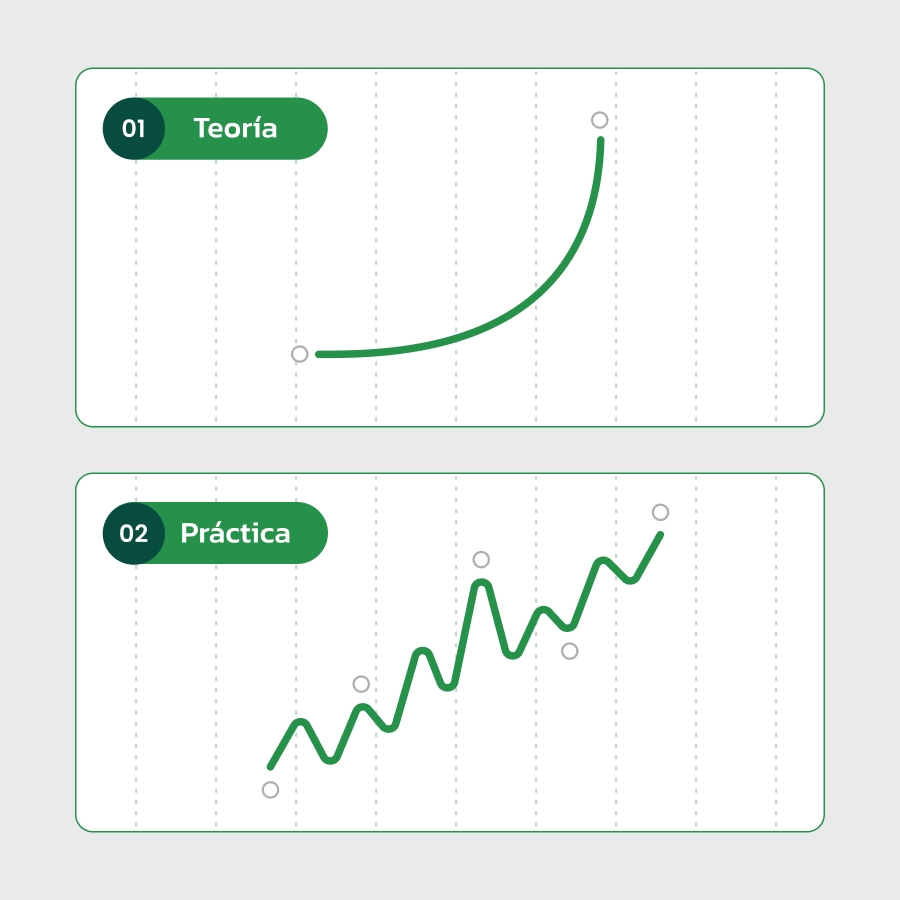

4. Mantén tu estrategia simple

La simplicidad no es un compromiso; es una estratégia que requiere centrarse en indicadores vitales, eliminar información innecesaria y tomar decisiones claras y concisas. Una estrategia simple agiliza las acciones y minimiza la confusión.

Como el principio de la navaja de Occam, que aconseja elegir la explicación más simple, centrándose únicamente en indicadores vitales y eliminando información innecesaria. En pocas palabras, este principio favorece lo simple sobre lo complejo. Las estrategias demasiado complicadas a menudo conducen a la indecisión y la ineficiencia. Adoptar la simplicidad permite a los traders reaccionar rápidamente a los movimientos del mercado y tomar decisiones con más confianza. Aplicar la navaja de Occam a tu enfoque significa concentrarte en la información esencial y garantizar la claridad y eficiencia en tus estrategias de trading.

