The European Central Bank’s July pause after its June rate cut reflects a delicate balancing act: inflation is inching closer to target, but persistent core pressures—especially from services and wages—keep policymakers cautious. President Lagarde’s data-dependent tone signals that the ECB is not yet ready to commit to a full-blown easing cycle.

Eurozone growth remains tepid, with Q2 GDP estimates stuck near 0.1%–0.2%, and manufacturing still in contraction. Though unemployment holds near historic lows, loan demand is collapsing and business investment is stalling—clear signs of an economy grappling with tight credit and fading momentum.

This backdrop puts the euro in a precarious position. As the Fed delays its cuts amid stickier US inflation, the EURUSD pair has edged lower toward the 1.17–1.16 range, dragged by widening rate differentials. Traders eyeing this divergence should brace for volatility: another ECB cut—likely in September or December—could deepen euro weakness, especially if US data stays resilient.

For forex traders, this means:

- EURUSD remains vulnerable to further downside if core inflation in the euro area stays sticky and the Fed continues to hold.

- EURGBP may see pressure if the Bank of England delays cuts or the UK labor market holds up better than expected.

- EURJPY could stay elevated as the Bank of Japan’s normalization lags far behind, despite yen intervention risks.

The European Central Bank (ECB) held its key interest rates steady in its July 2025 meeting, after delivering a single 25-basis-point rate cut in June—the first such move since its historic tightening cycle began in 2022. The deposit rate now stands at 3.75%, down from the 4.00% peak. ECB President Christine Lagarde reiterated a data-dependent approach, avoiding firm forward guidance while stressing the need to see “further progress on disinflation” before committing to more cuts.

Inflation Trends & ECB’s Mandate

Headline euro area inflation dropped to 2.4% in June, from 2.6% in May, moving closer to the ECB’s 2% target. Core inflation (excluding food and energy) remains more persistent at 2.7%, suggesting lingering price pressures in services and wages. The ECB has acknowledged that wage growth—particularly in Germany, France, and Spain—remains elevated and could delay full normalization.

While energy and goods inflation have moderated significantly, the services sector remains a key concern, primarily due to collective bargaining agreements signed earlier in the year. Market-based inflation expectations (5y5y forward) remain slightly above 2%, giving the ECB some breathing room—but not a clear green light for aggressive easing.

Eurozone Economic Indicators

Economic activity across the eurozone remains fragile. Q2 GDP is expected to have grown by just 0.1–0.2% QoQ, following flat growth in Q1. Business activity is mixed:

- The composite PMI (July flash) stands near 50.5, with the services sector still expanding while manufacturing remains in contraction territory (~46.7).

- Unemployment remains historically low at 6.4%, but hiring has slowed in recent months, particularly in Germany and the Netherlands.

- According to the ECB Bank Lending Survey, lending growth continues to decelerate, especially for businesses, where corporate loan demand fell to 2020 levels.

Despite sticky inflation, the euro area’s economic weakness limits the ECB’s ability to normalize rates too quickly.

Analyst & Institutional Expectations

Most institutional economists expect one to two additional rate cuts by year-end 2025, likely in September or December, depending on the inflation trajectory. According to swap pricing, markets are currently pricing at a 65–70% probability of one more cut before year-end.

However, hawkish members of the Governing Council (e.g., from Austria and the Netherlands) have cautioned against easing too rapidly. These voices call for patience until wage data and service inflation moderate more clearly.

Comparing the ECB and Fed

The ECB’s policy path now appears slightly ahead of the Federal Reserve, which has paused but not yet begun cutting. With the US labor market still showing strength and inflation less contained, the Fed is expected to delay its first cut until late Q3 or Q4 2025. This divergence has weighed on the euro, with EURUSD slipping toward the 1.17–1.16 zone in recent weeks as rate differentials favor the dollar.

Implications of Further ECB Easing

If the ECB cuts further in 2025, it would likely:

- Ease financial conditions and reduce borrowing costs for consumers and businesses.

- Potentially weaken the euro, supporting exports but also importing inflation.

- Risk reigniting price pressures if cuts occur before core inflation softens.

However, if the ECB pauses longer, credit conditions may remain tight, slowing investment and consumption—especially as fiscal support across the bloc recedes.

Summary

The ECB is walking a tightrope. Inflation is falling but not fast enough to justify an aggressive rate-cutting cycle, especially with high wage growth. Unless service inflation cools more decisively, the ECB will likely stick to a gradual easing path, lagging behind expectations for rapid normalization and keeping EURUSD sensitive to every shift in Fed vs. ECB divergence.

