In trading, every penny and every millisecond counts. If your trade isn't executed at the price you counted on, you get slippage. In this article, we break down what slippage is, why it happens, and how to avoid it.

June 30, 2025

Risk management

In trading, every penny and every millisecond counts. If your trade isn't executed at the price you counted on, you get slippage. In this article, we break down what slippage is, why it happens, and how to avoid it.

Slippage is the difference between the expected price of a trade and the price at which the trade is filled.

Slippage happens when your trade is executed at a different price than you expected. You click Buy or Sell, but by the time your trade goes through, the price has changed. In the milliseconds between the time you place your order and the moment it gets filled, the price “slips.” In most cases, slippage isn't dramatic (often just a few pips). But it can still put a dent in your profits, especially if you're trading frequently or using large positions.

Trading starts with FBS — register now!

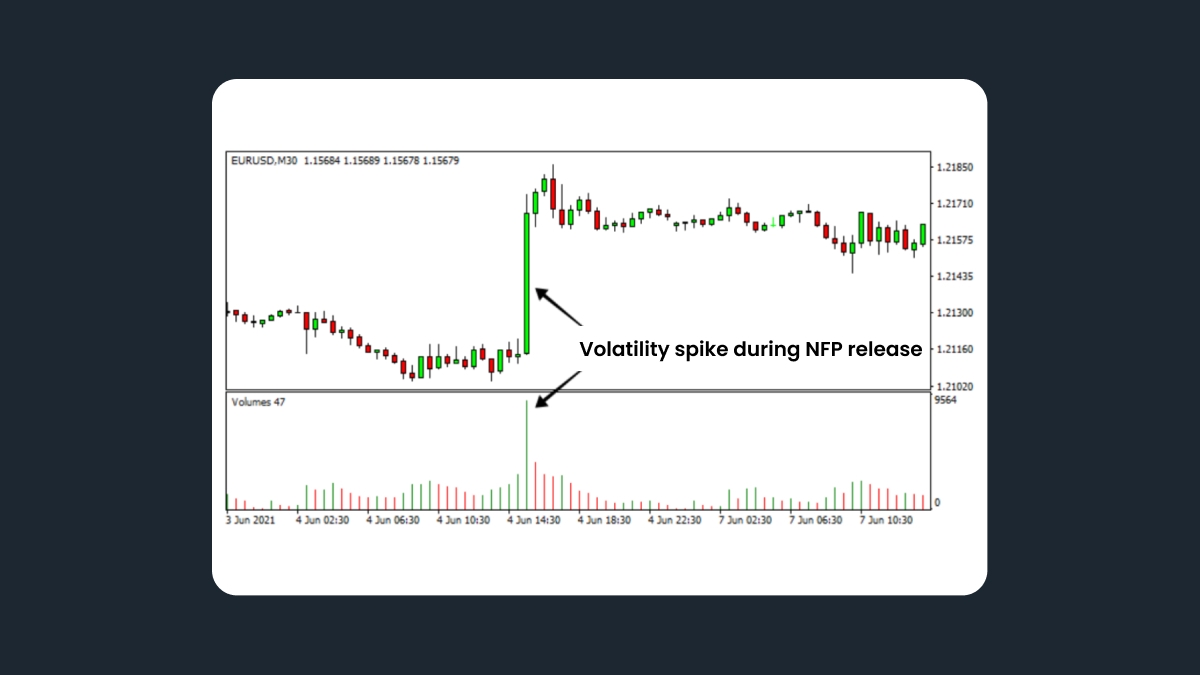

Major news releases, macroeconomic data (such as U.S. NFP or U.S. CPI), or unexpected geopolitical events can make prices jump in seconds and create gaps in the chart. If you place an order at this moment, it will go through at the first available quote, not necessarily the one you saw and counted on.

This happens because trade execution usually takes 50 to 300 milliseconds, depending on your Forex broker’s speed. When prices are rapidly moving, even limited orders may not fill at the desired level — sometimes, the system just can’t keep up.

For example, you buy EURUSD at 1.0800 just before the U.S. jobs report is released. Prices go up suddenly the moment the news hits and instead of getting in at 1.0800, your trade gets filled at 1.0815.

The more participants there are, the easier it is to find someone to take the other side of your trade. However, if the liquidity is low (there are few active buyers and sellers in the market at given price levels), slippage can also occur. This is very common during market openings, right before closings, during off-hours, or when trading exotic currency pairs and less active assets.

In the event of low-liquidity slippage, the order will be executed and filled at the nearest available price, which may be several pips different from your intended entry — especially if there's a lack of quotes in the order book.

For example, in April 2025, a sudden tariff escalation between China and the United States hit during overnight Asian trading — a time when liquidity is usually quite low. According to the reports, AUDUSD dropped from around 0.6400 to under 0.6100 within a few hours. That’s 300 pips, far worse than the usual fluctuation.

Slippage isn’t only negative. You can profit from it in a bid/ask spread — sometimes, your trade gets filled at a better price than you wanted. It’s less common than slippage negative (regular), but it happens. This is also called “reverse slippage.”

If you are new to trading Forex, try a demo account at FBS.

Slippage is common, especially in fast-moving or low-liquidity markets. Traders who deal with major currency pairs or other liquid assets during peak hours may face it much less often. Many traders accept it as an unavoidable part of the cost of doing business. However, if the slippage happens too often or it’s too large, it may be a signal that the trader should adjust their strategy.

Slippage is a normal part of trading any asset, be it Forex, equities, bonds, or futures. You can’t eliminate it completely, but you can significantly reduce its impact. Here are a few tips for avoiding slippage:

Use limit orders (stop-loss and/or take-profit) instead of market orders to control entry and exit prices. Limit orders may not always get filled, however.

Use limit stop orders instead of set option contracts — it can help to reduce your exposure to downside losses in abruptly changing markets.

The more liquidity, the better. Trade during high liquidity hours (for example, when the London and New York trading sessions overlap).

Trade calmer markets with less volatility, if possible.

Avoid risky trading during major news events if you don't have a solid strategy: it can lead to unexpected losses.

Choose a reliable broker with fast execution and low latency, such as FBS.

Configure slippage tolerance settings — some platforms allow you to specify the maximum amount of slippage you are comfortable with (commonly somewhere between 0.5% and 2%).

Try algorithmic trading — again, it won’t eliminate slippage completely, but it can help.

FBS is a reliable broker with good execution speed. Trade with FBS now!