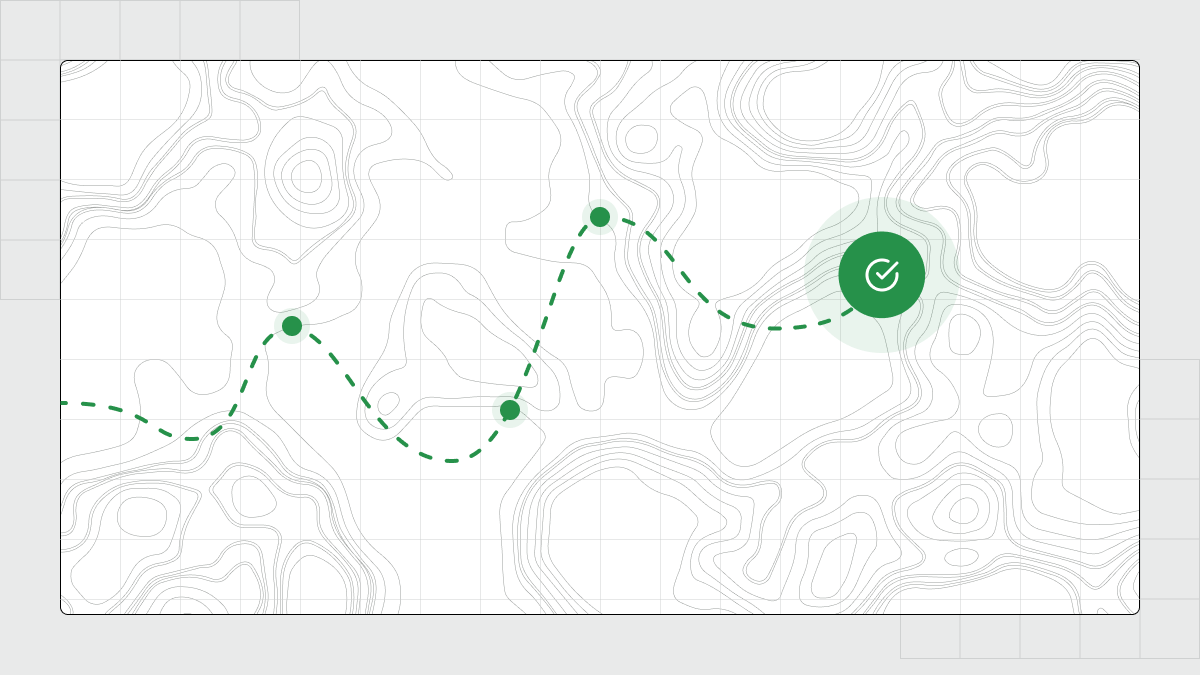

5. Planifica tu operación y opera según tu plan

Operar sin un plan es como navegar sin brújula. Otro componente fundamental de las reglas del trading de Forex es crear un plan para cada operación, incluyendo los puntos de entrada y salida, y apegarse a él. Un plan bien pensado garantiza que no estés operando de forma impulsiva, donde los resultados a menudo quedan fuera de tu control. Sin controlar el resultado, incluso las ganancias pueden carecer de sistematicidad, lo que hace incierto si se pueden replicar en el futuro.

Sin embargo, teniendo un plan definido y controlando los resultados, aunque las ganancias no sean sustanciales, se obtienen mediante un trabajo honesto y sistemático. Este enfoque controlado aumenta la probabilidad de repetir resultados exitosos. Al apegarse a una estrategia predeterminada, los traders establecen un marco disciplinado. Esta disciplina fomenta un entorno donde las ganancias consistentes y repetibles se vuelven más probables, asegurando que incluso las ganancias moderadas se obtengan a través de un enfoque sistemático y estructurado.

6. Entrena tu disciplina

Las fluctuaciones del mercado son inevitables, pero la disciplina es una elección y un aspecto vital de las reglas del trading. Los traders exitosos pueden mantener la calma en medio del caos, controlar sus emociones y seguir un plan bien pensado. Operar sin un plan estructurado suele conducir a decisiones espontáneas, lo que lleva a una falta de control sobre los resultados. Cuando se pierde el control sobre los resultados, incluso las ganancias se vuelven impredecibles y carecen de sistematicidad, lo que hace que sea incierto si podrán replicarse en el futuro.

7. No sigas a la manada

Otro enfoque crucial en las reglas del trading de acciones y otros instrumentos es tener una visión propia y un conocimiento profundo de los movimientos del mercado, porque la mentalidad de rebaño rara vez conduce al éxito sostenible. Se trata de crear tu estilo y estrategia de trading basándote en un análisis meticuloso en lugar de seguir ciegamente las tendencias populares.

