The 5-second rule technique

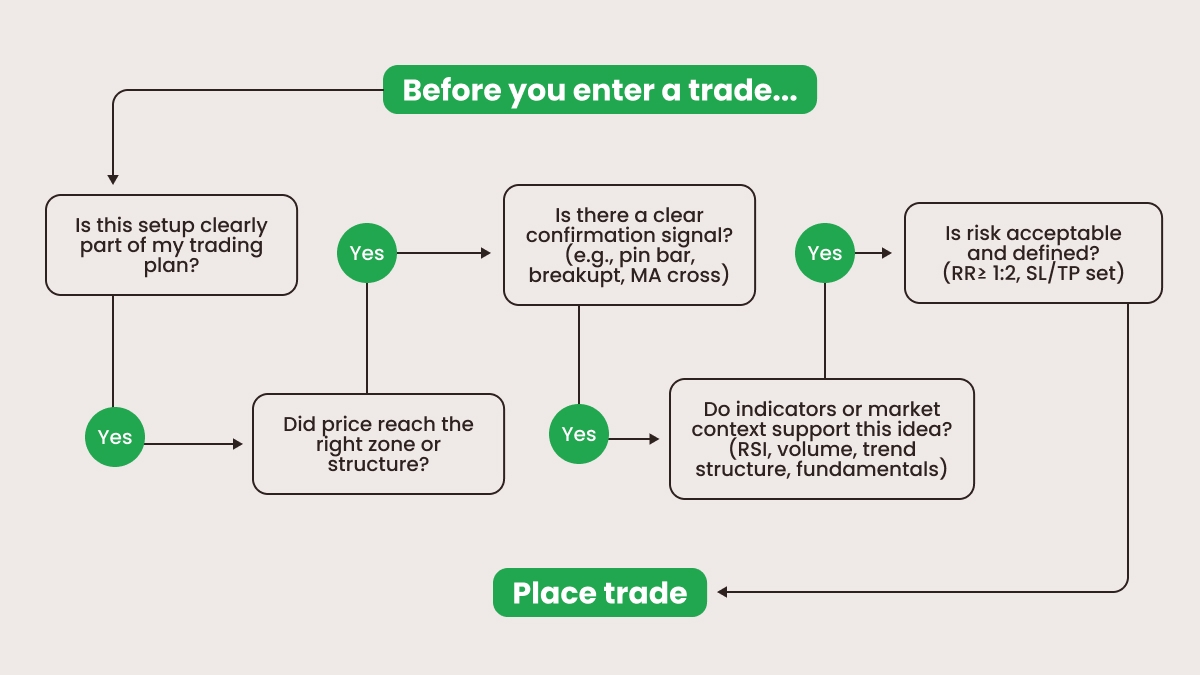

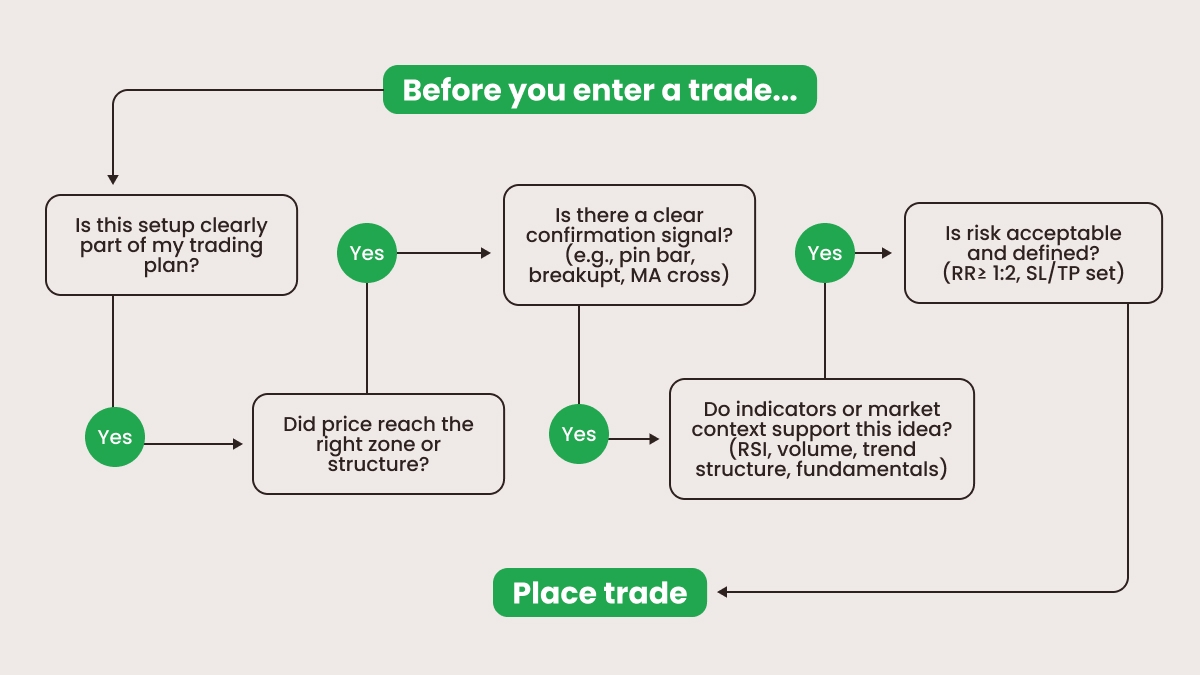

Impulsive actions are always fast. A disciplined approach is usually slow. Whenever you feel the urge to simply enter the market without any analysis, just because you feel like it, stop and count to five. Ask yourself:

This pause will not eliminate emotion, but it will give you time to think before opening a trade.

Answering these questions and thinking will kill the majority of irrational trades. You may also want to use the checklist available for download later on to answer various questions at different stages of your trading process and make sure you control your emotions properly.

Reason for entry

When you consider entering the market, comment on it. Describe your reason for entry. For example:

This is a short on GBPJPY because the price rejected resistance, RSI is overbought, and I see a bearish pin bar on H1.

Describe your logic in as many details as possible: you should understand and be able to explain why you want to enter the market. If you can’t explain it, you probably shouldn’t trade it.

Plus, if you record your reasons for all the positions in your trading journal, you can better analyze them and understand what setups work for you.

Risk management

Impulsive trades often skip stop-losses, overleverage, or break rules. If you want to stop acting on emotions and manage your risks properly for all your trades, follow some simple rules:

Risk no more than 1–2% of your available capital per trade.

Always set stop-loss values before entry.

Use take-profit orders for extra safety.

Determine your risk-to-reward ratio (aim for 1:2 or better).

Use lot calculators, don’t guess.

If in doubt, do nothing. Wait for the market to offer another setup without damaging your capital.

