Llegó el momento de desvelar el misterio detrás de dos gigantes financieros: los inversionistas y los traders. Muchas personas utilizan estos términos de forma intercambiable incorrectamente. Sin embargo, comprender las diferencias fundamentales entre ellos es crucial para cualquiera que navegue por los laberintos de los mercados financieros.

Este artículo esclarecedor revela cómo los traders realizan movimientos rápidos para aprovechar ganancias a corto plazo, mientras que los inversionistas construyen carteras a largo plazo con estrategias para una prosperidad duradera.

Puntos clave

- Tiempo: los traders obtienen beneficios de las fluctuaciones de precios a corto plazo al comprar y vender valores activamente. Los inversionistas adoptan un enfoque a largo plazo y se centran en el valor fundamental de los activos.

- Estrategia: los traders se basan en análisis técnico, indicadores de mercado y gráficos, mientras que los inversionistas analizan la salud financiera de una empresa, su potencial de crecimiento y las tendencias de la industria.

- Control emocional: los traders necesitan ser emocionalmente estables para manejar la presión de las fluctuaciones a corto plazo en el mercado. Los inversionistas pueden tomar un enfoque más relajado, ya que su atención se centra en las tendencias a largo plazo.

- Gestión de riesgos: los traders utilizan apalancamiento y derivados para amplificar posibles ganancias (y pérdidas), mientras que los inversionistas priorizan la diversificación, la asignación de activos y una cartera equilibrada.

- Monitoreo: los traders analizan todo el tiempo el mercado, los movimientos de precios y los eventos de noticias a lo largo del día. Los inversionistas siguen un enfoque más manos libres, monitoreando sus inversiones periódicamente.

Traders: buscadores de oportunidades financieras

Exploremos la definición y las características de los traders, sus roles en los mercados financieros y las herramientas y tecnologías que emplean en sus actividades.

Definición y características de un trader

Los traders son individuos o entidades que operan activamente en los mercados financieros comprando y vendiendo diversos instrumentos financieros con el objetivo principal de generar ganancias. Se centran en transacciones a corto plazo que se alinean con las tendencias del mercado.

Los traders poseen una variedad de características distintivas que los diferencia como participantes únicos en el mercado y les permite prosperar en este entorno dinámico y competitivo:

- Toma de riesgos. Los traders enfrentan constantemente niveles elevados de riesgo en su práctica. Están dispuestos a asumir estos riesgos y aprovechar oportunidades de mercado calculadas cuando surgen.

- Toma rápida de decisiones. Para navegar con eficacia las condiciones de mercado en constante cambio, los traders deben estar listos para tomar decisiones rápidas. Esta capacidad para analizar la información velozmente y tomar acciones decisivas es crucial para aprovechar oportunidades que dependen del tiempo.

- Adaptabilidad. Todos los traders exitosos demuestran un nivel excepcional de adaptabilidad. Ajustan sus enfoques de trading en respuesta a las cambiantes condiciones del mercado. Esta flexibilidad les permite mantenerse al tanto de las tendencias del mercado y colocar operaciones rentables.

- Control emocional. Todos los días, los traders enfrentan una montaña rusa de emociones mientras navegan por los altibajos de los mercados financieros. Los traders profesionales tienen un control emocional excepcional que les permite tomar decisiones sabias incluso en situaciones de incertidumbre.

- Gestión de riesgos. Los traders manejan habilidosamente los riesgos, reconociendo la importancia de la protección del capital en la imprevisibilidad y volatilidad del mercado. Emplean diversas técnicas y desarrollan planes integrales de gestión de riesgos para cumplir con este objetivo.

- Análisis regular del mercado. El éxito en el trading implica un compromiso con el análisis periódico del mercado. Para tomar decisiones razonables, los traders analizan noticias, indicadores económicos, factores geopolíticos, indicadores técnicos, patrones de precios y tendencias del mercado.

- Disciplina en el trading. El trading es un proceso que requiere una disciplina estricta y un enfoque estructurado. Los traders lo consideran una profesión que exige estabilidad y adherencia a un horario específico para lograr el éxito.