8. Apégate a tu plan de trading

Un plan de trading es esencial. Sin embargo, crear un plan es solo el comienzo. Ejecutarlo a fondo es el verdadero desafío. Si te mantienes fiel al plan, puedes evitar tomar decisiones impulsivas que puedan tener consecuencias indeseables.

9. Evita los gurús del mercado

Si bien la orientación es valiosa, la lealtad ciega a los autoproclamados expertos puede ser perjudicial. Además, millones de falsos "gurús del trading" pueden simplemente obtener su dinero sin conocer las reglas del trading de Forex. Es mejor aprender solo de formadores de trading de confianza y utilizar sus conocimientos como referencia, sin dejar de lado tu propio análisis y pensamiento crítico. Nuestras guías preparadas por analistas financieros de FBS pueden ayudarte a aumentar tus habilidades en el trading.

10. Utiliza tu intuición

Equilibrar las decisiones basadas en datos y la intuición es un arte y una de las reglas del trading de Forex más desafiantes. Pero al aumentar tu experiencia, podrás permitir que tu intuición complemente el análisis sin eclipsar la importancia de la estrategia. Y si tienes un fuerte presentimiento de que debes ajustar tu estrategia y la experiencia suficiente para hacerlo, sigue tu intuición.

11. No te enamores

El trading requiere racionalidad. Evita el apego emocional a traders o activos, siguiendo las reglas del trading del análisis objetivo. Los sesgos emocionales pueden cegar a los traders ante posibles riesgos, por lo que es fundamental basar las decisiones en un análisis objetivo en lugar de en un apego emocional.

12. Organiza tu vida personal

Tu bienestar personal también influye en tus resultados de trading. Para mejorar tu toma de decisiones y tu desempeño general, debes mantener el equilibrio, controlar el estrés y garantizar un estilo de vida saludable. Por lo tanto, antes de abrir una operación, asegúrate de no tener pensamientos que te distraigan.

13. No intentes vengarte

Operar sin pérdidas es imposible, y los traders sensatos aprenden de las pérdidas y no intentan obtener una recuperación inmediata, lo que puede llevar a decisiones impulsivas. Es importante evitar el exceso de operaciones o riesgos innecesarios para compensar las pérdidas.

14. Mantente atento a las advertencias

Existen varias señales de advertencia en los mercados, desde indicadores técnicos hasta tendencias económicas globales. Reconocer y prestar atención a las advertencias es crucial. No ignores ni descuides estas señales, que pueden generar ganancias o pérdidas significativas, desafiando la esencia de las reglas del trading del mercado de valores.

15. Olvídate del santo grial

No existe una fórmula mágica para garantizar el éxito en el trading. Evita perseguir la estrategia del "santo grial". El éxito se basa en un enfoque bien pensado, adaptable y disciplinado, en lugar de buscar una fórmula secreta difícil de alcanzar.

16. Deshazte de la mentalidad del cheque de pago

El trading no es un trabajo de ingresos fijos de nueve a cinco. Evita abordarlo con una mentalidad de cheque de pago. Las ganancias fluctúan y comprender esta volatilidad es esencial para hacer crecer tu cuenta de trading.

17. No cuentes tus pollos antes de que nazcan

Anticipar las ganancias de forma prematura puede llevarte a tomar decisiones apresuradas. Espera hasta que una operación llegue a concluir según tu estrategia en lugar de celebrar de forma prematura las posibles ganancias. Esto se alinea con la importancia de mantener la disciplina en las reglas del trading.

18. Adopta la simplicidad

La complejidad no asegura el éxito. Simplifica tu estrategia de trading, enfócate en los indicadores vitales y evita complejidades innecesarias para mejorar tu rendimiento en el trading.

19. Amígate con las pérdidas

Aceptar las pérdidas como parte del trading ayuda a mantener la estabilidad emocional y se alinea con las reglas de oro del trading de Forex. Aprende de tus pérdidas para crecer y mejorar estrategias futuras en lugar de lamentarte.

