay dividends to their shareholders, reflecting their profitability and stability.

Open an FBS account

By registering, you accept FBS Customer Agreement conditions and FBS Privacy Policy and assume all risks inherent with trading operations on the world financial markets.