TDI trading strategies

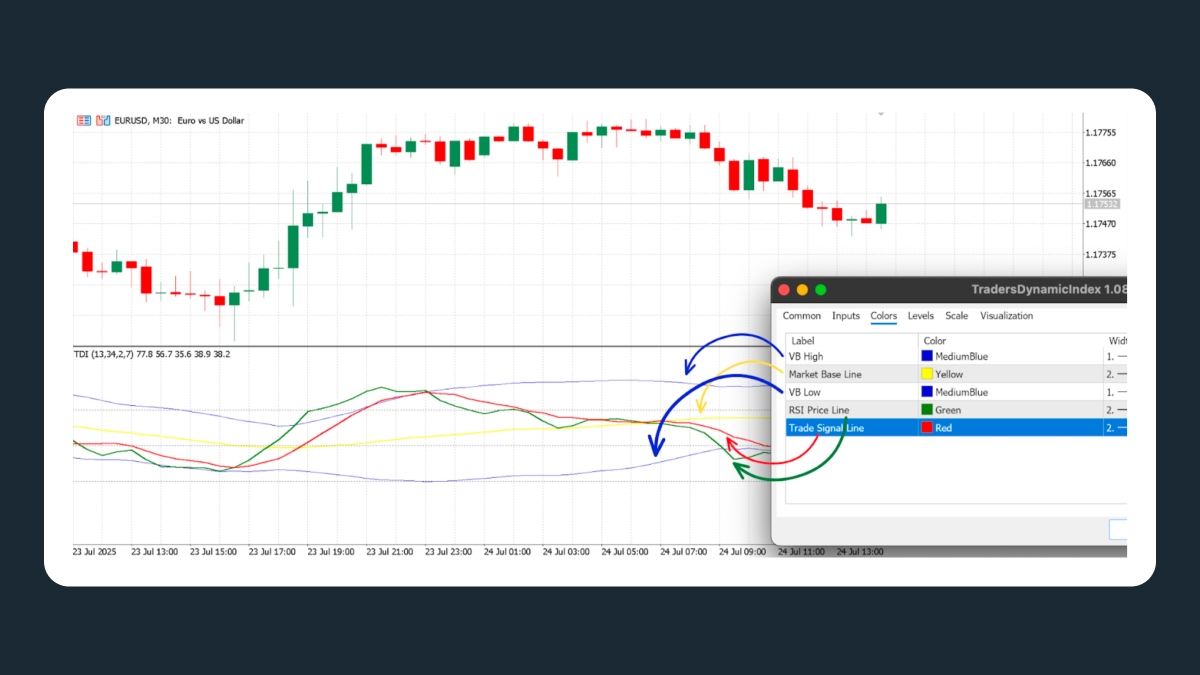

Basic Crossover

This is one of the most common approaches. In this strategy, traders enter long when the green RSI price line crosses above the red signal line, and enter short when it crosses below.

The slope and position of these lines compared to the yellow market base line help confirm the trend’s direction. Many traders exit on the opposite crossover or during a spike in volatility.

The Basic Crossover Strategy works best in trending markets, so it’s often paired with higher timeframes to reduce noise.

Volatility Breakout

This strategy is applicable when the Bollinger Bands tighten, showing low volatility. When the green and red lines break out together, it can signal a strong price move.

The Volatility Breakout works especially well on 15-minute to 1-hour charts.

Trend Continuation

The Trend Continuation strategy looks for the green line to bounce off the red or yellow line while moving in the same direction as the overall trend.

The slope of the MBL and candle patterns helps confirm the setup.

Divergence Reversals

The Divergence Reversals strategy focuses on differences between price action and the TDI:

If the price makes a new high but the RSI line doesn’t, it can signal a bearish reversal.

If the price makes a new low but the RSI doesn’t, it can signal a bullish reversal.

This strategy often combines a green/red crossover with easing Bollinger Band pressure. It works best when confirmed with other technical tools like support/resistance or candlestick patterns.

Limitations and common pitfalls

Like any indicator, the TDI is not a guarantee of profitable trades and comes with its own limitations. For example, in sideways or choppy markets, the green and red lines can cross many times, giving false signals (especially on lower timeframes). Also, because it’s a smoothed indicator, it can react slowly when the market moves fast.

Other limits include the fact that it doesn’t use volume data like OBV or VWAP (only price action). Changing the settings too much can make backtest results look impressive but fail in live trading.But don’t worry! These risks can be managed. To do this, add some fundamental analysis and use good risk management (like stop-loss orders and the right position size).