20. Ten cuidado con los refuerzos

El refuerzo puede llevarte a conductas repetitivas, muchas veces impulsivas, basadas en éxitos pasados. Mantente alerta contra el exceso de confianza y sigue un plan bien definido.

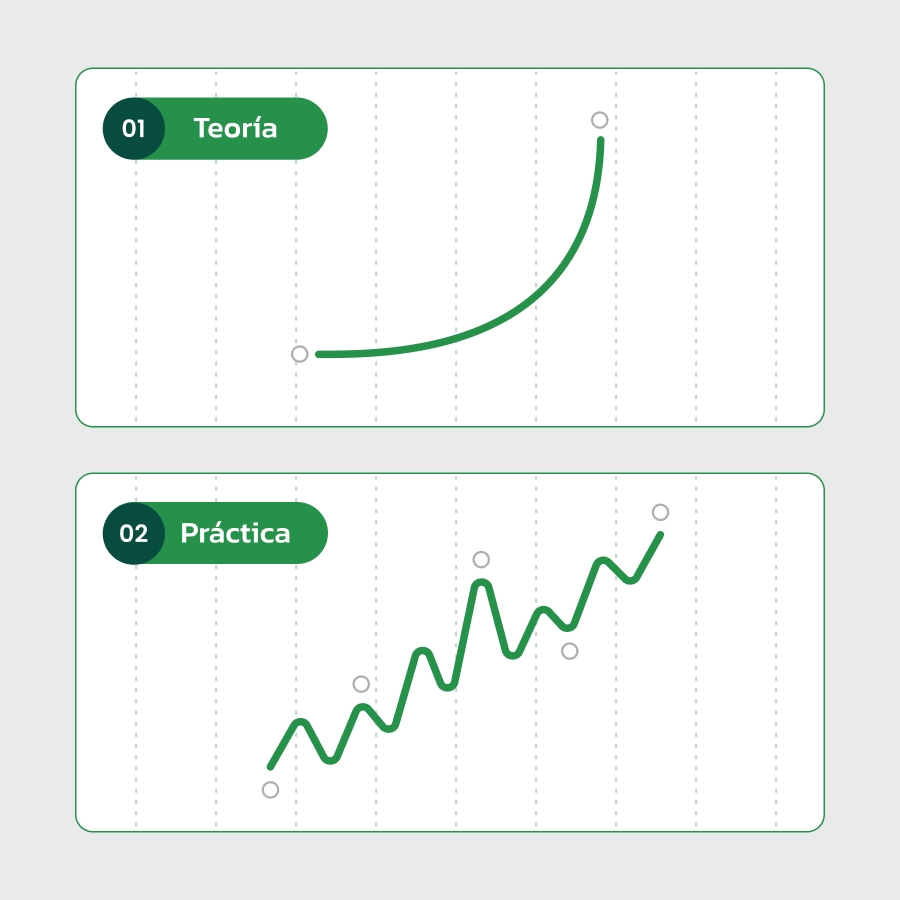

El camino para convertirte en un trader exitoso implica aprendizaje y adaptación continuos. Domina estas 20 reglas del trading e intégralas a un plan y una mentalidad de trading integrales.

El arte de operar es tanto una ciencia como un arte. Implica analizar datos, comprender la psicología del mercado, gestionar riesgos y tomar decisiones oportunas. Exige disciplina, paciencia, y un compromiso con la educación continua.

Conclusión

En conclusión, las 20 reglas del trading cruciales no son solo un conjunto de pautas, sino que son una brújula que guía a los traders a través de las mareas siempre cambiantes de los mercados financieros. Dominar el trading no se consigue de la noche a la mañana, es un camino lleno de dedicación, aprendizaje continuo y voluntad de adaptarse.

Los traders exitosos no son simplemente participantes del mercado, también son estrategas, gestores de riesgo, psicólogos y aprendices permanentes. Adoptar estas reglas y evolucionar con la dinámica del mercado es el camino hacia el éxito sostenido en el cautivador mundo del trading.

