Introducción

En el dinámico mundo del mercado de divisas, es vital comprender los patrones técnicos para navegar por los mercados de manera eficiente. Por ejemplo, las banderas alcistas y bajistas son indicadores poderosos de movimientos potenciales del mercado. Cuando los traders reconocen estos patrones, pueden tomar decisiones más informadas aprovechando las tendencias de precios a corto plazo que señalan dinámicas de mercado más significativas. El objetivo de este artículo es desmitificar las complejidades de estos patrones de bandera y ofrecer a los traders de todos los niveles de experiencia, desde principiantes hasta expertos, información sólida para prever y capitalizar los movimientos del mercado con eficacia.

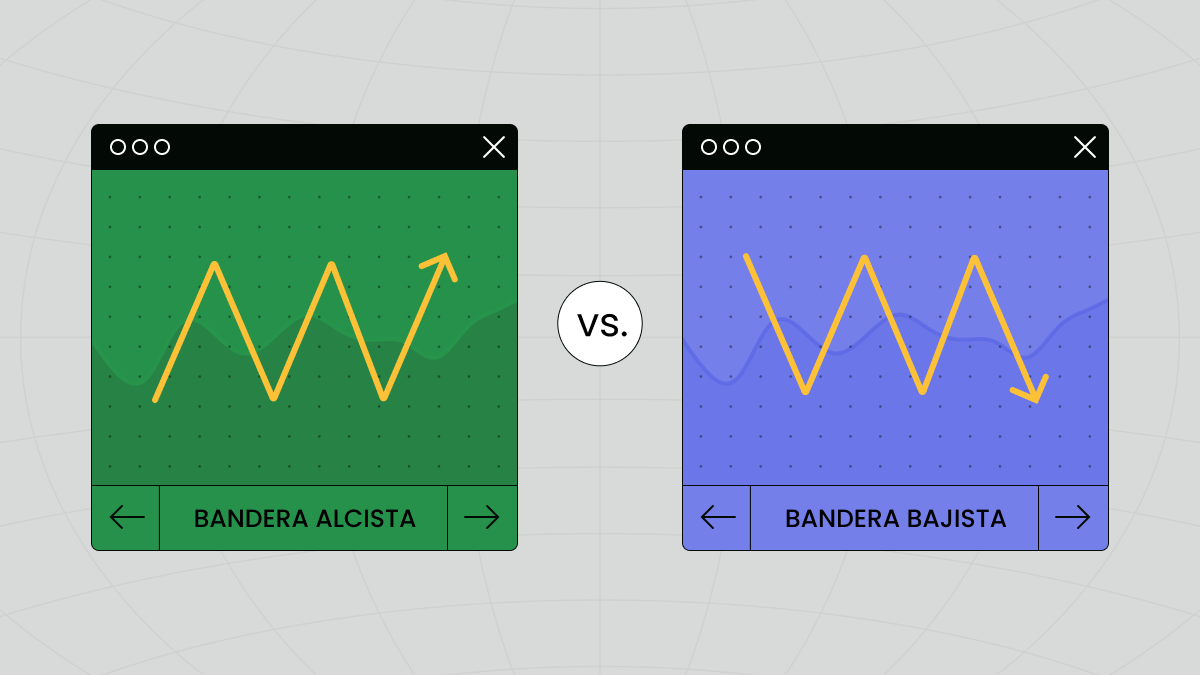

¿Qué son las banderas alcistas y bajistas?

