Si necesitas comprender mejor el significado de un mercado alcista, este artículo te dará una visión detallada de este fenómeno de mercado. Las siguientes secciones explicarán qué es un mercado alcista en el mercado de valores y otros activos de trading, y te darán todo lo que necesitas saber para tener más confianza al operar.

¿Qué es un mercado alcista?

La siguiente sección te permitirá familiarizarte con el significado de un mercado alcista, y te dará ejemplos de lo que es un mercado alcista en acciones y pares de divisas, entre otros activos. Además, responderá a las preguntas que se hacen la mayoría de los traders principiantes: “¿cuánto dura un mercado alcista?”, “¿es “bueno” o “malo”?”.

¿Qué es un mercado alcista?

La definición de mercado alcista (llamado "bull market" en inglés) proviene de la imagen de un toro que ataca a su presa empujando sus cuernos hacia arriba. Un mercado alcista se refiere a un periodo de alza generalizada de los precios y de confianza de los inversores. Los agentes del mercado utilizan el término para describir un entorno positivo y optimista en el que se espera que el valor de las acciones aumente.

Ejemplo de mercado alcista

Mira el gráfico a dos años de APPL: la inclinación constante que ves es la tendencia alcista.

Otro ejemplo es el bitcoin, quizás la criptomoneda más importante del mundo. Es conocida por sus cambios drásticos de rendimiento. Aquí, vemos que el BTCUSD muestra tendencias alcistas significativas abruptas con caídas repentinas: tendencias bajistas, lo contrario del mercado alcista.

Esto último ocurre de forma constante en el trading, pero regresaremos a esto en algunas secciones.

Características clave de un mercado alcista

Como sabrás por la definición de mercado alcista, la mayoría de los inversores lo ven como una tendencia positiva. Podemos señalar las siguientes características para describirlo:

- Aumento de los precios de los activos

- Confianza de los inversores

- Crecimiento económico

- Tasa de desempleo baja

- Volumen de trading alto

- Sentimiento positivo

- Aumento de las fusiones y adquisiciones

- Tasas de interés bajas

Un mercado alcista se produce en el contexto de un entorno político y económico positivo. Es un periodo de crecimiento y confianza alimentado por noticias positivas. Pero las tendencias alcistas no pueden durar para siempre, ya que el mercado no es ajeno a los giros dramáticos. Sin embargo, como demuestra la historia, el mercado tiende a curarse a sí mismo, dando lugar a nuevos crecimientos y pendientes de los gráficos, con nuevos máximos superiores a los anteriores y nuevos mínimos que nunca retroceden a los niveles anteriores.

¿Cuánto dura un mercado alcista?