El papel de los traders en los mercados financieros

Los traders desempeñan un papel crítico en el funcionamiento fluido y la liquidez del mercado financiero. Facilitan la eficiencia general del sistema de mercado al comprar y vender activamente instrumentos financieros. Consideremos algunos roles clave que los traders desempeñan en los mercados financieros:

Creación de liquidez de mercado

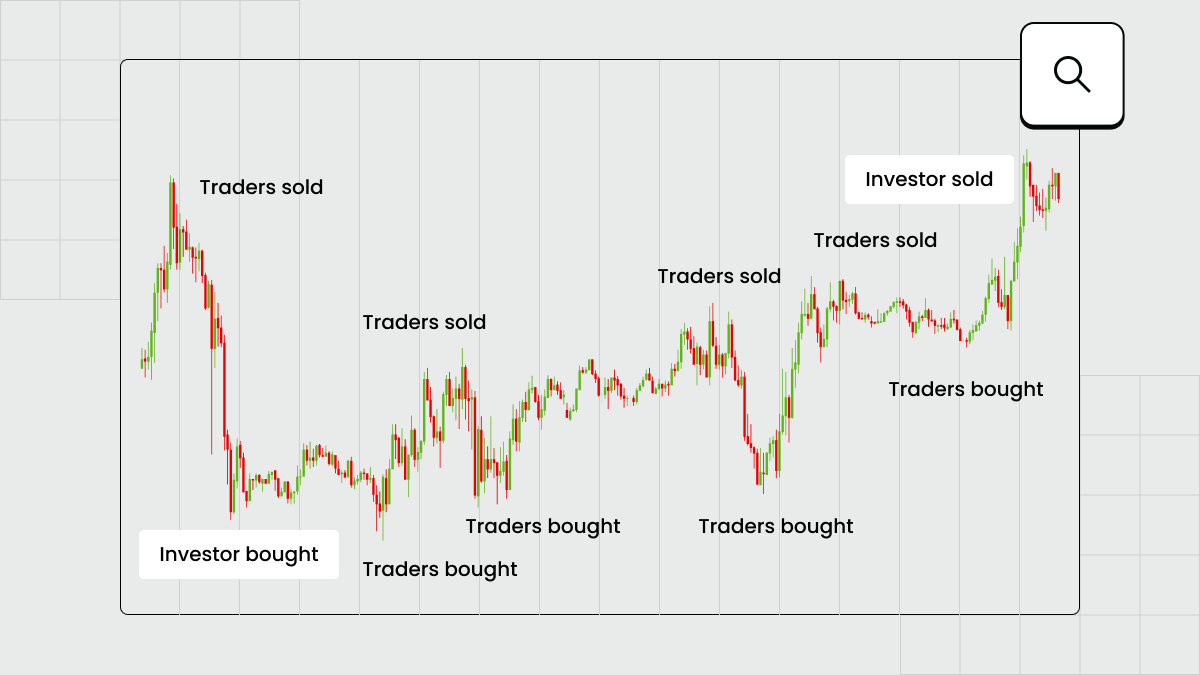

La constante participación de los traders crea un flujo constante de oferta y demanda. Motivados por ganancias a corto o mediano plazo, los traders garantizan la liquidez en el mercado al comprar y vender activamente instrumentos financieros. Este enfoque de vender en niveles más altos y comprar en niveles más bajos crea liquidez en el mercado, aumenta los volúmenes de trading y minimiza el riesgo de ejecución de las transacciones.

Contribución a la determinación de precios y eficiencia

Los traders desempeñan un papel crítico en el proceso de determinación de precios. Al comprar y vender activamente instrumentos financieros, contribuyen a la formación de precios de mercado justos y eficientes. Sus acciones ayudan a igualar la oferta y la demanda, garantizando una valoración precisa y efectiva de los activos.

Gestión de riesgos

Los traders desempeñan un papel crucial en la gestión y mitigación de riesgos en los mercados financieros. Ayudan a equilibrar los riesgos del mercado tomando posiciones en ambos lados de las operaciones. Esto permite a los inversores y otros participantes del mercado minimizar sus riesgos y gestionar sus carteras de manera efectiva.

Herramientas y tecnologías inherentes al trading

El trading implica el uso de diferentes herramientas y tecnologías importantes que mejoran la práctica de los traders. Aquí están las herramientas básicas:

- Software de trading proporcionado por los brokers, con acceso a gráficos, datos de mercado en tiempo real y posibilidades de colocar órdenes.

- Herramientas de análisis técnico para analizar gráficos de precios al realizar un examen profundo del mercado.

- Herramientas de análisis fundamental, que incluyen estados financieros de las empresas, indicadores económicos y noticias.

- Herramientas de gestión de riesgos para maximizar las ganancias y mitigar las pérdidas.

- Sistemas de trading automatizado para ejecutar operaciones basadas en parámetros predefinidos.

FBS utiliza las mejores soluciones del mercado (por ejemplo, MetaTrader) para ayudar a muchos tipos de traders a operar cómodamente.

Inversionistas: los jugadores de larga duración en las finanzas

Esta sección trata la definición de un inversionista, su papel en la cadena financiera, sus objetivos y las herramientas que aplica en su práctica.