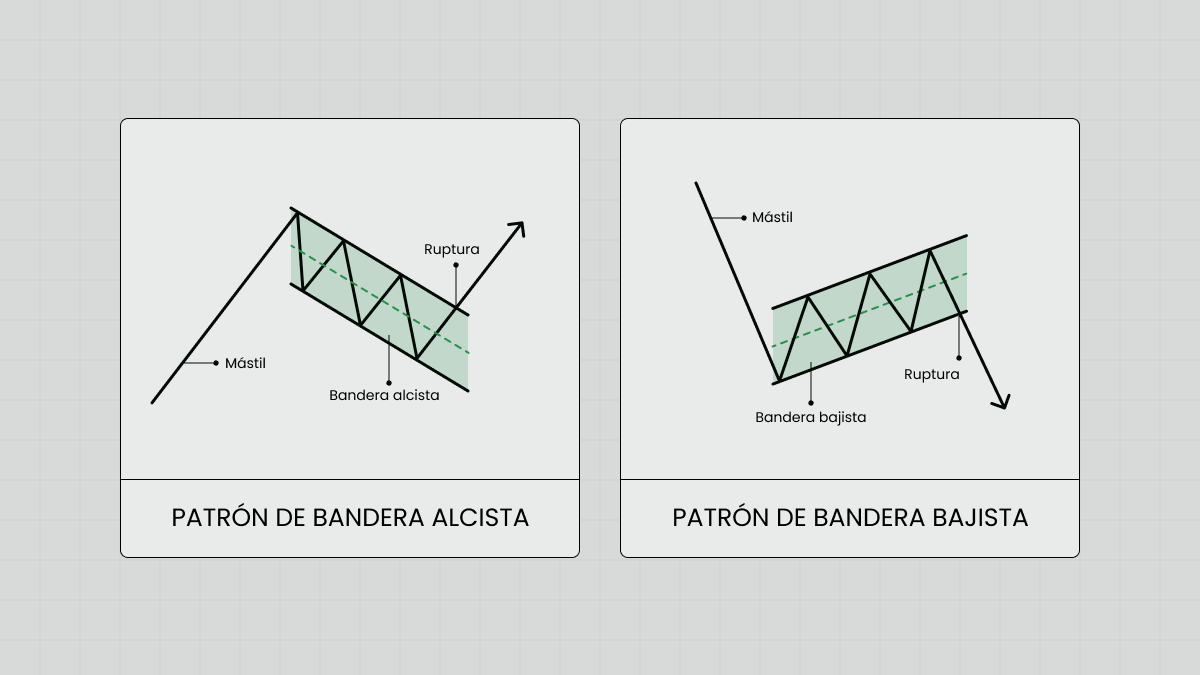

Las banderas alcistas y bajistas son patrones de continuación a corto plazo en el mercado de divisas. Estos patrones se asemejan a una bandera en un mástil, lo que explica su nombre. En Forex, una bandera de este tipo indica una posible continuación en la dirección de la tendencia anterior.

Banderas alcistas

Una bandera alcista se forma durante una tendencia bajista y señala una posible reversión al alza. Comienza con una subida fuerte y pronunciada del precio, conocida como "asta de bandera", seguida de una consolidación descendente que forma la "bandera". Este patrón sugiere que el mercado se está tomando una breve pausa después de un pico de precios al alza significativo antes de una probable continuación de su ascenso. Por lo general, la bandera alcista se considera completa cuando el precio supera el límite superior de la misma.

Banderas bajistas

Por el contrario, una bandera bajista se produce durante una tendencia alcista y sugiere un próximo movimiento a la baja. Al igual que la bandera alcista, comienza con una fuerte caída del precio, que forma el asta de la bandera. Le sigue una consolidación ascendente, que representa la bandera. El patrón bajista indica que el mercado se está consolidando antes de reanudar potencialmente su trayectoria descendente. El patrón se confirma cuando el precio rompe por debajo del límite inferior de la bandera.

Ambos patrones de bandera tienen:

- Un asta: Un movimiento direccional sólido del precio, ya sea al alza o a la baja.

- Una bandera: Un movimiento contrario al asta representa un periodo de consolidación. Puede ser horizontal, pero suele inclinarse en contra de la dirección del movimiento inicial del precio.

- Volumen: Por lo general, el volumen disminuirá durante la formación de la bandera y aumentará en la ruptura, confirmando la fuerza y la continuación del patrón.

¿Por qué son importantes las banderas alcistas y bajistas?

