Breaking News! FBS Cuts Trading Spreads on GBPUSD!

The GBPUSD pair, often referred to as "cable," represents the exchange rate between the British Pound and the US Dollar. This rate is influenced by various factors, including macroeconomic indicators, central bank policies, and geopolitical events. The British Pound’s performance is primarily driven by decisions made by the Bank of England, which sets interest rates and monetary policy based on the UK’s economic health. On the other hand, the US dollar's strength in global markets is shaped by the actions of the Federal Reserve, particularly in response to the US economic data and inflation rates.

UK Unemployment Rate, May 14, 08:00 (GMT+2)

The UK unemployment rate is a critical economic indicator that reflects the labor market's health. If the UK unemployment rate were reported below the expected 4.0%, it would suggest a more robust labor market, leading to bullish sentiment for the British Pound as it implies economic resilience. A strong labor market may prompt the Bank of England to consider tightening monetary policy through interest rate hikes, thereby strengthening the Pound. This would increase the GBPUSD rate as a stronger Pound buys more Dollars. However, the reported rate of 4.2% suggests a weakening labor market, which could lead to a bearish sentiment for the Pound as the Bank of England might adopt a more accommodative policy stance to stimulate the economy, potentially leading to a depreciation of the Pound and a decrease in the GBPUSD rate.

US Consumer Price Index (CPI) YoY, May 15, 14:30 (GMT+2)

The US Consumer Price Index (CPI) serves as a pivotal economic indicator, exerting significant influence on the monetary policy decisions of the Federal Reserve. An actual US CPI figure surpassing the forecast, such as 3.5% compared to an expected 3.4%, signals higher-than-anticipated inflation. This inflationary surge could prompt the Federal Reserve to contemplate raising interest rates to mitigate inflationary pressures, consequently bolstering the Dollar. A strengthened dollar implies that fewer dollars are needed to purchase a pound, thereby reducing the GBPUSD rate. Conversely, a CPI figure below the forecast, indicating subdued inflationary pressures, may delay interest rate hikes by the Fed, potentially weakening the Dollar. A weakened Dollar would result in a higher GBPUSD rate, as more Dollars would be required to purchase a Pound.

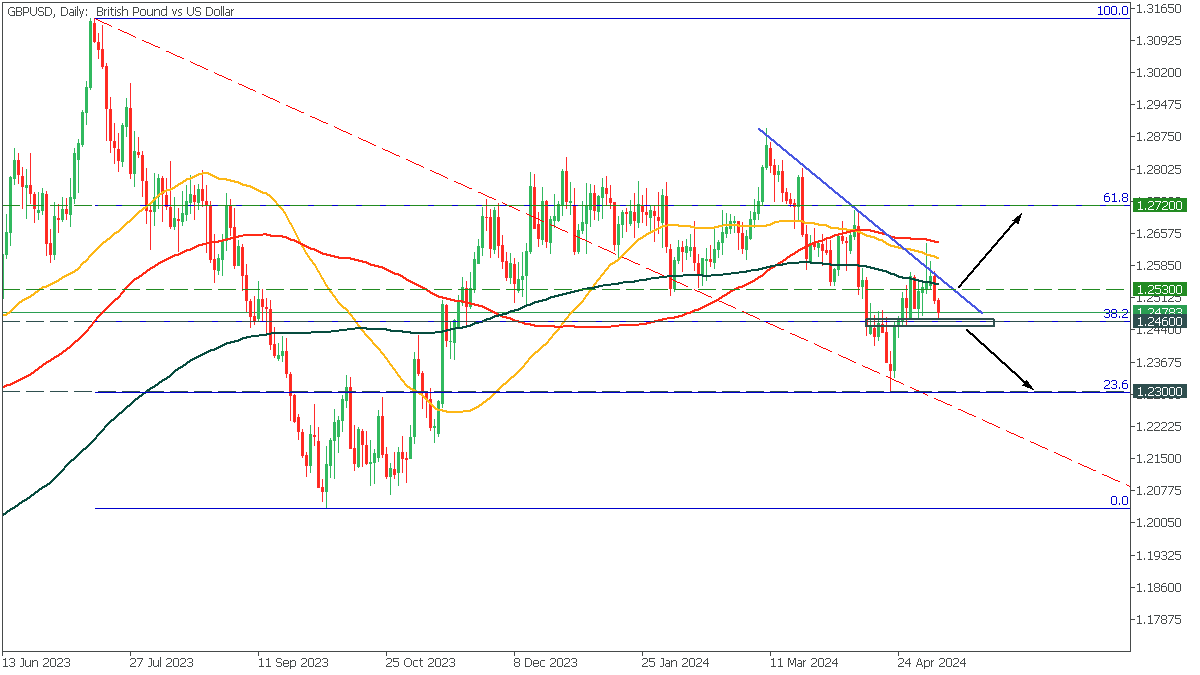

In the Daily Timeframe, GBPUSD exhibits a short-term bearish trend. Despite the heightened volatility, the price hovers near the 38.2 Fibonacci support level. Although the moving averages suggest a continuation of the downward trajectory, two potential scenarios emerge.

If GBPUSD falls below 1.2460 support, it will fly down to 1.2300, corresponding to 23.6 Fibonacci;

However, if the bulls push the price above the resistance at 1.2530, breaking the trend line, then it could be expected to rise to 1.2720.