Definición y características de un inversionista

Un inversionista es un individuo o entidad que asigna fondos con la expectativa de generar ganancias durante un período de tiempo. A diferencia de los traders que participan en compras y ventas constantes, los inversionistas generalmente tienen una perspectiva a largo plazo y se centran en construir riqueza durante un período prolongado.

Aquí hay algunas características significativas de los inversionistas que los hacen participantes excepcionales en el mercado:

- Enfoque a largo plazo. Los inversionistas se centran en generar ganancias a largo plazo. Pueden buscar inversiones que ofrezcan dividendos regulares o pagos de intereses con miras a una posible apreciación de capital.

- Tolerancia al riesgo y paciencia. La inversión es un proceso a largo plazo, y los inversionistas por lo general muestran un mayor nivel de tolerancia al riesgo. Comprenden que los activos en los que invierten pueden experimentar fluctuaciones, y es esencial mantener la paciencia mientras buscan el potencial de crecimiento y rendimiento a largo plazo. Al ser pacientes y aceptar los riesgos probables, los inversionistas están mejor preparados para mantener el enfoque en sus objetivos de inversión.

- Enfoque en la toma de decisiones. Los inversionistas generalmente toman sus decisiones basadas en el análisis fundamental. Aprenden aspectos como la situación financiera de una empresa, tendencias de la industria, informes de noticias y eventos geopolíticos para evaluar oportunidades de inversión.

El papel de los inversionistas en los mercados financieros

Los inversionistas son una parte crucial en el rompecabezas completo del sistema financiero. Aquí están algunos de los roles principales que los inversionistas desempeñan en el mercado:

Promoción del crecimiento económico

Los inversionistas respaldan el crecimiento económico asignando capital a empresas y proyectos. Estas inversiones facilitan diversas innovaciones, investigaciones y desarrollos. Al proporcionar fondos, los inversionistas aseguran la creación de empleos y el desarrollo de infraestructura. Todos estos aspectos de apoyo son vitales para el progreso económico en general.

Influencia y gobernanza corporativas

Inversionistas importantes, como institucionales y accionistas mayoritarios, pueden influir en la gobernanza corporativa y en la toma de decisiones dentro de las empresas. Tienen sus derechos de voto y pueden promover prácticas responsables y sostenibles.

Inversión a largo plazo y estabilidad

Los inversionistas por general se centran en una perspectiva a largo plazo, con la intención de tener activos durante un período prolongado. Este enfoque contribuye a la estabilidad en los mercados financieros, ya que los inversionistas proporcionan continuidad y estabilidad de capital, permitiendo que las empresas planifiquen y ejecuten proyectos a largo plazo.

Contribución a la liquidez del mercado

Los inversionistas contribuyen a la liquidez en el mercado al comprar y vender instrumentos financieros seleccionados, aunque en menor medida que los traders.

Facilitación de la determinación de precios

Cuando los inversionistas compran o venden instrumentos financieros, expresan su evaluación de valor de esos activos. Si bien las acciones de un solo inversionista puede que no impacten de forma directa en el mercado, combinadas con las acciones de otros inversionistas, pueden crear colectivamente una fuerza impulsora significativa.

Herramientas y tecnologías inherentes a la inversión

Aquí hay algunas herramientas y tecnologías comunes utilizadas por los inversionistas:

- Plataformas de noticias financieras que empoderan a los inversionistas con los datos más recientes esenciales para llevar a cabo un análisis de mercado integral.

- Plataformas de corretaje en línea que permiten a los inversionistas comprar o vender activos en línea.

- Asesores robóticos para crear y gestionar carteras de inversión basadas en las preferencias y objetivos de los inversionistas.

- Proveedores de investigación y datos de mercado que ofrecen un examen de alta calidad de precios históricos, informes de la industria y estados financieros de las empresas.

Aunque FBS no se especializa en inversiones, nuestros servicios pueden simplificar significativamente la vida de todo tipo de participantes en el mercado.