Comprender las banderas alcistas y bajistas es esencial para los traders, ya que estos patrones proporcionan información sobre el sentimiento del mercado y los posibles movimientos de los precios. Estos son algunos aspectos esenciales que respaldan su importancia en el trading:

Valor predictivo

Las banderas alcistas y bajistas son muy apreciadas por su valor predictivo a la hora de indicar la continuación de una tendencia. Una vez que una ruptura identifica y confirma un patrón de bandera, los traders pueden esperar que la tendencia se reanude en la dirección de un fuerte movimiento previo. Esta capacidad de predicción permite a los traders posicionar sus entradas y salidas de forma más estratégica, lo que puede dar lugar a mayores ganancias.

Trading de alta probabilidad

Los patrones de bandera se encuentran entre las herramientas de análisis técnico más confiables. Dado que tienen una alta tasa de éxito, son utilizados con frecuencia tanto por traders principiantes como experimentados para tomar decisiones informadas. Son sencillos, lo que facilita identificarlos y actuar con base en ellos, reduciendo la ambigüedad que a menudo se asocia con otros patrones.

Gestión de riesgos

Una ventaja significativa de las banderas alcistas y bajistas es su contribución a una gestión de riesgos eficaz. La estructura definida de estos patrones permite a los traders establecer niveles precisos de stop loss y take profit. Por ejemplo, se puede colocar un stop loss justo fuera de la bandera, en el lado opuesto de la ruptura, para minimizar las pérdidas potenciales si no se materializa la continuación esperada.

Momento de entrada y salida del mercado

La fase de consolidación dentro de un patrón de bandera ofrece a los traders una oportunidad de entrar en el mercado con un riesgo relativamente bajo. Dado que la ruptura tiende a producirse en la dirección de la tendencia inicial, los traders pueden planificar sus entradas durante la formación de la bandera y ejecutar operaciones cuando el precio rompe más allá de ella. Esta capacidad de sincronización es crucial para sacar provecho de los rápidos movimientos de precios a menudo asociados con estos patrones.

Versatilidad en todas las temporalidades

Las banderas alcistas y bajistas son efectivas en varias temporalidades, lo que las convierte en herramientas versátiles para traders intradía, swing traders o inversores a largo plazo. Ya sea analizando gráficos minuto a minuto para operaciones rápidas o gráficos diarios para estrategias a largo plazo, estos patrones siguen siendo aplicables y confiables.

Entonces, ¿cómo puedo utilizarlos?

El uso eficaz de las banderas alcistas y bajistas requiere un buen ojo para el detalle y una sólida estrategia de ejecución. Te compartimos algunos pasos prácticos para incorporar estos patrones en tu enfoque de trading:

1. Identifica el patrón

El primer paso consiste en identificar con precisión la presencia de un patrón de bandera. Busca un movimiento brusco del precio, que forma el asta de la bandera, seguido de una fase de consolidación más leve y contraria a la tendencia, que forma la bandera. Recuerda que lo ideal es que la consolidación sea menos volátil y esté confinada dentro de un estrecho rango de precios.

2. Confirma el patrón con el volumen

El volumen desempeña un papel crucial a la hora de confirmar la validez de un patrón de bandera. Por lo general, el volumen debería aumentar durante la formación del asta, disminuir a medida que se forma la bandera y crecer de nuevo durante la ruptura. Este patrón en el volumen ayuda a confirmar la señal de continuación proporcionada por la ruptura del precio.

3. Espera la ruptura

La paciencia es vital a la hora de operar usando estos patrones. Espera a que el precio rompa la formación de la bandera de manera concluyente. Esto significa que el precio debería cerrar fuera del límite de consolidación. Una entrada prematura antes de una ruptura confirmada puede provocar señales falsas y pérdidas potenciales.

4. Establece puntos de entrada

Una vez que se confirma un patrón, establece tu punto de entrada:

- Bandera alcista: entra en una posición larga después de que el precio rompa por encima de la bandera.

- Bandera bajista: ingresa una posición corta cuando el precio caiga por debajo de la bandera.

5. Gestiona los riesgos y determina los objetivos de ganancias

Para gestionar los riesgos de forma eficaz, establece una orden stop loss:

- Bandera alcista: coloca un stop loss ligeramente por debajo del punto más bajo de la bandera.