Preguntas frecuentes

¿Cuál es la regla más importante del trading?

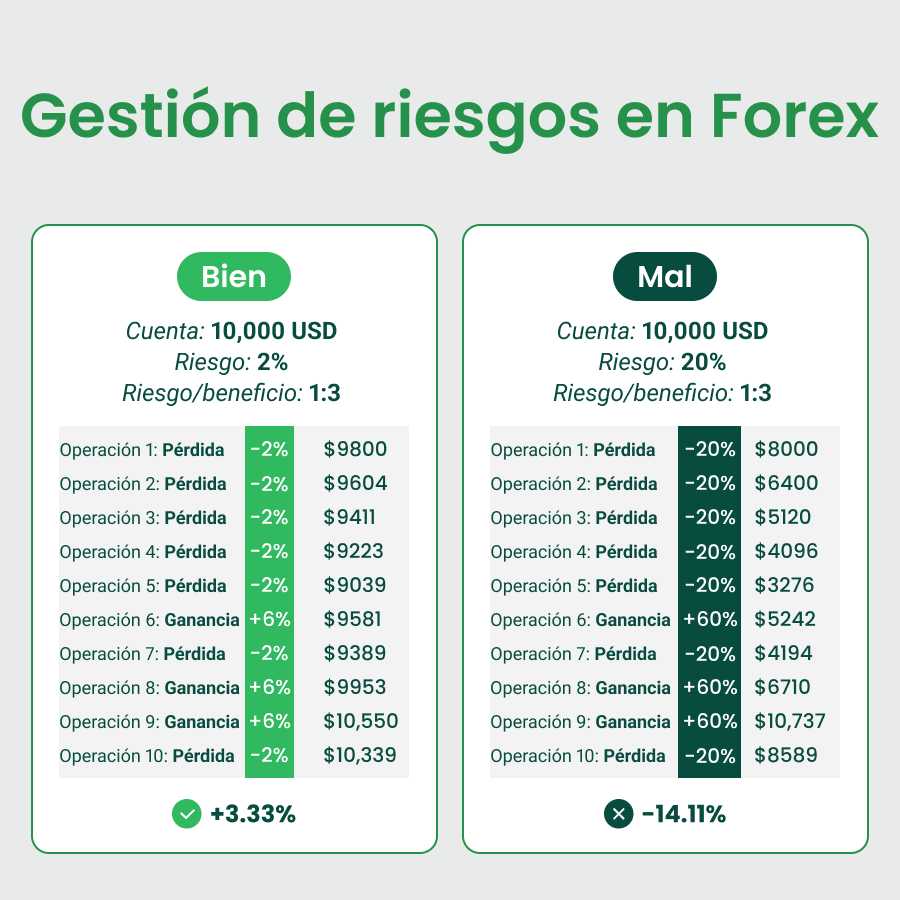

Una gestión de riesgos disciplinada es fundamental. Al controlar los riesgos y preservar el capital, los traders se protegen contra pérdidas sustanciales, asegurando la sostenibilidad en el mercado.

¿Qué es la regla del 90% en el trading?

La regla del 90% es una estadística comúnmente citada, que establece que el 90% de los traders de Forex principiantes pierden el 90% de su dinero en los primeros 90 días. Esta regla recuerda a los traders la dura realidad del trading y la importancia de la gestión de riesgos y de una estrategia eficaz.

¿Cuáles son las reglas de oro del trading?

La gestión de riesgos disciplinada, cumplir con un plan de trading, evitar tomar decisiones emocionales, el aprendizaje continuo y la capacidad de adaptarse a las condiciones del mercado engloban las reglas de oro del trading. Estos principios actúan como guías para navegar en mercados volátiles.

¿Cuál es la regla número uno en el trading intradía?

La gestión de riesgos eficaz tiene prioridad en el trading intradía. Implementar órdenes stop loss para limitar las posibles pérdidas y mantener la disciplina con puntos de entrada y salida predefinidos son estrategias fundamentales para tener éxito en el trading intradía.