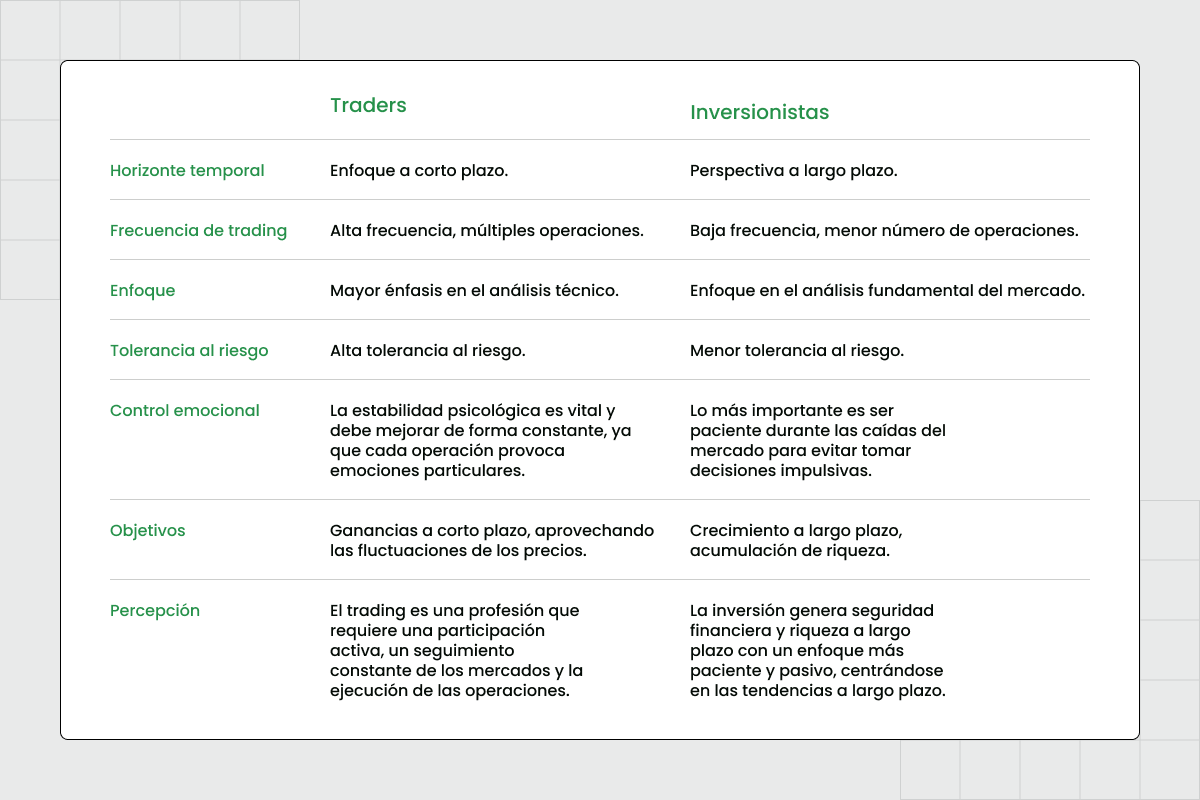

Diferencia entre inversionistas y traders

Aquí tienes una tabla resumida que muestra las diferencias entre inversionistas y traders:

Si bien estas diferencias por lo general son ciertas, puede haber variaciones y superposiciones en las estrategias que las personas utilizan. Algunos traders pueden tener un enfoque a más largo plazo, y algunos inversionistas pueden estar interesados en prácticas a corto plazo. Todos tienen técnicas y preferencias únicas que no necesariamente se ajustan a ninguna de las dos categorías.

Resumen

El trading y la inversión son dos enfoques distintos en los mercados financieros, cada uno con sus propias características y objetivos únicos. Los inversionistas y traders desempeñan roles cruciales en el mundo de las finanzas, facilitando la liquidez del mercado, contribuyendo a la determinación de precios y promoviendo el crecimiento de la economía. Sus acciones reflejan el sentimiento del mercado y sirven como indicadores valiosos para otros participantes del mercado. Desde cualquier enfoque, es vital aprender sobre los riesgos involucrados para implementar estrategias apropiadas. Con FBS, puedes ser trader o incluso inversionista.

Preguntas frecuentes

¿Cuál es la diferencia entre los inversionistas y los day traders?

Los inversionistas y los day traders difieren en su enfoque de tiempo y su estrategia de mercado. Los day traders utilizan herramientas de análisis técnico para obtener ganancias a partir de movimientos de precios a corto plazo dentro de un día de trading. Los inversionistas utilizan el análisis fundamental para beneficiarse de posiciones a largo plazo.

¿Cuál es el papel de un inversionista en un proyecto?

Los inversionistas desempeñan un papel crucial en el desarrollo de proyectos al acumular capital. Su participación ayuda a dar vida a ideas, impulsa el crecimiento económico y genera posibles ganancias tanto para el proyecto como para los inversionistas.

¿Se puede llamar trader a un inversionista?

Un inversionista puede participar en actividades de trading para aprovechar oportunidades ventajosas en el mercado y ser considerado un trader. Aunque el trading y la inversión son enfoques diferentes, un inversionista se puede llamar trader en ciertas circunstancias.