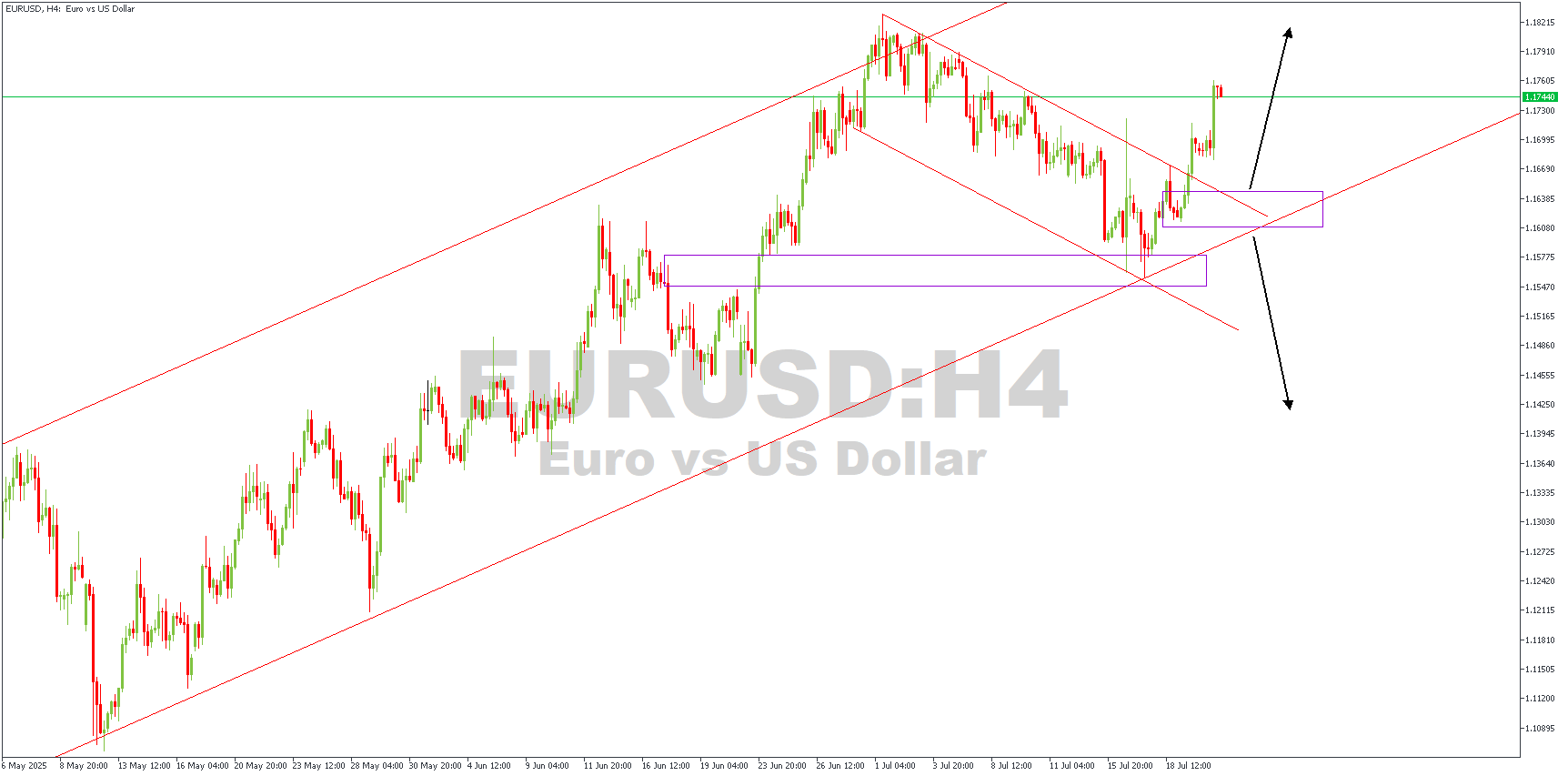

EURUSD – H4 Timeframe

The 4-hour timeframe chart of EURUSD shows that the price recently broke out of a consolidation channel within a larger channel after bouncing off the confluence of the turncoat demand zone and the lower channel boundary line. The outcome of the retest of the highlighted demand zone would determine the eventual bias. Should price present bullish confirmations at the confluence region, the bullish sentiment would be confirmed; otherwise, the bearish sentiment would be confirmed.