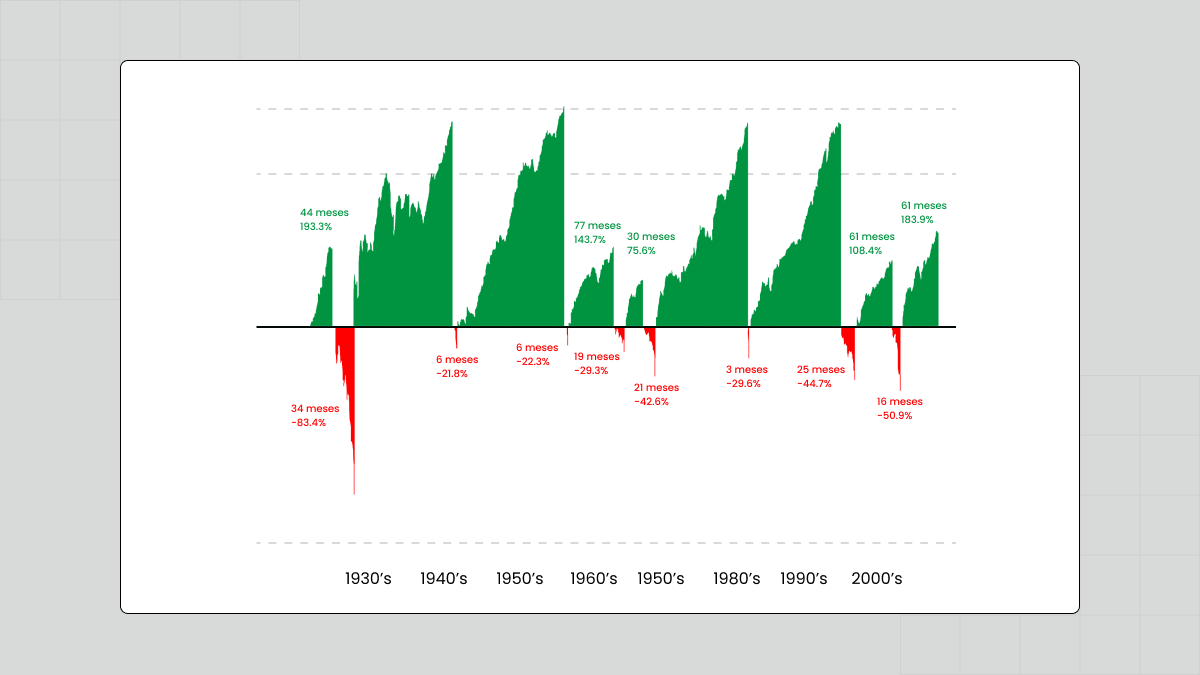

Un mercado alcista puede durar hasta varios meses. Sin embargo, por muy larga que sea una tendencia alcista, siempre termina con una bajista. Pero no te preocupes, hay una forma de ver este ciclo de forma positiva.

Si ampliamos el mercado, obtendremos una visión más amplia del mismo y veremos que toda la herencia de tendencias alcistas y bajistas forma parte de una tendencia alcista mayor.

Una de las mejores formas de ver el mercado es considerarlo un fractal, donde los acontecimientos a menor escala son copias exactas de acontecimientos a mayor escala. Y la tendencia mayor, la tendencia predominante, es un mercado alcista. Por lo tanto, dentro de este mercado alcista en constante crecimiento, se puede tropezar con periodos más pequeños de tendencias alcistas seguidos de otros bajistas, y luego el ciclo se repite.

¿Qué es un mercado alcista en términos de bueno y malo?

Si se considera un mercado alcista desde el punto de vista de la dicotomía entre lo bueno y lo malo, se puede afirmar que, en general, se considera favorable para los inversores y la economía. Durante un mercado alcista, los precios de los activos suben, lo que se traduce en una mayor rentabilidad de las inversiones y un aumento de la riqueza de los inversores.

Aunque un mercado alcista suele reflejar una economía fuerte y en crecimiento y altos niveles de confianza de los inversores, cabe señalar que puede conllevar cierto riesgo, por lo que los inversores deben actuar con cautela y ser conscientes de las posibles caídas del mercado.

Cómo invertir en un mercado alcista

A estas alturas, la pregunta "¿qué es un mercado alcista?" ya debería estar resuelta. Lo que probablemente te estés preguntando es cuál debe ser tu forma de operar durante esta tendencia.

Invertir en un mercado alcista requiere un enfoque reflexivo y estratégico para aprovechar el impulso alcista y, al mismo tiempo, gestionar los riesgos potenciales. Estas son algunas consideraciones clave para invertir en un mercado alcista:

- Adopta una perspectiva a largo plazo. A pesar de las condiciones favorables del mercado, resiste la tentación de buscar ganancias a corto plazo. En cambio, enfócate en crear una cartera bien diversificada con una mezcla de acciones, bonos y otras clases de activos que se ajusten a tus objetivos de inversión y tolerancia al riesgo.

- Investiga a fondo. Busca compañías con fundamentos sólidos, un crecimiento de ganancias estable y una ventaja competitiva en su sector. Evita las exageraciones y especulaciones del mercado y concéntrate en invertir en compañías con perspectivas de crecimiento sostenible.

- Gestiona los riesgos. Diversificar tu cartera puede mitigar el impacto de las caídas del mercado y reducir la volatilidad general. Además, considera la posibilidad de utilizar órdenes stop loss para protegerte de las caídas repentinas de los precios y evita el uso excesivo del apalancamiento o el trading de margen.

- Mantén un enfoque disciplinado de la inversión. Evita tomar decisiones emocionales basadas en las fluctuaciones del mercado a corto plazo y apégate a tu estrategia de inversión a largo plazo.

- Sigue las tendencias del mercado, los indicadores económicos y los acontecimientos geopolíticos. Ser consciente de los riesgos potenciales y mantenerte al tanto de la evolución del mercado puede ayudarte a tomar decisiones de inversión informadas en un mercado alcista.

Riesgos a tener en cuenta en un mercado alcista

Cuando se habla de riesgo en un mercado alcista, el mejor punto de partida es el potencial de sobrevaloración de los activos. Durante un mercado alcista, el optimismo de los inversores puede llevar a precios inflados que los fundamentos subyacentes de las compañías podrían no respaldar. Esto puede provocar una corrección del mercado o incluso un desplome cuando los activos sobrevalorados se reevalúen en función de su valor real.