For example, if you risk 1% and have $1000 in your account, you can lose no more than $10. In this case, bad trades won’t ruin you, and you will have a better chance to earn on good ones. Even better, you may want to start with a demo account and only move to trading with real money when you better understand what’s going on in the market. This will eliminate the risk of losing your money when you only learn and master logic-driven trading.

Pauses in trading

After every entry, pause for at least 5–10 minutes. Impulsive trades are often followed by more impulsive trades:

When the trade is profitable, you feel invincible and want to open one more trade to continue profiting.

When you lose, you want to recover your losses.

Making pauses between trades breaks this chain reaction, helping you avoid revenge or overconfident trades.

Silent mode

Turn off push notifications. News, trading apps, and signals trigger FOMO. Silence them all during market hours and focus only on your planned setups, not hype.

Close everything and only keep your chart open.

Trade your plan, not someone’s tweet or random signal.

Rely on your analysis instead of market noise.

Post-trade routine

When you close any position, analyze your results by answering a few questions:

Was this trade planned or emotional?

Did you apply risk management and follow your limits?

What did you feel before/during/after the trade?

What worked for you or failed during this trade?

Record your answers in your trading journal and review the results weekly. You’ll be able to spot patterns and regain control.

Conclusion

Naturally, no one can win every trade. What you can do is control your every click and every action. Impulse trading resembles gambling a lot. Disciplined trading is like chess.

Follow your rules, respect your risk limitations, and stay calm while others burn their accounts chasing noise.

Feel more confident and prepared for logic-driven trading now?

Register your demo account now and open your first trade to implement your knowledge.

Read our other materials that will help you eliminate anything that stands in your way to success. Be sure to download our checklist, which you can use to control your emotions and stop impulsive trading.