- Bandera bajista: coloca un stop loss justo por encima del punto más alto de la bandera.

Se puede fijar un take profit a una distancia igual a la longitud del asta de la bandera sumada al punto de ruptura, proyectando un movimiento similar tras la ruptura.

6. Supervisa la operación y haz los ajustes necesarios

Cuando inicies una operación, vigila de cerca las condiciones del mercado y la acción de los precios. Si el mercado muestra signos de condiciones cambiantes o si el movimiento esperado del precio se extiende más allá de las proyecciones iniciales, prepárate para ajustar tus niveles de stop loss y take profit.

7. Revisa y aprende

Cada operación ofrece lecciones valiosas. Revise tus operaciones para comprender qué funcionó y qué no. Este proceso de aprendizaje continuo perfeccionará tu capacidad para identificar y capitalizar los patrones de bandera.

Preguntas frecuentes

¿Qué es una bandera bajista?

Una bandera bajista es un patrón de bandera importante en Forex que señala la continuación de una tendencia bajista. Este patrón, una de las banderas bajistas críticas en Forex, consiste en una fuerte caída de los precios que forma el asta de la bandera, seguida de una leve consolidación ascendente que se asemeja a una bandera. La finalización de una bandera bajista a menudo conlleva una mayor caída de los precios, por lo que es un patrón crítico a reconocer por los traders de Forex que pretenden generar ganancias a partir de los movimientos a la baja.

¿Qué es una bandera alcista?

Una bandera alcista es un patrón fundamental en Forex que indica la probable continuación de una tendencia alcista. Un patrón de bandera alcista prominente en Forex presenta un rápido aumento del precio (el asta de la bandera) y una fase de consolidación posterior que se sumerge ligeramente o se mueve de forma horizontal (la bandera). Esta bandera alcista es una fuerte señal de que los compradores pueden recuperar pronto el control, empujando el precio al alza, y es una vista común en los análisis de banderas de Forex.

¿Cómo puedo operar usando banderas alcistas y bajistas?

Operar usando banderas alcistas y bajistas requiere una observación aguda y puntos de entrada estratégicos. Para las banderas alcistas, los traders deben considerar entrar en una posición de compra una vez que el precio rompe por encima de la zona de consolidación. Esta indica el patrón de bandera alcista en Forex, lo que sugiere un impulso alcista. Por el contrario, entrar en una posición de venta después de que el precio rompa por debajo de la bandera puede ser rentable cuando se opera usando banderas bajistas, alineándose con la tendencia bajista señalada por el patrón de bandera. En ambos casos, es esencial comprender las banderas de Forex y emplear estrategias disciplinadas de stop loss para gestionar los riesgos potenciales con eficacia.

Conclusión

Las banderas alcistas y bajistas son elementos fundamentales en la caja de herramientas de los traders de Forex exitosos. Su capacidad para señalar continuaciones en las tendencias del mercado los hace muy valiosos para predecir los movimientos del mercado y ejecutar operaciones de alta probabilidad de manera eficiente. Como se explora en este artículo, la comprensión de estos patrones mejora la capacidad de análisis de un trader y proporciona una ventaja estratégica en la gestión de operaciones con eficacia.

Los traders que dominan el reconocimiento y la interpretación de las banderas alcistas y bajistas pueden aprovechar estos patrones para tomar decisiones informadas, gestionar los riesgos con prudencia y optimizar los resultados de sus operaciones. La clave del éxito con las banderas reside en la práctica diligente, la ejecución precisa y el aprendizaje continuo. Mediante la incorporación de estos patrones en tu estrategia de trading, puedes mejorar tu capacidad para navegar por las complejidades del mercado de divisas y aumentar tus ganancias potenciales.

En FBS, nos comprometemos a proporcionar a los traders las herramientas, los recursos y el apoyo necesarios para tener éxito en el dinámico mundo del mercado de divisas. Te invitamos a utilizar los conocimientos de esta guía para perfeccionar tus estrategias de trading y aprovechar al máximo las oportunidades que ofrecen las banderas alcistas y bajistas.