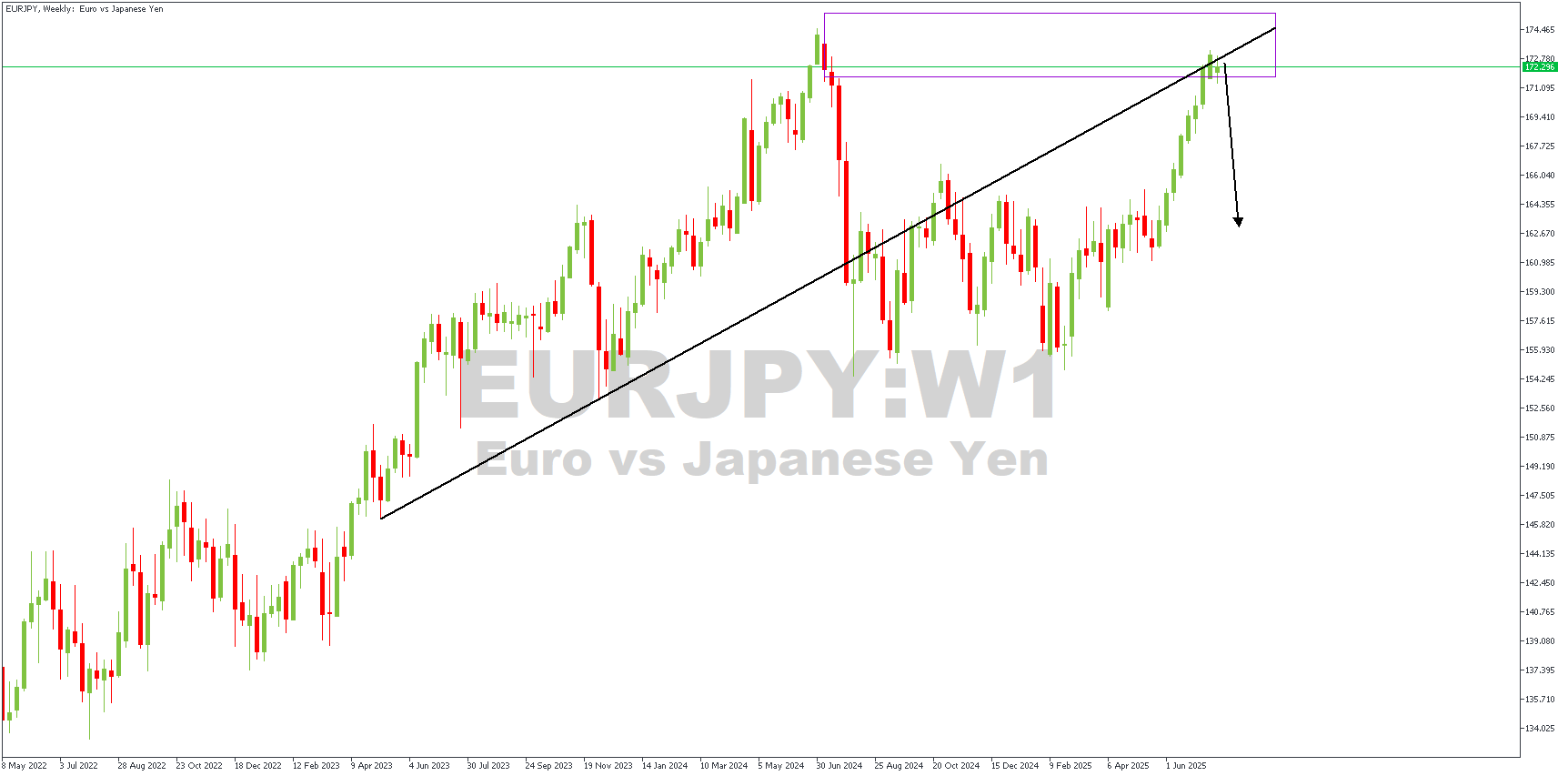

EURJPY – W1 Timeframe

The weekly timeframe chart of EURJPY above provides the following insights;

- Long-Term Uptrend

- Price has been in a strong uptrend, marked by higher highs and higher lows, confirmed by the upward-sloping trendline.

- Major Resistance Zone (Purple Box: ~173.00–174.50)

- Price has re-entered a key supply zone where previous selling pressure caused a significant drop. This area marks multi-year highs, making it a strong resistance level.

- Trendline Retest & Rejection Wicks

- Price is currently retesting the long-term trendline from underneath. Repeated rejections around this area suggest weakening bullish momentum as price struggles to close decisively above it.

- Bearish Price Action Setup

- The most recent weekly candle shows indecision or potential exhaustion near the upper boundary of the resistance zone — hinting at a possible reversal.

My Trading Plan:

I’m watching for a bearish confirmation (e.g., bearish engulfing candle, long upper wick, or weekly close below the trendline).

If confirmed:

- I’ll consider a short entry near the 173.00–174.50 resistance zone

- Target zones:

- 1st target: 169.50 (minor support and structure level)

- 2nd target: 165.00 (previous swing low and demand area)

Invalidation: A weekly close above 174.50 invalidates the bearish setup and signals bullish continuation.

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.