Otro riesgo de un mercado alcista es la complacencia. A medida que suben los precios, los inversores pueden caer en la complacencia y pasar por alto posibles señales de alarma o riesgos en el mercado. Esto puede llevar a una falta de diversificación en las carteras de inversión y a no evaluar y gestionar los riesgos de forma adecuada.

El apalancamiento excesivo y el trading de margen son habituales en los mercados alcistas, ya que los inversores confían más en la trayectoria alcista de las cotizaciones bursátiles. Aunque el apalancamiento puede aumentar los rendimientos en un mercado alcista, también puede aumentar las pérdidas en un mercado bajista, lo que podría provocar dificultades financieras significativas a los inversores con un apalancamiento excesivo.

Los acontecimientos geopolíticos, las recesiones económicas y los impactos inesperados del mercado pueden producirse incluso durante un mercado alcista, provocando caídas repentinas y graves del mercado. Los inversores deben permanecer alerta y preparados para tales acontecimientos, incluso en un entorno de mercado sólido.

Un mercado alcista puede ser un momento lucrativo para los inversores, sin embargo, es fundamental mantener la cautela y ser consciente de los riesgos potenciales. La diversificación, la gestión de riesgos y la información son estrategias esenciales para afrontar los riesgos de un mercado alcista.

Resumen

Un mercado alcista puede ser una oportunidad fantástica para convertir esta tendencia positiva a favor del trader. Para ello, el trader debería centrarse en inversiones de alta calidad, con fundamentos sólidos y un gran potencial de crecimiento. Asignar un mayor porcentaje de la cartera a valores y sectores que suelen funcionar bien en los mercados alcistas (tecnología, consumo discrecional y financiero) también es una buena idea.

Los traders también deberían revisar sus carteras con regularidad para aprovechar las nuevas oportunidades. Diversificar la cartera y evitar asumir riesgos excesivos puede ayudar a evitar pérdidas drásticas.

Por último, mantenerse al día sobre las tendencias del mercado y los indicadores económicos ayudará a los traders a tomar decisiones de inversión informadas durante un mercado alcista.

Preguntas frecuentes

¿Cómo invertir en un mercado alcista?

Invertir en un mercado alcista puede resumirse en unos cuantos consejos básicos, entre los que se incluyen:

- Apegarte a una cartera de calidad

- Seguir tu plan financiero

- Continuar acumulando ganancias

- Adoptar un enfoque gradual a la hora de invertir y vender

- Apostar por el impulso del mercado

- Utilizar opciones para cubrir el riesgo

¿Es bueno comprar en un mercado alcista?

Tradicionalmente, un mercado alcista se considera un momento favorable para invertir. Sin embargo, hay que tener en cuenta los riesgos que pueden producirse, ya que los mercados alcistas tienden a dar paso a tendencias bajistas, lo que provoca pérdidas financieras.

¿Debo invertir en un mercado alcista o bajista?

Invertir en un mercado alcista puede tener ventajas, ya que suele caracterizarse por el alza de los precios de las acciones y el sentimiento positivo de los inversores. Sin embargo, invertir en un mercado bajista también puede presentar oportunidades, ya que los precios de las acciones suelen ser más bajos y pueden ofrecer puntos de entrada atractivos para los inversores a largo plazo.

Considera tu tolerancia al riesgo, tus objetivos de inversión y tu marco temporal a la hora de decidir si invertir en un mercado alcista o bajista. Diversificar tu cartera, buscar asesoramiento profesional y mantenerte al tanto de las tendencias del mercado puede ayudarte a tomar decisiones informadas independientemente de las condiciones del mercado. En última instancia, la decisión de invertir en un mercado alcista o bajista debe basarse en una cuidadosa consideración de tu situación financiera y tus objetivos de inversión.

¿Cuál es la mejor inversión en un mercado alcista?

Por lo general, los toros (los inversores en mercados alcistas), se enfocan en activos orientados al crecimiento, como las acciones, en particular las de compañías con fundamentos sólidos y potencial de crecimiento a futuro de las ganancias. Otros sectores que funcionan bien en un mercado alcista son la tecnología, el consumo discreto y la salud. Algunos toros consideran la posibilidad de invertir en fondos cotizados (ETF) que siguen índices de mercado amplios o sectores específicos.